Bringing back 'Made in USA'

Updated: 2015-01-30 12:04

By Paul Welitzkin(China Daily USA)

|

||||||||

Many US-based manufacturers are finding that having an operation in China is no longer giving them what they used to get: low-cost products. And they are coming home in greater numbers, Paul Welitzkin reports from New York.

For 74 years, Miller Manufacturing Co in Eagan, Minnesota, has been a successful maker of farm, ranch and pet products distributed in the United States, Canada and overseas.

Like other US-based manufacturers, Miller CEO Dan Ferrise had suppliers in China; they made products like the company's "Chow Tower" automatic dog feeder. In 2013, after seeing a sharp increase in shipping and labor costs in China, Ferrise decided to have the dog feeders molded at a plant in Minnesota.

The dog feeder marked Ferrise's slowly turning away from China and back to the US. "We wanted to market beekeeping supplies and considered Chinese suppliers. Instead we partnered with a company in Kentucky," Ferrise said.

Pleased with the sales and quality of the products, Miller and its parent (Frandsen Corporation) purchased Kelly Beekeeping of Clarkson, Kentucky, last year."We wanted to secure our product source and now we employ 115 in our beekeeping supplies business," he said.

Ferrise is not alone in returning contract manufacturing to the US from China. After years of vacating the US for lower-cost China, manufacturers are reshoring - bringing production back to the US.

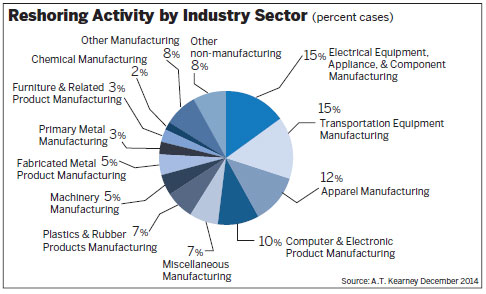

While not a tidal wave, reshoring is at the very least a discernible trend. Management consultant A.T. Kearney said in 2013 there were 210 reshoring cases and estimates about 300 for 2014. In 2010 there were 16.

"Even though there is no torrent of renewed manufacturing activity moving the needle just yet, it's clear that the reshoring movement is growing. At the very least, it should make US companies think twice about where they will manufacture their products in the next few years," Kearney said last year in a report entitled Solving the Reshoring Dilemma.

Reshoring estimates

"Back in 2010, we projected that it (reshoring) wouldn't really get started until 2015. That's because it takes time for a company to consider all of the factors on where to locate a plant. Our estimate is that reshoring will bring around 2.5 million to 5 million jobs to the US over the next five-plus years," said Hal Sirkin, senior partner and managing director of the Boston Consulting Group and a professor at Northwestern University's Kellogg School of Management.

In its third annual online survey of senior level US manufacturing executives from companies with at least $1 billion in yearly revenue, Boston Consulting found last year that more than half of the 252 respondents (54 percent) are considering bringing production back to the US, a 20 percent increase in the number that are actively reshoring now.

Even though reshoring has gained some traction, it doesn't mean that US firms will abandon China and its manufacturing sector completely.

Harry Moser, founder and president of the Reshoring Initiative, an industry-funded nonprofit based in Kildeer, Illinois, that promotes US manufacturing, said that the US is now more competitive with China in manufacturing.

"The US is competitive with some products but not all products. The US is competitive for products that are sold in the US, but not competitive for products sold in China or Asia. US labor costs are still higher (4 to 5 times) than in China, but US productivity is higher, which makes up a lot of the labor difference," he told China Daily.

Ferrise of Miller Manufacturing said many factors have to be considered when outsourcing to China or any other foreign country.

"For example, what does it cost to qualify a supplier in China, what will you do if there is a delay in shipping or if there is a longshoreman's strike and customs always has the potential to become an adventure," he told China Daily.

Ties remain

But even Ferrise hasn't broken all his ties with China. "We get components from Mexico and China. We will make a blend to reach our primary threshold," he said.

Another factor limiting reshoring is that many suppliers in a manufacturing supply chain also have relocated to China.

"Once US companies decided to move production to China, about two to four years later their suppliers also moved to China. We find that companies are coming back to the US, but many of their suppliers are staying in China. They are being cautious," said Patrick Van den Bossche, a partner at Chicago-based A.T. Kearney and one of the authors of the reshoring report.

