Enter the Dragon, the NetDragon that is

Updated: 2014-07-25 11:44

By Luo Weiteng in Hong Kong (China Daily USA)

|

||||||||

NetDragon Websoft Inc, a mainland online gaming and mobile applications developer, announced on June 4 it had acquired the mobile solutions business of Cherrypicks, a mobile technology and mobile marketing leader. The deal was worth $30.5 million (HK$236.5 million)

The agreement made Cherrypicks the second local apps developer striking a strategic merger with a Hong Kong-listed, mainland-funded enterprise. The first involved Magic Feature, producer of the smash hit mobile game "Tower of Saviors". Forgame Holdings Limited, a leading mainland developer and publisher of web games, invested HK$543.27 million ($70 million) to acquire a 21-percent stake in Magic Feature on March 4.

This brought Hong Kong's boom development industry to the forefront. The acquisition was met with different interpretations by industry players.

"By virtue of this acquisition, Cherrypicks can access the resources and network of NetDragon, which will bring major exposure on the mainland and present opportunities to explore that market," said Karen Cheung, managing director of the Hong Kong-based app developer Onelinkup. "It's quite clear that after all the exploration in different Asia Pacific countries, China is definitely a big stop that can't be missed. The cherries are just waiting to be picked."

Heather Huang, founding member of the Hong Kong team that developed the world's first voice messenger app, TalkBox, offered a different perspective. Huang, who now works in San Francisco at the Hong Kong startup MailTime, observed: "Although mainland expansion may be high on Cherrypicks' agenda, as a typical city-based app outsourcing company, it should direct most of its funding into Research and Development (R&D) so that it can gradually move away from the need to take on outside contracts."

The latest survey by the Hong Kong Wireless Technology Industry Association (WTIA) showed that among 100 App developers who responded, most began in the hope of developing their own products. About 40 percent of them switched to taking up projects outsourced by other companies.

"Every app company that takes on work outsourced by other companies longs to shift to R&D and work on self-developed products," said Huang. "The problem is R&D products are usually not money-making but require large investment. So, many local app developers opt to undertake contract work to financially support the products they are developing in-house."

Contract work

Green Tomato boasts its self-developed products, HK Movie and TalkBox. Innopage established its reputation with Carrot Worthy. Cherrypicks created iButterfly. But all local app developers continue to undertake contract work for other companies. They need the business to stay afloat, said Huang.

Cheung agreed. "Cherrypicks has already developed patent-pending technology and ready products. It has built a complete solution through R&D in its O2O (online to offline) mobile marketing solution. Yet, it hasn't achieved the best revenue model. The aim of this merger is to clear the channels."

The vast capital pool on the mainland presents a great many tempting and attractive opportunities, said Ma Yuexin, a Beijing-based app developer who said he was not surprised by the acquisition.

He said IT startups on the mainland enjoy a comparatively low entry barrier, with the bulk of venture capital hunting for promising startup projects.

Accepting outsourced contract work is an alternative when there is a failure to obtain venture capital, said Ma.

Charles An, CEO of the city-based app developer, CardApp, was reluctant to make a strong distinction between accepting outsourced work and self-developed products.

The combination of accepting contract work and R&D is the prevailing practice among Hong Kong app developers. "Accepting outside contracts can also help nurture creative thinking," said An. "When taking outsourced work, some app developers manage to come up with great ideas and find new outlets for their self-developed products."

The app industry will evolve along two tracks namely, product-oriented B2C (business to consumer) and project-oriented B2B, (business to business), predicted An.

"B2B is in the order of providing a tailored-made solution for clients. During the customization process, if app developers dominate, the result becomes very much like an in-house development (of a product). So, the boundary between accepting outsourced contract work and self-development is blurring," he said. "What matters is whether the product can be successfully replicated and whether the company can figure out a market model it can fit into."

As the WTIA report revealed, there is no lack of well-received mobile applications in the local market. Standouts include TalkBox and Toilet Rush, an app for informing users where the nearest public lavatory is located. The app also provides details about the conditions and amenities of the nearby facilities. These promising products are doomed to meet a bottleneck, stunting their expansion, due to the small-scale of the local market, however.

Last year's Nielsen report, "Decoding the Asian Mobile Consumer", showed that Hong Kong boasts the highest smartphone penetration in the Asia Pacific Region (87 percent). Nihon Keizai Shimbun revealed that Hong Kong leads all of Asia with 2.39 smartphones per person.

The population base of only seven million, however, makes it difficult to achieve standing as the tech innovation hotspot, said An.

