Bigger market role in IPO

Updated: 2013-12-03 08:14

(China Daily)

|

||||||||

The reform plans that China's securities watchdog unveiled at the weekend spell new opportunities for Chinese investors in the long run.

After suspending new share offerings for more than a year, the China Securities Regulatory Commission issued guidelines to introduce a system of registration for IPO issuances to replace the current administrative approval mechanism.

Given that more than 700 firms are in the IPO pipeline and about 50 of them are expected to go to market by the end of January, it is understandable that stocks in China tumbled amid worries that a flood of IPOs could divert funds from the secondary market.

The benchmark Shanghai Composite Index shed only 0.6 percent on Monday. Meanwhile the 8.4-percent plunge of the ChiNext Composite Index, the country's Nasdaq-style board of more than 350 growth enterprises, marked a record loss since its launch in 2010.

Such performances are surely a result of profit taking since the latter was up more than 80 percent this year before Monday while the former barely registered any growth.

Yet, more importantly, the divergence in the performance of Chinese shares also speaks of the new characteristics of the country's coming economic reforms.

It is obvious that new reforms in the stock market are in line with China's ambition to let market forces play a more "decisive role" in its economic reforms.

However, to deepen economic reforms that have already entered "deep water" requires Chinese leaders to focus on breaking down "entrenched interests" to improve the overall efficiency of the economy, instead of pursuing the low-hanging fruits of growth policies that benefit everyone.

Such reforms will thus be difficult to swallow for some people just like the imminent relaunch of IPOs that will put downward pressure on the prices of certain stocks to the disappointment of some investors.

But a streamlined, market-oriented and law-based IPO system as well as supervision by the securities watchdog will do Chinese investors good in the long run. Increased stock supply and strengthened investor protection will force listed companies to better serve shareholders as a whole.

As will China's other deep-water reforms be good for the country's economic progress.

(China Daily 12/03/2013 page8)

Simulated archaeology takes you back in time

Simulated archaeology takes you back in time

Thai PM calls for talks, protest leader defiant

Thai PM calls for talks, protest leader defiant

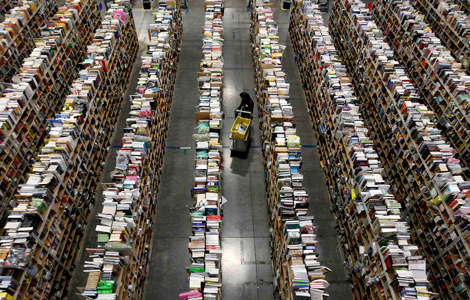

'Cyber Monday' sales set to hit record

'Cyber Monday' sales set to hit record

Tapping the power of youth volunteers

Tapping the power of youth volunteers

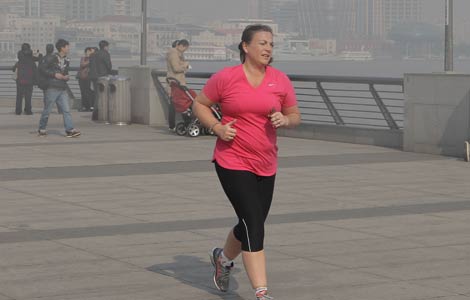

Shanghai braces for second day of severe pollution

Shanghai braces for second day of severe pollution

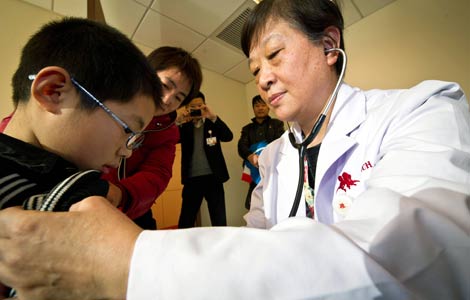

Private hospitals face challenges

Private hospitals face challenges

Chinese premier meets Britain's Cameron

Chinese premier meets Britain's Cameron

Washington's panda named Bao Bao

Washington's panda named Bao Bao

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Staggered flu shot plan best for China: study

Online shopping changing retail world

House hunting the world in Chinese

Chinese credit agency forecasts future US downgrade

China-UK collaboration is about time: President Xi

Biden's Asia trip under pressure

FTZ OKs offshore accounts

Amazon testing delivery with drones

US Weekly

|

|