"Ten years ago, it was a slam-dunk case on whether it's cheaper and more productive to manufacture in China over the US. That is not the case anymore," said Moser.

According to Sirkin, if transportation costs are high, US companies are more likely to reshore.

If US labor costs are high, a company is less likely to bring manufacturing back. The ideal situation for reshoring is high transportation costs abroad and low US labor costs, he explained.

The US has regained its manufacturing competitiveness because companies have managed to address most of their major costs. "Manufacturers in the US have done a good job in maintaining costs and increasing productivity. This has helped large contract manufacturers to look at and in many cases choose a US location," said Sirkin.

"Shipping products from China is time consuming and costly. Chinese wages are rising and the Chinese currency is appreciating and energy prices such as electricity and natural gas are lower in the US. It's estimated that about 25 percent of what the US imports from China to be sold in the US, would actually be more profitable if it were made here," said Moser.

Nothing illustrates that better than the sharp increase in apparel manufacturing returning to the US last year. According to Kearney, of the top three reshoring industries in 2014 apparel manufacturing was third at 12 percent behind electrical equipment, appliance and component manufacturing and transportation equipment manufacturing at 15 percent each.

"Of all the industries, apparel would be one of the last you would expect to return to the US because apparel manufacturing supposedly required lots of cheap labor," Van den Bossche told China Daily.

While labor costs have stabilized in the US, they have risen sharply in China. Van den Bossche said the labor cost advantage still resides in China, but the gap continues to shrink as labor costs will continue to increase on the mainland. In the Yangtze River Delta region, he said labor costs averaged 82 cents an hour in 2001. In 2014, those same labor costs averaged $4.93 an hour.

One dynamic in apparel manufacturing that is turning out to be an advantage for the US is close proximity to a company's target market and supplier. "Being closer to a market source means an apparel company can operate with less inventory and working capital. It also means they can adjust quickly to fashion trends which tend to shift in a heartbeat," Van den Bossche said.

Inventory management is an even bigger reason than labor costs some manufacturers cite for shifting production back to the US.

Anthony Parisi is a vice-president of Plastimold Products in Delray Beach, Florida. The company has annual sales of about $2 million making molds used to manufacture combs and medical products.

Plastimold has eight employees and may have to add up to 10 more to make a mold for a medical product that was made in China.

"We are building a mold for a customer who has been in China. Even though it will cost more to do the mold here, he wants that because of the proximity. It's worth it to him because he can drive over to us and make changes in a day. Plus he doesn't have to speak Chinese," Parisi told China Daily.

He said more of Plastimold's business is coming from companies that used to outsource to China. "When you add in shipping costs and the quality we deliver, the price here isn't that much higher than what you get in China."

Reshoring to the US is being supplemented by Chinese companies moving manufacturing operations to the US for many of the same reasons US companies are returning.

CEO Xin Hu developed Taizhou Fuling Plastics Co Ltd in China, starting with a small factory with 10 employees and now employs more than 1,200. Taizhou Fuling makes plastic cutlery, cups, plates, straws and other tableware items for fast-food restaurants.

Later this year Fuling is scheduled to open a plant in Upper Macungie Township, Pennsylvania, in the Lehigh Valley north of Philadelphia. It is expected to employ 75 workers who will make and ship straws.

Bob Chapleski, vice-president of operations at Fuling Plastics USA, told China Daily that 40 percent of the company's sales are in the US. "He (Xin Hu) had been looking to move some of his production here. The biggest driver of this was freight costs. It just got too expensive to ship plastic straws from China to here."

Chapleski said Fuling looked at locations in Maryland and North and South Carolina before settling on Pennsylvania. "(Xin Hu) believes this is a good place to reach his customers."

Production of the cutlery and bowls will remain in China for now, but if the Lehigh Valley facility works out, Chapleski said Fuling may move more production to the US.

"Increasingly Chinese companies are establishing manufacturing operations in the US," added Moser of the Reshoring Initiative.

Outsourcing factors

Miller's Ferrise said outsourcing production involves many considerations. "I know that the Chinese New Year is coming up (Feb 19). That means the country will shut down for about a month. You need to build up inventory before that and then store it. It can get expensive."

Another factor that figures into the reshoring equation is the marketing appeal of the "Made in America" label. Can it become a marketing tool?

