From the Chinese Press

Updated: 2013-09-25 07:58

(China Daily)

|

||||||||

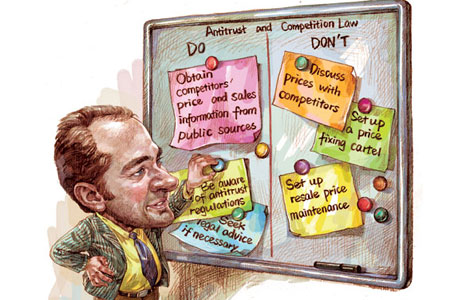

Plea for household income tax

Several tax experts have suggested that individual income tax be changed to household income tax to reduce wage earners' burden, and higher taxes be imposed on the high-income group to establish a fair taxation regime, says an article in China Youth Daily. Excerpts:

Household, not individual, income determines the living standard of a family. Therefore, it would be fair to tax people according to their household income. The biggest advantage of household income tax is that it takes into consideration the actual expenditure of a family and is thus a fairer method of taxation.

In countries that have a relatively mature tax system, the threshold of individual income tax is linked to economic indicators such as fluctuations in the consumer price index and other dynamic socio-economic shifts. For example, in Germany, while measuring a household's burden officials see whether it is a one-person, married-without-children or married-with-children family. They also take into consideration the amount the family spends on children's education and other necessary matters.

Although it is difficult to switch from individual to household income tax, it is not infeasible. Many experts and officials say China should follow international convention in terms of taxation, and it is time it did so by learning from the examples of other countries.

To reform the income distribution system and establish a harmonious society, China has to ensure social wealth is distributed in a fair and reasonable manner.

Some government departments reportedly have already taken the first steps toward tax reforms by setting up a network connecting between national and local taxation systems. Therefore, it is likely that social consensus will be reached in the near future on replacing individual income tax with household income tax.

Maintenance fees system

The National Audit Office has made public the audit results of the social maintenance fees collected by nine provinces and cities. Preliminary data show 45 county governments illegally allocated 1.627 billion yuan ($265.81 million) of social maintenance fees to family planning and other departments, eliciting calls to strengthen audit supervision, says an article in Beijing News. Excerpts:

Governments collect social maintenance fees as a compensational charge and use the money on sectors concerning people's livelihood, such as education and healthcare. But lax management has turned the fee collection into a chaotic phenomenon.

The audit has proved right the long-held doubts and worries over social maintenance fees, making it all the more important for the government to strengthen supervision over fee collection and increase accountability. For instance, local governments and officials who violate the law and regulations should be punished accordingly.

Besides, family planning departments also have a role to play in clearing the mess. The fee-collection mechanism has to be reformed to ensure better social maintenance. For example, people should be allowed to request for a public hearing before being made to pay huge amounts as social maintenance fees.

If the authorities make the details of the collection and use of the social maintenance fees public, local family planning departments would not dare to collect the fees illegally. Hopefully, the audit results will make it mandatory for relevant departments to disclose information on social maintenance fees.

(China Daily 09/25/2013 page9)

China's investment a 'job-saver' in Europe

China's investment a 'job-saver' in Europe

Pollution control plan to slash PM2.5

Pollution control plan to slash PM2.5

The beauty and beasts of selling hot houses

The beauty and beasts of selling hot houses

Tian'anmen's flowery moments for National Day

Tian'anmen's flowery moments for National Day

When animals meet beer

When animals meet beer

Microsoft revamps Surface to challenge Apple

Microsoft revamps Surface to challenge Apple

Gold rush for new coin

Gold rush for new coin

China's growth: Fundamental challenges still remain

China's growth: Fundamental challenges still remain

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

93 killed as quake hits SW Pakistan

Smithfield deal 'great' for US shareholders: CEO

China expects to complete space station by 2023

China rebukes US drone reports

New top trader coming to stage

UN General Assembly starts debate

China aims to attract more foreign students

Microsoft enters China's gaming market

US Weekly

|

|