University's deal spree exposes Zhao as chip billionaire

Updated: 2015-03-25 07:45

By Bloomberg(China Daily)

|

||||||||

The man spearheading China's government-sponsored drive to buy foreign chip technology has revealed himself as a billionaire in the process.

Zhao Weiguo tapped connections at his alma mater Tsinghua University, whose alumni include China's two most recent presidents, to make acquisitions and amass a $2 billion fortune, according to the Bloomberg Billionaires Index. Tsinghua Unigroup Ltd, a unit of the university's holding company of which Zhao is chairman, signed a $1.45 billion deal with Intel Corp last year and was shortlisted to buy more than $2.5 billion of Hewlett-Packard Co assets, people familiar with the matter have said.

China, with 1.3 billion mobile-phone accounts, is seeking to build its domestic chip industry and reduce reliance on overseas producers. Chinese companies led by Unigroup have tapped that State support for most of the $6.1 billion in major chip-related takeovers they have made during the past two years, according to data compiled by Bloomberg.

"The electronics industry is getting a lot of policy and State capital support because it's seen as a key industry to build out," Fan Guohe, an analyst with Phillip Securities Ltd in Shanghai, said by phone. "There is a huge gap to fill."

Chip designers

If Unigroup is successful, the deal would be its third major acquisition in the past two years. The Beijing-based company bought US-listed Spreadtrum Communications Inc for $1.5 billion in 2013 and RDA Microelectronics Inc last year for $893 million, data compiled by Bloomberg show.

In September, Intel agreed to spend as much as 9 billion yuan ($1.45 billion) on a stake in a Unigroup subsidiary holding stakes in the two chip designers. The transaction values the unit, which is wholly-owned by Unigroup, at about $7.3 billion.

Three calls and an email sent to Unigroup's investors relations department went unanswered.

Tsinghua University founded what later became Unigroup in 1988, according to the company's website. In a 2010 privatization, Beijing Jiankun Group, controlled by Zhao, became Unigroup's second-biggest shareholder after the university.

Two degrees

Zhao controls 70 percent of Beijing Jiankun, which will own about 39 percent of the Unigroup subsidiary holding the two chip designers after Intel's investment, according to company filings obtained by Bloomberg News. That gives Zhao a 27 percent interest in the Unigroup unit valued at about $2 billion.

Li Yi and Li Luyuan, the other two shareholders of Beijing Jiankun with a 15 percent stake each, are both worth about $424 million.

Zhao has bachelor's and master's degrees in electronic engineering from Tsinghua University, according to a biography posted on the website of Tsinghua Entrepreneur & Executive Club, an alumni organization. Beijing Jiankun, which he founded in the early 2000s, invests in technology, natural resources and real estate.

(China Daily USA 03/25/2015 page15)

Families mourn victims of Airbus A320 crash

Families mourn victims of Airbus A320 crash

Snow blankets Chicago after spring storm

Snow blankets Chicago after spring storm

Haze descends on Paris

Haze descends on Paris

Tokyo's plans to build new US base possibly scuppered

Tokyo's plans to build new US base possibly scuppered

Conversation topics only heard in China

Conversation topics only heard in China

Zhejiang villager creates a world of clay

Zhejiang villager creates a world of clay

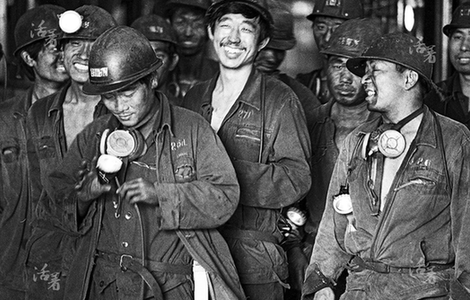

Dramatic changes for Chinese miners in the last 30 years

Dramatic changes for Chinese miners in the last 30 years

Top 10 young Chinese entrepreneurs defining the future

Top 10 young Chinese entrepreneurs defining the future

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Plane crash in France kills 150, black box found

Small US businesses using RMB for transactions: Survey

Iconic Chinese play hits America

Christie's has richest Asia Week

China keen to invest in US

Beijing 'welcomes interested nations joining the AIIB'

Innovation is talk of summit on investment

House passes resolution urging Obama to send arms to Ukraine

US Weekly

|

|