Beverage battle in China goes beyond colas

Updated: 2015-05-12 11:03

By Jack Freifelder in New York(China Daily USA)

|

||||||||

After the establishment of diplomatic relations between China and the US in 1979, Coca-Cola became one of the first international brands to re-enter the Chinese market.

PepsiCo Inc followed two years later, bringing the cola wars to the world's most populous country.

Fast-forward more than 30 years, and the two soft-drink giants are still battling for market share. But now there are plenty of other soft drinks for Chinese consumers, according to Suzanna Clarke, head of beverages for Canadean, a market research firm focused on consumer goods.

"Historically, the carbonates market has been extremely pivotal to the Chinese soft drinks market, accounting for more than one-third of soft drinks consumption in 2000," Clarke said. "Nearly 20 years later, Chinese carbonates' share of the soft drinks market is anticipated to have fallen 10 percent.

"When considering Coca-Cola and PepsiCo's presence in the Chinese soft drinks market, their overall share has battled to remain at the same level compared to 10 years ago as domestic production has increased," Clarke wrote in an email to China Daily. "But the per capita consumption of carbonates is still increasing as their reach is tapping in to more urban areas of China,"

Global soft drinks volumes expanded more than 3 percent in 2014, with the value of sales climbing by more than 6 percent to $867.4 billion, data from Euromonitor showed.

The US is the world's largest soft drinks market, in both value and volume, but markets such as China, Brazil and Mexico have grown in recent years, Euromonitor said in January.

Energy drinks (9.8 percent) and bottled water (6.1 percent) saw the largest year-over-year increase, while carbonates and juice lagged due to "growing consumer concerns" about sugar content, price and artificial flavoring.

"It is [these] other soft drinks categories that are set to outpace carbonates consumption — notably packaged water, still drinks, iced tea and energy drinks," Clarke said.

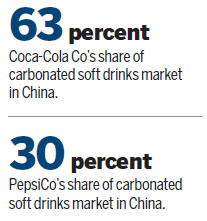

The Coca-Cola Co maintains an edge over PepsiCo in the China carbonated soft drinks (CSD) market, with a share of 63 percent in 2014, according to Euromonitor. PepsiCo's share was nearly 30 percent, according to an April 22 research note from Bill Schmitz, an analyst who covers PepsiCo and Coca-Cola for Deutsche Bank.

"Today China is already one of the largest liquid refreshment beverage (LRB) markets in the world and will be a key contributor to the growth of the global beverage sector," a spokesman with PepsiCo Greater China Region said in an e-mail to China Daily. "China remains an attractive consumer market; total consumption has grown four times in the last decade, well above the rest of the world."

Pepsi's offerings in China include Pepsi-Cola, Pepsi Light (Diet Pepsi), 7-Up and Mirinda. PepsiCo is also responsible for a line of non-carbonated drinks and juices under the Gatorade and Tropicana brand lines, as well as foodstuffs and snack items.

In 2012, PepsiCo's Asian R&D Center opened in Shanghai. Pepsi also announced a deal with Tingyi-Asahi Beverages (TAB) in 2012 to make it the franchise bottler in China. The partnership is one of the largest LRB systems in China, with more than 70 plants in operation.

On April 17, Coca-Cola announced it would buy the beverage business of China Culianwang Beverages Holdings Ltd for $400.5 million. The deal gives it a foothold in the multi-grain drinks category, a "growing beverage category in China", Coke said in a statement.

Coca-Cola now has more than 10 brands and 50 flavors of beverages in China, including sodas like Coca-Cola, Diet Coke, Fanta and Sprite. Beyond soft drinks, Coca-Cola offers sparkling drinks, juices, tea, water and coffee.

The company has 43 plants and nearly 50,000 employees in China.

Henrique Braun, the president of Coca-Cola's Greater China & Korea Business Unit, told China Daily that through 2014, the company had invested $9 billion in its China operations.

"We continue to view China as an attractive market with a lot of opportunities for all beverages companies to grow," Braun said in an e-mail.

Ali Dibadj, an analyst who covers Coke and Pepsi for Sanford C Bernstein and Co, said the brand recognition for the two is "quite high" in China.

"Although, Coca-Cola has much higher share," Dibadj wrote. "Moreover, recently, Pepsi is losing share to Coca-Cola especially since Pepsi sold the right to bottle its product to Tingyi."

Coca-Cola's Sprite sells well in China, he said, as well as Master Kong and Wahaha, two large domestic Chinese soda brands.

"Trends are clear that per capita consumption is rising, even though the growth has slowed," Dibadj wrote. "The penetration of the category is still quite low, so it will grow, even as health and wellness becomes a growing concern."

Reuters contributed to this report.

jackfreifelder@chinadailyusa.com

|

Soft-drink choices abound in an Asian market in Queens, New York. The Coca-Cola Co and PepsiCo are the dominant carbonated soft-drink companies in China, but the market is seeing some shift toward other beverages. Han Meng / for China Daily |

(China Daily USA 05/12/2015 page2)

Heads of state show you around Xi'an

Heads of state show you around Xi'an

Cross dressing for Peking Opera

Cross dressing for Peking Opera

Ten photos you don't wanna miss - May 13

Ten photos you don't wanna miss - May 13

Passionate creatives with fresh ideas

Passionate creatives with fresh ideas

Chinese buyers spend $116m at art auction in NY

Chinese buyers spend $116m at art auction in NY

Portrait of a health conference

Portrait of a health conference

China and Russia hold naval exercise

China and Russia hold naval exercise

Ten photos you don't wanna miss - May 12

Ten photos you don't wanna miss - May 12

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

At least six die in Philadelphia train derailment, scores hurt

Cui: How to get a win-win in Asia

Animated Deng Xiaoping set to hit silver screen this week

Foreign reserves show a record decline in Q1

Amtrak train derails in Philadelphia, kills 5 people

Kerry off to China ahead of key talks

Beverage battle in China goes beyond colas

Volvo picks South Carolina for plant

US Weekly

|

|