Spreading the message on pet nutrition

Updated: 2015-03-20 07:14

By Wang Zhuoqiong(China Daily)

|

||||||||

Mars Petcare banks on consumer awareness to support its growth in China, says top executive

Shifting demographics and spending patterns will weigh on profit margins of pet food makers in China, but the long-term prospects still remain bright, the top official of a leading global company said. Though China is already home to one of the world's largest pet populations, success in the niche market hinges on providing healthy and wholesome products for pets, which also calls for a certain level of knowledge about pet nutrition, said Carl Su, general manger of Mars Petcare China.

According to Su, there are three groups that require formula food - infants, astronauts and pets. Tackling the complex pet food market has been a big challenge in China compared with other developed-markets, he said, largely due to the lack of nutrition awareness.

Su said that about 97 percent of the Chinese pet owners still feed their pets with home-cooked food or leftovers. In addition, many Chinese consumers consider the simple mix of meat and vegetables as healthy food for pets.

However unlike humans, pets cannot gauge whether they have had enough or balanced nutrition for their growth. Excess nutrition or nutrition deficiency will both cause problems for pets, he said.

Su, the first Chinese general manger of Mars Petcare, the US-based pet food division of global confectionary major Mars Inc, says his primary responsibility in China is to boost awareness about whole-some nutrition.

"There is no doubt that all pet owners in China love their pets. But learning to look after them properly is something that requires professional knowledge," he said.

Mars Inc has 41 global pet food brands and products under its portfolio, including big names like Pedigree dog food, Whisk as cat food, Royal Canin, Cesar, Sheba, Kitekat, Chappi and Catsan.

Su said that he became aware of the lack of knowledge in China after gauging responses from other overseas markets. Pet owners in most of the overseas markets opted for comprehensive and balanced nutrition, while the same was relatively low in China.

"What was surprising was that in China, even the veterinarians did not give answers veering toward comprehensive, balanced nutrition," he said.

Adding to problems for companies has also been the relatively low pet food conversion rate in China, in single digits, compared with more than 85 percent in developed markets such as the United States and Europe.

Speaking on the advantages of food conversion for pets, Su said the shift to professional pet food will reduce early death in toddler cats and dogs by 50 percent, the risks of bone deformity by 100 percent and the chances of infective dental diseases by 40 percent.

Responsible and disease preventive feeding is crucial for good pet health, said Su. About 80 percent of the dogs above three years old often suffer from dental calculus. An introduction of a dental chew would help save the dog from being subject to painful dental cleaning, he said. "Prevention is better than the actual medical treatment," said Su.

As the world second-largest country in terms of the number of registered pets only after the US, China represents a huge opportunity for Mars, a market it entered 20 years ago.

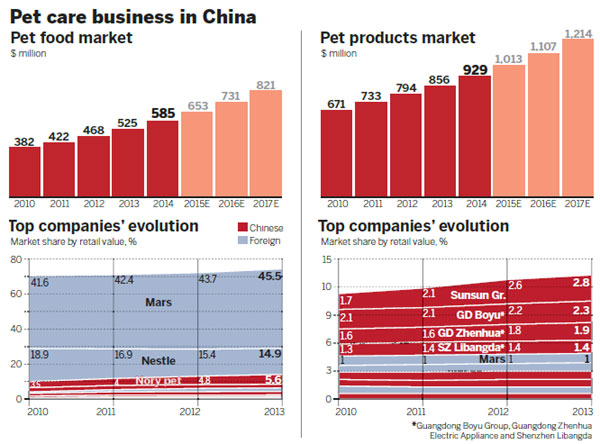

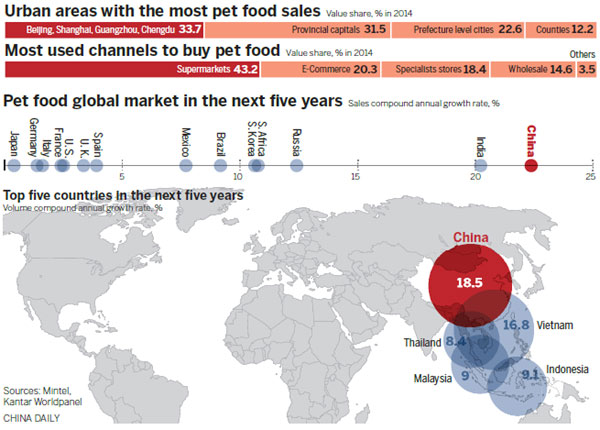

The number of pets in China has increased nearly 900 percent to 120 million with in a decade since 2003. According to global market research firm Euromonitor International's forecast, the pet food market is expected to grow to $821 million in 2017 from $585 million in 2014.

The total value of pet products will climb to $1.214 trillion from $856 million during the same period, it said.

