Rein in speed of debt rise

Updated: 2014-01-16 07:55

By Louis Kuijs (China Daily)

|

||||||||

As to local government debt, the NAO's numbers show that the overall pace of build-up of local government debt has been too fast, from a sustainability perspective. In addition, specific problems and financial risks have resulted. In the case of some of the infrastructure that is being built, the revenues are unlikely to ever be sufficient to repay the loans, even after maturity extension. Thus, the associated local government investment platforms may need to default on their loans.

Going forward, in order to put local government finances on a sounder, more sustainable footing, the government will need to both recognize and address the problems with the existing stock of local debt and stem the flow of new local government borrowing and the associated risks.

China's leadership has started to take measures in this direction. Most of the measures proposed so far call on banks and local governments to take action and change behavior. While such measures are key, the central government will also need to acknowledge its role in the creation of the problems and become more actively involved in the resolution of legacy problems.

With regard to existing bad loans, resolution will often require the involvement of local governments, especially in the case of local governments in poorer parts of China, and higher levels of government. The losses will have to be absorbed by the banks, local governments and higher levels of government.

For a while already, the central government has tried to stem the flow of new lending by local government investment platforms, including by instructing banks to halt lending to those investment platforms with dubious financial prospects.

However, by itself such a stop could be disruptive and lead to the kind of stress that is not obviously in the interest of the bank, which is why it has in practice been difficult to enforce the rules.

At the Third Plenary Session of the 18th Central Committee of the Communist Party of China in November 2013, the leadership called for hardening local government budget constraints through increased transparency and stricter budget management as well as strengthening incentives among local government officials to contain debt, including by making debt a criterion in the performance evaluation system for senior local government officials.

Such measures are key but not enough. In part local government borrowing has resulted from a mismatch between their revenues and their expenditure responsibilities. Unlike almost all other countries, in China local governments are largely responsible for expenditure on healthcare, education and social security, in addition to most local infrastructure, and the current structure of intergovernmental fiscal relations often does not provide sufficient resources for them to carry out these mandates.

The central government has taken some steps to relieve the financial pressures on local governments by transferring some expenditure responsibilities to the central government and increasing the revenue base of local governments. However, the steps so far have been modest and piecemeal. China needs a complete overhaul of the intergovernmental fiscal relations in these directions. Together with the hardening of budget constraints, the rebalancing of incentives of local governments and orderly development of local government bond issuance this would go a long way in putting local government finances on a sound footing.

The author is chief China economist with The Royal Bank of Scotland.

Wuhan overpass swings into place

Wuhan overpass swings into place

Detroit auto show features fuel-efficient cars

Detroit auto show features fuel-efficient cars

Palestinian students show military skills

Palestinian students show military skills

Cristiano Ronaldo wins FIFA best player award

Cristiano Ronaldo wins FIFA best player award

Xuelong carries on mission after breaking from floes

Xuelong carries on mission after breaking from floes

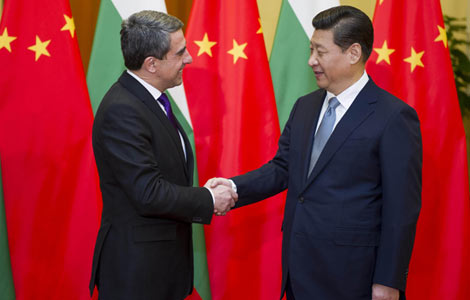

Beijing and Sofia vow new initiatives

Beijing and Sofia vow new initiatives

71st Golden Globe Awards

71st Golden Globe Awards

Bangkok unrest hurts major projects and tourism industry

Bangkok unrest hurts major projects and tourism industry

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China seeks to calm US fears over missile

Doubt on Tokyo's diplomatic push

China Mobile and Apple 'tie the knot'

Russia battles terror before Olympics

China vows reform to curb corruption

Corrupt officials beware this New Year

Shanghai schools to close on heavily polluted days

Air China ups Houston-Beijing service to daily

US Weekly

|

|