"It already is. Wal-Mart has pledged to purchase $50 billion of US-made products by 2022. It doesn't mean they won't buy Chinese-made products, but they will buy more US-made products," said Moser.

"We put Made in the USA on our products. We see it as a way to differentiate ourselves," Ferrise said. However he offers some cautionary advice to those who might think this will become a major driver of sales. "Made in the USA only matters if the price is the same as most consumers don't differentiate."

Assuming that reshoring is a trend that will persist, what does it mean for China's economy and for the bilateral relationship with the US?

Sirkin of the Boston Consulting Group doesn't think it will have much impact on China. "What we won't see because of reshoring are plants closing in China. As long as China maintains its growth rate of 6 or 7 percent, China will be able to absorb the loss of jobs to the US from reshoring and still manage to have a robust economy. If China's growth rate were to slow down below the target, then it might be a different story. But I don't see that happening."

Meredith Miller is the senior vice-president of trade, energy, and the economic affairs group at the National Bureau of Asian Research in Washington. She said China's leadership is working to grow the services sector and develop a more consumption-based economy.

"If successful, this effort will shrink the manufacturing sector's overall contribution to the economy. That said, China's manufacturing sector as a value added percentage of GDP (gross domestic product) is still fairly high and has hovered around 31 to 32 percent since 2005 according to the World Bank," she said in an e-mail to China Daily.

Wage increases

Miller said there are several factors behind the rise in wages in China including the government's effort to boost consumption, to improve living standards by increasing the minimum wage and to shift to higher income services jobs.

Miller said she doesn't expect reshoring to reach a stage where it affects diplomatic relations with China and in the long term may help the relationship.

"Estimates vary on how many of these new (manufacturing) jobs are the result of reshoring from China or elsewhere, but as US exports grow and the trade deficit between the US and China lessens, this could boost bilateral relations between the two countries. America's large trade deficit with China has fueled calls for the Obama administration and Congress to take action against what critics allege are unfair trade practices, such as China's fixed exchange-rate policy," she said.

Nick Vyas, professor at the University of Southern California's Marshall School of Business in Los Angeles, said in an e-mail to China Daily that because the US and Chinese economies have been interconnected for decades now, there will likely be a push toward collaboration in the growing technological aspect of the future of the manufacturing sector.

"A 'technology race' similar to the cold war arms race between the US and the Soviet Union could develop as the Chinese laborer slowly becomes replaced by robotics. However, I sense a trend towards collaboration and idea sharing. The US and China are major hubs for consumerism and while the US has led innovation over the past century, China's unique social and economic dynamics make it a breeding ground for possible large-scale innovation in the near future. A collaborative effort is in the best interest of the two powerhouses," he said.

Contact the writer at paulwelitzkin@chinadailyusa.com

|

Miller Manufacturing Co. considered suppliers in China for beekeeping supplies. Instead, the Minnesota company partnered with Kelley Beekeeping of Clarkson, Kentucky(above). After strong sales, Miller and its parent, Frandsen Corporation, purchased Kelley last year. Provided To China Daily |

(China Daily USA 01/30/2015 page19)

US futurist touts the rise of the "Global Southern Belt"

US futurist touts the rise of the "Global Southern Belt"

Ten surprising facts about Jack Ma

Ten surprising facts about Jack Ma

Gas blast at Mexico City children's hospital kills 7, injures 54

Gas blast at Mexico City children's hospital kills 7, injures 54

Ten characteristic streets in Beijing

Ten characteristic streets in Beijing

Outgoing US Defense Secretary Hagel lauded at farewell

Outgoing US Defense Secretary Hagel lauded at farewell

Don't have to be a queen to live in frozen wild of snow

Don't have to be a queen to live in frozen wild of snow

Across Canada Jan 30

Across Canada Jan 30

New consul general greeted

New consul general greeted

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US futurist touts the rise of the "Global Southern Belt"

Chinese brands derive rising revenue proportion overseas

Mongolian culture to highlight New Year's concert

Alibaba quarterly revenue disappoints, shares fall

'Nightmare' incompatible with China-US relations

Alibaba adjusted profit tops estimates, revenue falls short

US ambassador to China calls for Flying Tigers movie

Taobao locks horns with regulator

US Weekly

|

|