House hunting the world in Chinese

Updated: 2013-12-03 07:54

By Chen Jia in San Francisco (China Daily USA)

|

||||||||

The United States is the top investment destination for Chinese buyers who are interested in buying overseas property this year, according to the latest report from Juwai.com, an international property portal catering to Chinese-speaking shoppers.

However, the US is not among the top five "fastest growing countries in 2013 Chinese property buyer interest", according to the report.

"The country where the property is located can be less important. What's happening is that more high-net-worth buyers are beginning to search by property price and lifestyle," Andrew Taylor, co-CEO of Juwai.com, told China Daily.

According to Juwai.com's research, a quarter to half of all buyers start hunting for property without any particular country in mind.

For example, a client might want a house on the coast, within an hour of an international airport and in the $5 million to $10 million range. It could be in Australia, California or the south of France.

"The traditional gateway cities for Chinese investors no longer have the highest rates of growth in Chinese buyer interest," Taylor explained.

"There are still the top destinations, but other and newer destinations are growing more quickly," he said. "The momentum is shifting from the traditional leaders to a new batch of locations."

In 2013, New Zealand is the fastest growing country in Chinese property buyer interest, followed by Italy, Thailand, France and Portugal.

A similar trend also challenges the ranking of traditional cities in the US, where New York has been by far the top city for Chinese investor interest in 2013, followed by Los Angeles, Philadelphia, Detroit and Houston.

The fastest growing American cities are Honolulu, Detroit, Charlotte, Chicago and Austin, said the report.

Juwai.com lists properties from 53 countries and has customers from the world over.

Its site is in both traditional and simplified Chinese.

Some 82 percent of Juwai's users are from China, and the rest from are from other countries such as Singapore and Malaysia.

Taylor said that there are only two channels that are important for wealthy and middle class Chinese considering overseas property: the Internet and word of mouth.

"Despite everything we invest in our website and editorial content, our biggest advantage is the relationships we have established with Chinese buyers and the real estate industry in places like the US," he said.

"If a home seller can choose between an agent who markets in China, and one who doesn't, of course they will choose the one who does," he said.

"I spoke with an agent just this week who told me that she has a customer with a coastal property in the $50 million range. This seller doesn't want those properties marketed in the US, only in China," he said.

Another San Francisco-based agent, Joel Goodrich, said, "I have a couple of mainland Chinese buyers who Juwai.com connected me with just this month and are just starting to look in New York."

One is looking for a condo in the $1 million to $2 million range, and the other is looking for an apartment over $10 million, he said.

"Without Juwai.com, I absolutely would not have connected with these buyers," he said.

Contact the writer at chenjia@chinadailyusa.com

Thai PM calls for talks, protest leader defiant

Thai PM calls for talks, protest leader defiant

'Cyber Monday' sales set to hit record

'Cyber Monday' sales set to hit record

Tapping the power of youth volunteers

Tapping the power of youth volunteers

Shanghai braces for second day of severe pollution

Shanghai braces for second day of severe pollution

Private hospitals face challenges

Private hospitals face challenges

Chinese premier meets Britain's Cameron

Chinese premier meets Britain's Cameron

Washington's panda named Bao Bao

Washington's panda named Bao Bao

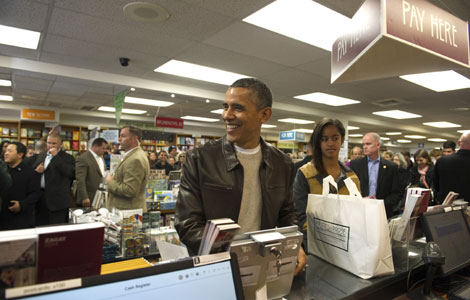

Obama stuns bookstore shoppers

Obama stuns bookstore shoppers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese credit agency forecasts future US downgrade

China-UK collaboration is about time: President Xi

Biden's Asia trip under pressure

FTZ OKs offshore accounts

Amazon testing delivery with drones

Private hospitals face challenges

China shares slide on move to restart IPOs

Economic rebound not likely: group

US Weekly

|

|