China, US: dealmaking in Texas

Updated: 2015-04-01 11:21

By May Zhou in Austin, Texas(China Daily USA)

|

|||||||||

Bringing together Chinese investors, and Americans looking to raise capital for business ventures is the goal of an investment summit this week in Austin, Texas.

More than 200 hundred people are attending the 2015 China-US Private Investment Summit from Monday to Wednesday. The summit is focused on three areas of cooperation: international franchise and licensing; immigration investment (EB-5); and strategic partnerships and joint ventures. About 30 US projects were presented at the summit.

"Finding mutually beneficial ways to connect advantages, capital and the two largest markets in the world is an important endeavor for this summit," said Jay Riskind, summit executive chairman and president of The Riskind Group.

"There is significant opportunity to channel capital flows from China into mutually beneficial opportunities," he said."Many entrepreneurs in China have made the connection that the China Dream is intrinsically connected to the American Dream."

According to summit organizers, most of the 50 Chinese delegation members are private investors with net worths ranging from $15 million to $120 million, and most of them are from tier two and tier three cities in China. The 200-plus US attendees included policymakers, entrepreneurs, trade associations, economic development groups and professional service firms.

Clark Randt, former US ambassador to China from 2001 to 2009, gave the summit's opening keynote speech. Randt had worked as a commerce attach in China, promoting various US projects there in the 1980s before becoming an ambassador.

"Who would have guessed that more than 30 years later I will be here to welcome the Chinese investors?" he said.

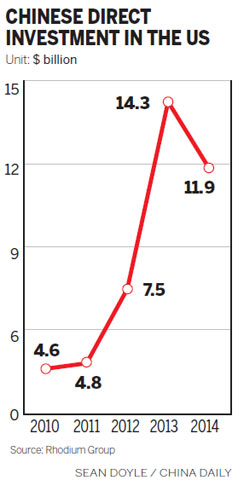

Randt said that Chinese private investment is playing an ever-increasing role in foreign direct investment (FDI) in the US.

"Chinese investment in the US has surpassed US investment in China in 2014," he said. "Of $47.5 billion in Chinese FDI in the US last year, more than $29 billion was from private investors."

Randt also praised cross-cultural exchanges such as the summit as playing an important role in bilateral relations.

The conference's first day focused on what opportunities are available in the US and what the Chinese investors are seeking.

Bill Owens, a retired US Navy admiral and former vice chairman of the Joint Chiefs of Staff who later was CEO of Nortel, said that there are plenty of investment opportunities yet to be explored by the Chinese investors.

He used as an example Singapore, which he said had made more investment in the US than China did last year.

Paul Lam,chairman of Asian Holdings, said that Chinese private investors are still in the stage of seeking real estate and educational opportunities for their children, and investment in technology has not really started yet.

Gao Ping, a private investor, said that to secure investment from private Chinese investors, one needs first to build a personal relationship with and win trust from them. "Treat them as if you treat your family, then you will win their business," advised Gao.

Liu Heren, president of Meritros Investment in Beijing, said that the private investment has grown from not only a domain of the wealthy but the middle classes, especially in overseas real estate.

"They want to diversify their assets and they have become more sophisticated, Liu said. "When you present your projects to them in EB-5 program, you need to have an impressive program to attract them."

Policies, case studies and models for successful combinations of capital between the two countries also were discussed.

The summit continues on Wednesday, with the focus on partnership opportunities and dealmaking behind closed doors.

A total of 30 projects will be presented to the Chinese investors, according to information provided by the summit.

Among the US companies seeking investment were:

PreferUS Healthcare, which provides orthopedic services to China, is seeking capital for similar operations in Yinchuan and Shanghai;

EnV/Capital Arts is seeking an exclusive Chinese company to distribute rights to the vintage archive in the Chinese market;

CKE Restaurant Group's Carl's Jr. Unit, a hamburger chain with 3,600 restaurants worldwide, is looking to establish franchises in north and central China, Beijing and Shanghai;

Fastsigns International, a sign and graphics company that works in B-to-B franchise space in nine countries, wants to expand to China;

Jamba Juice, which sells fruit smoothies, juices, light food and snacks, also wants to do business in China.

Another fast-growing investment area is the US government's EB-5 visa program, which leads to US residency for investors who invest a minimum of $500,000 to $1 million (depending on the location) and preserve or create 10 jobs.

The program brings in $5 billion in new capital to the US each year, and China represents 85 percent of EB-5 participants. Several prospective EB-5 scenarios were presented at the summit.

Former President Bill Clinton met with Chinese investors in a private closed session on Tuesday evening.

mayzhou@chinadailyusa.com

(China Daily USA 04/01/2015 page1)

6 cultural differences between China and the US

6 cultural differences between China and the US

Mother illustrates her pregnancy

Mother illustrates her pregnancy

In memory of movie star Leslie Cheung

In memory of movie star Leslie Cheung

Top 10 best employers in China in 2015

Top 10 best employers in China in 2015

World's largest reclining Buddha statue in Jiangxi

World's largest reclining Buddha statue in Jiangxi

First round-world solar flight stops in China

First round-world solar flight stops in China

Elderly care explored for investors, needy

Elderly care explored for investors, needy

Sasha Obama took trip to China

Sasha Obama took trip to China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

PMI indicates factories back to expansion

Chinese woman charged with fraud remains in US jail

Forty-six countries seek to join AIIB

Tales of a nomad

US 'willing to work with AIIB': Lew

Silk Road connects China to the world: BOC chairman

Washington 'willing to work with AIIB'

China should police bad foreigners, too: expert

US Weekly

|

|