Some analysts cited the Hong Kong-centered food review app OpenRice and its mainland counterpart Dianping. The mainland company, having drawn benefit from the vast mainland market, is planning a US listing after Tencent in February injected $500 million to acquire a 20-percent stake in Dianping.

An pointed out the small-scale local market shouldn't be the whole story for many failed apps. He included OpenRice among that list. He pointed out OpenRice still has a strong grip on the local market and is expanding to the mainland and overseas to varying degrees.

"The app industry is high profit and high risk. It's not rare to see some roaring company success turning out problematic apps at its next stage," said An. Ma concurred. The industry has seen far too many smash hit apps, whose success proves to be short-lived. New arrivals appear much the same, said Ma.

If an app developer is unable to identify the core demands of users, a highly successful app can also be abandoned by choosy customers very quickly. "In fact, only a fraction of local IT companies have their eyes trained on the local market. But attracting foreign venture capital and playing in the broader market is far from easy," said Huang.

"For one thing, mainland investors expect Hong Kong companies to venture into the mainland. But as foreign companies remain bound hand and foot on the mainland, Hong Kong companies are not allowed to dabble in a host of pillar industries.

"In the information technology sector, it's common to see Hong Kongers start up business on the mainland, but it's fairly rare for Hong Kong-based companies to run their businesses in the mainland market," he said.

For another thing, Huang noted, investors from Silicon Valley show little interest in projects outside the US border. And in the global market, Hong Kong-based companies do not enjoy much of a competitive edge.

Success stories

Huang thought Cherrypicks' possible entry into the mainland showed promise. "Although there are few success stories about Hong Kong-based B2C companies on the mainland, Cherrypicks is a B2B company and the strategic merger with NetDragon Websoft will greatly lower the policy threshold."

Cheung chose to be more conservative. "How Cherrypicks will perform in the mainland actually depends on the NetDragon network. We are still waiting until the end of the year to see the turnover of Cherrypicks, which will affect the final acquisition price. It is expected that NetDragon is also waiting to see, with the support of its corporate network, how Cherrypicks will perform."

Like Cherrypicks, most Hong Kong-based IT companies at scale consider venturing into the mainland. But they have reservations about basic issues - laws and regulations, the business environment and human resources - things that remain significantly different from conditions in Hong Kong, said Cheung. "The different rules of the game make many local IT companies inclined to take a wait-and-see approach," added An.

luoweiteng@chinadaily.com.cn

(China Daily USA 07/25/2014 page7)

Panda cub Bao Bao will celebrate her first birthday

Panda cub Bao Bao will celebrate her first birthday

HK kid's symphony returns to NY

HK kid's symphony returns to NY

China, US reach agreement

China, US reach agreement

40 bodies from jet returned to Dutch soil

40 bodies from jet returned to Dutch soil

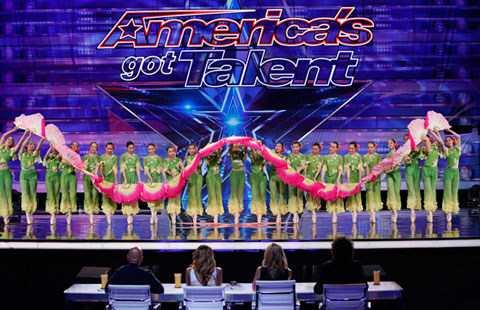

Dance troupe's fusion performance wins over judges

Dance troupe's fusion performance wins over judges

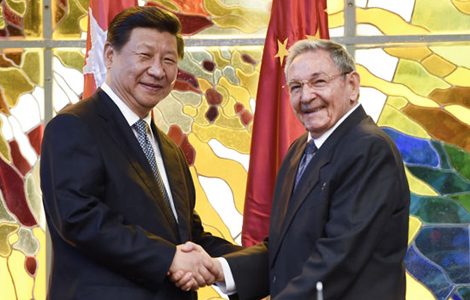

Chinese business leader feels at home in Cuba

Chinese business leader feels at home in Cuba

China, Cuba ink cooperation pacts

China, Cuba ink cooperation pacts

Fusion dance wins over TV show judges

Fusion dance wins over TV show judges

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

France: Air Algerie plane 'probably' crashed

TransAsia crash while landing in Taiwan

China, UC-Davis set up food safety center

Chinese firms eye huge methanol plant for Texas

Tainted food scandal now focuses on supply chain

Meat supplier in global crisis

Death toll in Gaza mounts to 701

Dogs 'capable' of feeling jealousy

US Weekly

|

|