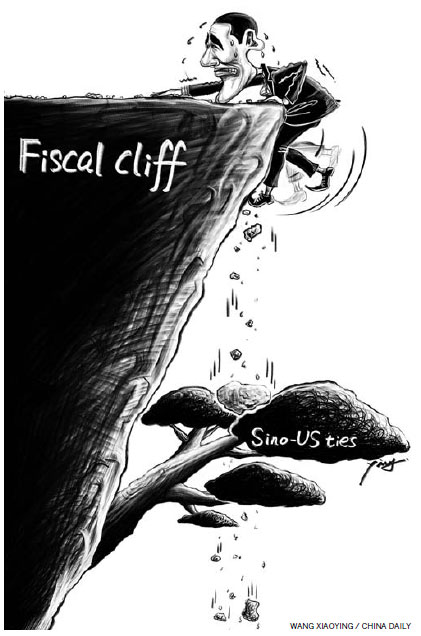

Sino-US ties in times of fiscal cliff

Updated: 2013-01-09 08:07

By Dan Steinbock (China Daily)

|

||||||||

The recent mini-deal to help the United States avoid the fiscal cliff is just another timeout. In the next few weeks, a highly divisive showdown is likely to take place in Washington.

Only 6 percent of the 234 Republicans in the US House of Representatives are from congressional districts where Barack Obama won in the last presidential election. Also, Obama won only one of the 13 states - just 7 percent - where 14 Republican senators will seek re-election in 2014.

In his second term, President Obama hopes to work on his legacy, whereas congressional Republicans have fewer incentives for compromise since they must worry about their re-election.

Nonetheless, in the next four to eight weeks, the president, the House and the Senate must agree on a compromise over a new debt ceiling, a deficit-cutting plan, the Bush tax cuts, automatic spending cuts, unemployment benefits, payroll tax cut, capital gains and dividend taxes. The outcome of such an agreement (or the lack of it) has vital implications for the world economy, especially China-US relations.

At the end of 2012, US debt exceeded the $16.4-trillion ceiling, which led Standard & Poor's to repeat its warning that America could face another downgrade by 2014 or earlier. The debt burden translates to more than $52,000 per American citizen (about $15,000 more than in Greece). Only a credible, long-term fiscal adjustment program can ease this burden.

Like in summer 2011, the US Treasury Department is using "extraordinary measures" to borrow $200 billion, which gives legislators two months' time to raise the official limit. As the US' largest foreign creditor, China owns about $1.1 trillion of US Treasury debt. China's foreign exchange reserves total $3.3 trillion, or more than 40 percent of its GDP, with 65-70 percent of these reserves in US dollars.

Therefore, any prolonged friction over the US debt ceiling is likely to fuel a debate among Chinese and foreign creditors over the prospects of America's economy and creditworthiness, the dollar and the need to gradually diversify away from holdings in the US.

Then, there is the issue of automatic spending cuts, which were instituted in August 2011 when Washington lost its triple-A credit rating. The Republicans demand large cuts in non-defense spending as part of any tax deal, whereas the Democrats demand substantial cuts in defense spending. As a result, Republican analysts and neoconservatives will fight the proposed defense cuts, arguing that defense cuts are a threat to national security, while trade hawks will seek to contain the expansion of Chinese companies in the US.

Apart from the debt and spending cuts, there is also the challenge of unemployment, which remains at 7.8 percent. Indeed, there is a temptation to perceive US structural unemployment in the context of "unfair" Chinese competition, innovation, currency and trade policies, and intellectual copyrights issues.

The US unemployment challenge is amplified by the debate over the Bush-era tax cuts for wealthy families making more than $250,000 a year. In the absence of policy changes, the US debt burden will increase by another $10 trillion in the next decade and more than 40 percent of it can be attributed to these cuts.

In reality, Washington cannot afford any tax cuts. In 2010, the federal government's revenue accounted for 15 percent of GDP, but its expenses were almost 24 percent. It is thus clear that the longer it will take to create a sustainable political solution, the greater will be the impasse for the US economy. If the bill for the impending fiscal cliff deal will amount to 1.5 percent and US growth is 2 percent, real growth will stagnate in 2013 - and that's the benign scenario.

The US-China relationship suffers from mutual mistrust, which stems from the two countries' different political systems, economic models and security interests. Also, the US leadership at the Sino-US Strategic and Economic Dialogue is about to change. Veteran Democrat John Kerry will replace Secretary of State Hillary Clinton and Secretary of Treasury Timothy Geithner plans to leave by the end of January. Though government- to-government dialogue is based on institutions rather than personalities, human relationships matter.

On the security side, the two countries should find deeper understanding on the US rebalancing in the Asia-Pacific region, regional maritime disputes, modernization of China's military, international cyber espionage, Iran's nuclear program and the Democratic People's Republic of Korea.

On the economic side, China and the US must come to terms with global rebalancing, trade and investment, intellectual property rights, innovation policies and commitments in the World Trade Organization.

Times of great risks are also times of great opportunities, however. If Washington can finally initiate the impending debt cuts and if Obama can build a legacy as the first multipolar US president, longstanding mistrust could gradually give way to a strategic reset in the most important bilateral relationship of the 21st century.

The author is research director of international business at the US-based India, China and America Institute and visiting fellow at Shanghai Institutes for International Studies (China) and EU Centre (Singapore).

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|