Rein in speed of debt rise

Updated: 2014-01-16 07:55

By Louis Kuijs (China Daily)

|

||||||||

At the end of last year, the National Audit Office released the results of its long-awaited updated survey of China's local government debt, which totalled 17.9 trillion yuan ($2.95 trillion) in June 2013, up from 10.7 trillion yuan at the end of 2010, when the previous tally by the NAO took place.

Included in the June 2013 total is around 7 trillion yuan of contingent liabilities that the NAO calls "debt that the governments may have". These contingent liabilities, largely resulting from explicit and implicit government guarantees by local governments to local government investment platforms, rose a full 75 percent from the end of 2010 to June 2013, as local government investment platform borrowing continued to take place on a very large scale, despite earlier intentions to rein it in.

The NAO's survey confirms that a large-scale rollover of local government debt is taking place, as the short-term maturity of most loans is inconsistent with their use in financing infrastructure, which tends to generate direct or indirect revenues only after a time lag. Indeed, the NAO found that 23 percent of the local government debt matured in the second half year of 2013. With another 22 percent maturing in 2014, rollover - either into new loans or bonds - will have to continue in 2014.

Once we include local government borrowing, fiscal policy has been more expansionary in recent years than the official fiscal data suggests. The inclusion of local government debt pushed up total government debt to around 57 percent of GDP at the end of last year. This is still a manageable level, especially when compared to the government debt in developed countries.

However, it is important to also look at the pace at which these debts have risen in recent years. Whereas the official fiscal data says China's government deficit was around 1.5 percent of GDP in recent years, RBS estimates, which take into account the NAO's data on local governments, suggest it was actually around 7 percent between 2011 to 2013, with the bulk contributed by local governments. The only reason why, despite such high deficits, the government debt-to-GDP ratio did not rise faster than it did in the past five years was that GDP growth remained fairly high.

At RBS we think that, from a macroeconomic perspective, China's overall debt of around 210 percent of GDP and the associated financial risks do not seem large enough to overwhelm the economy and financial system, when we look at macroeconomic indicators, the pattern of growth in the real economy and the robustness of the banking sector. Nonetheless, overall debt is rising too rapidly and the pace of increase needs to be reined in.

Wuhan overpass swings into place

Wuhan overpass swings into place

Detroit auto show features fuel-efficient cars

Detroit auto show features fuel-efficient cars

Palestinian students show military skills

Palestinian students show military skills

Cristiano Ronaldo wins FIFA best player award

Cristiano Ronaldo wins FIFA best player award

Xuelong carries on mission after breaking from floes

Xuelong carries on mission after breaking from floes

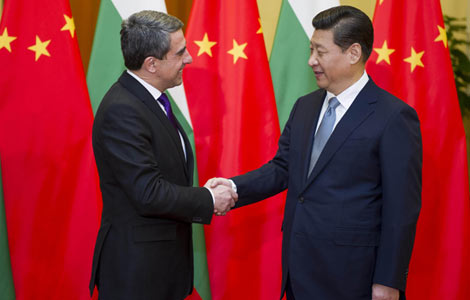

Beijing and Sofia vow new initiatives

Beijing and Sofia vow new initiatives

71st Golden Globe Awards

71st Golden Globe Awards

Bangkok unrest hurts major projects and tourism industry

Bangkok unrest hurts major projects and tourism industry

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China seeks to calm US fears over missile

Doubt on Tokyo's diplomatic push

China Mobile and Apple 'tie the knot'

Russia battles terror before Olympics

China vows reform to curb corruption

Corrupt officials beware this New Year

Shanghai schools to close on heavily polluted days

Air China ups Houston-Beijing service to daily

US Weekly

|

|