Frost is flab's new enemy with his diet drug bet

Updated: 2015-02-05 08:37

By Bloomberg(China Daily USA)

|

||||||||

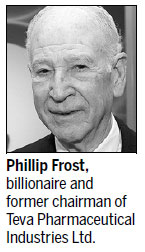

Phillip Frost at 78 isn't your usual Florida retiree. Rather than spending his days playing golf and relaxing, the billionaire former chairman of Teva Pharmaceutical Industries Ltd has embarked on his life's most quixotic quest: a blockbuster cure for obesity.

Many before him have tried and failed. Medicines currently on the market haven't sold well. And investors are a little skeptical about Frost's latest wager.

"It's kind of like the unicorn of the pharma industry," said David Munno, head of drug research at Sphera Global Healthcare, a hedge fund in Tel Aviv.

"So many companies have tried and had their drugs pulled out of the market or fail miserably."

Frost believes he can achieve what billions of pharma dollars and decades of research have failed to produce by using the blueprint that allowed him to amass a $4.9 billion fortune: re-engineering an existing product to stifle its flaws.

"The chances of success are extremely high," he said.

A native of South Philadelphia, Frost turned a $50,000 investment in Key Pharmaceuticals Inc, a struggling drug developer, in 1972 into a $825 million sale to Schering-Plough Corp 14 years later. His next company, the maker of generic drugs Ivax Corp, he sold to Teva, the industry leader, for $7.4 billion in 2006.

Not hungry

"We have a lot of respect for Phil Frost and we definitely wouldn't write him off," Munno said. Still, he gives any drug that hasn't entered human clinical tests - as is the case with Frost's product - a chance of success that's less than 5 percent.

Frost, who retired as Teva's chairman last year, was freed up to focus on Opko Health Inc, the drug development company he started after selling Ivax.

Valued at $5.2 billion on the New York Stock Exchange and based in Miami, Opko has been working on tweaking a hormone called Oxyntomodulin, a powerful appetite suppressant whose mechanism of action isn't well understood, and which alone lacks the staying power required for a diet medicine.

"We're talking about a hormone that tells our brain that we're no longer hungry," said Gili Hart, the company's vice president of clinical development.

Obesity paradox

Opko has licensed technology from Israel's Weizmann Institute of Science that could change that, according to Hart. It allows the hormone to act longer in the body, requiring one injection per week instead of one every few hours, she said. Opko tested the product on obese mice and rats, which shed more than 20 percent of their weight with no worrisome side effects. Human studies are slated to begin this year.

Frost figures the drug's revenue potential could be about $100 billion, leapfrogging the pharmaceutical industry's all-time bestseller, Pfizer Inc's cholesterol medicine Lipitor. The market for an obesity medicine is huge - even just in the US, where an estimated 79 million people are overweight or obese. But so far no drugmaker has managed to convert that potential into a blockbuster, and it's so early for the Opko drug that a lot could go wrong.

Because obesity isn't a disease, regulators have a low tolerance for worrisome side effects, and patients often give up treatment when they come to realize it's no panacea.

(China Daily USA 02/05/2015 page16)

Australian journalist Peter Greste arrives home

Australian journalist Peter Greste arrives home

Celebrating being mermaids at Merfest convention

Celebrating being mermaids at Merfest convention

Snowboarder towed by a plane reaches speed of 78mph

Snowboarder towed by a plane reaches speed of 78mph

Business opportunities of 'Year of the Sheep'

Business opportunities of 'Year of the Sheep'

Italy's new president gets unanimous welcome

Italy's new president gets unanimous welcome

At least 6 dead in Metro-North train crash

At least 6 dead in Metro-North train crash

Torturous, beautiful and fun ways of commuting

Torturous, beautiful and fun ways of commuting

NATO should not provide aid in Ukraine crisis

NATO should not provide aid in Ukraine crisis

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US deputy secretary of state to visit Asia

Lawyers: Evidence shows Saudi Arabia aided 9/11 hijackers

31 killed in TransAsia plane crash, 16 from Chinese mainland

Top Obama communications advisers to step down

Senior US official urges DPRK to act in 'good faith'

Plane with 53 passengers aboard crashes into river

Chinese swarm for new 10-year US visa

China: UN presidency will be 'fair, open, transparent'

US Weekly

|

|