Funding of AIIB will be open to other countries

Updated: 2015-03-23 07:48

By Zhong Nan and Chen Jia(China Daily)

|

||||||||

Finance officials said on Sunday that China will follow international practice and allow other nations to inject capital into the Asian Infrastructure Investment Bank.

Jin Liqun, secretary-general of the Multilateral Interim Secretariat for Establishing the AIIB, said that even though China is the biggest shareholder in the financial institute, the country will have no privileges but more obligations to improve Asia's economy in a fair and sustainable manner.

Eager to enhance regional connectivity, investment and trade ability, China committed $50 billion in October and organized 27 partner countries to form the AIIB. The China-led bank will target infrastructure projects such as the construction of roads, ports and other infrastructure across Asia, with a focus on Association of Southeast Asian Nation members.

The bank's long-term goal is to raise $100 billion for future projects.

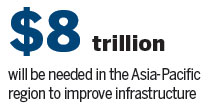

Statistics from the Asian Development Bank show that between 2010 and 2020, around $8 trillion in investment will be needed in the Asia-Pacific region to improve infrastructure. However, the ADB is able to provide only about $10 billion annually for this cause.

The long-term investment cycle and the lack of interest from private companies are two other factors hindering the region's development.

"Under such circumstances, the establishment of the AIIB will be complementary to the ADB and other multilateral financial institutions, including the World Bank," Jin said at the China Development Forum in Beijing.

"What the region urgently needs is to establish a practical financial mechanism to build a platform to allow all partners to participate in the decision-making process," said Jin.

Finance Minister Lou Jiwei said the AIIB was proposed amid enormous demand for infrastructure investment in Asia and will not compete with existing organizations that aim to relieve poverty.

"The AIIB will draw on the experience of established banks and set up a three-tier structure including a council, a board of directors and management," Lou said, also promising a supervisory mechanism to ensure sufficient, open and transparent policy-making.

International Monetary Fund chief Christine Lagarde said the IMF is willing to cooperate with the AIIB as "there is massive room for cooperation with AIIB on infrastructure financing".

Lagarde said the World Bank will also cooperate with the AIIB. Her comments come after a number of countries said they would participate in the new bank slated to start operations by the end of this year.

Lyu Chang contributed to this story.

Contact the writers through zhongnan@chinadaily.com.cn

(China Daily USA 03/23/2015 page1)

China joins legendary flower show

China joins legendary flower show

Monks perform tea-picking ritual in Hangzhou

Monks perform tea-picking ritual in Hangzhou

Singapore founding father Lee Kuan Yew

Singapore founding father Lee Kuan Yew

Solar eclipse wows viewers

Solar eclipse wows viewers

New Year Carnival thrills Vancouver

New Year Carnival thrills Vancouver

Across America over the week (from March 13 to 19)

Across America over the week (from March 13 to 19)

How much do world leaders earn?

How much do world leaders earn?

Daredevil ropejumpers leap 200 meter off cliff

Daredevil ropejumpers leap 200 meter off cliff

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Singapore former PM Lee Kuan Yew passes away

Six Western economies apply to join AIIB

US urged to honor pledge

Ex-wife of Chinese fugitive

to be released

China's plan to move from being 83

Investors tour Bay Area

Ex-Chinese official indicted in

money laundering

Yahoo to exit from Chinese

mainland market

US Weekly

|

|