The pet market has maintained an annual growth rate of 30 percent, and the potential is huge in China. While about 62 percent of the US families own pets, the number is only 12 percent in first-tier cities in China.

Mars has taken a dominant share of China's pet food category, with about 45.4 percent market share in 2013, ahead of Nestle SA's 14.9 percent and NoryPet (Shanghai) Co Ltd's 5.6 percent, according to Euromonitor.

Mars dog food brand Pedigree accounts for one-third of the dog food consumption in China, and it has seen strong growth, said Su.

Demand for both adult and infant dog and cat pet food is growing rapidly, at a speed much higher than the food retailing industry on average.

Online distribution channels have also created more growth opportunities for Mars Petcare due to the deep penetration of cellphones among Chinese consumers.

Mars has teamed up with leading e-commerce platforms like Tmall, JD.com and Yihaodian and Amazon.cn, realizing growth rates four times over that gained from offline channels. The data collected from the online retailers have also helped Mars better understand consumers, Su said.

Though a private company, Mars is focusing more on how it can implement its vision of balanced nutrition for pets in China, rather than growing market share, said Su.

"I learned the importance of building ecosystems to make Petcare thrive. It takes time and patience, commitment and concerted effort to work with all the stakeholders and trade partners, but I find it rewarding," he said.

Su said much of his market understanding comes from his own love for pets.

"My brother is a pet owner and a dog lover, and I have enjoyed the happiness of a pet along with him. But it was only after I joined the pet care industry that I realized how much pets can enrich the lives of its owners."

At Mars, employees can even take their pets to office where there are pet-friendly facilities. Su said he has always enjoyed jobs that are closely related to people's lives.

"Working with a fast-moving consumer goods company keeps me abreast of market dynamics and fosters a deeper understanding of customers, which helps me better meet their needs. I feel a sense of achievement just by consistently doing a good job, especially if I can make a difference in people's everyday lives," he said.

After 10 years of working at Wrigley, Mars' chewing gum brand, Su wanted to pursue new challenges. "Petcare was a good fit," he said explaining his decision to enter the industry.

Working in the pet care sector requires a more in-depth understanding of consumers, the pet owners who buy the products and the pets who consume them, he said. "Petcare is built on love and trust, and we take our job seriously," said Su.

To further its roots, the company set up the Mars Petcare Academy in China in 2012. It is aimed at sharing the concept of pet nutrition among Chinese consumers.

Su said that Mars Petcare Academy has been gaining in popularity and received about 10 million page views after it went online in 2013. The site also had unique visits of more than 6 million, which means more than 6 million consumers have gained professional knowledge.

New media and technology have also enabled Mars to engage and interact with Chinese pet owners and imbibe scientific knowledge on pet feeding and caring so as to boost pet food conversion.

The company also has an official WeChat account to offer online and offline content and activities along with easy-to-understand pet nutrition and care knowledge. "We are still on a journey. And we have to work with our peers to do the right thing," he said.

As a working father, Su tries to manage his time well so that he has enough time to spend with his twin children and family in Beijing.

"At home, I am a part of a team of five. I live with my wife, my mother-in-law and my two sons, Harry and William," he said.

"My twins are curious and love to learn. I always feel a sense of pride when I spend time with them," he said. "Harry likes reading, he always asks me to read for him, while William likes geometric shapes and enjoys pushing buttons on appliances and in elevators."

wangzhuoqiong@chinadaily.com.cn

|

A girl plays with her pets at an international pet products exhibition in Beijing. According to global market research firm Euromonitor International's forecast, China's pet food market is expected to grow to 5.13 billion yuan ($821 million) in 2017 from 3.6 billion yuan in 2014. Provided To China Daily |

(China Daily USA 03/23/2015 page15)

China joins legendary flower show

China joins legendary flower show

Monks perform tea-picking ritual in Hangzhou

Monks perform tea-picking ritual in Hangzhou

Singapore founding father Lee Kuan Yew

Singapore founding father Lee Kuan Yew

Solar eclipse wows viewers

Solar eclipse wows viewers

New Year Carnival thrills Vancouver

New Year Carnival thrills Vancouver

Across America over the week (from March 13 to 19)

Across America over the week (from March 13 to 19)

How much do world leaders earn?

How much do world leaders earn?

Daredevil ropejumpers leap 200 meter off cliff

Daredevil ropejumpers leap 200 meter off cliff

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Singapore former PM Lee Kuan Yew passes away

Texas Republican Cruz announces presidential bid

Fictional TV presidents more popular than Obama - poll

Funding of China-backed bank will be open to other countries

Six Western economies apply to join AIIB

US urged to honor pledge

Ex-wife of Chinese fugitive

to be released

China's plan to move from being 83

US Weekly

|

|