Monetary union road to EU prosperity

Updated: 2015-01-19 08:13

By Mario Draghi(China Daily)

|

||||||||

The second implication of the absence of fiscal transfers is that countries need to invest more in other mechanisms to share the cost of shocks. Even with more flexible economies, internal adjustment will always be slower than it would be if countries had their own exchange rates. Risk sharing is thus essential to prevent recessions from leaving permanent scars and reinforcing economic divergence.

A key part of the solution is to improve private risk sharing by deepening financial integration. Indeed, the less public risk sharing we want, the more private risk sharing we need. A banking union for the eurozone should be catalytic in encouraging deeper integration of the banking sector. But risk sharing is also about deepening capital markets, especially for equity, which is why we also need to advance quickly with a capital markets union.

Still, we have to acknowledge the vital role of fiscal policies in a monetary union. A single monetary policy focused on price stability in the eurozone cannot react to shocks that affect only one country or region. So, to avoid prolonged local slumps, it is critical that national fiscal policies perform their stabilization role. And to allow national fiscal stabilizers to work, governments must be able to borrow at an affordable cost in times of economic stress. A strong fiscal framework is indispensable to achieve this, and protects countries from contagion.

But the crisis experience suggests that, in times of extreme market tensions, even a sound initial fiscal position may not offer absolute protection from spillovers.

This is another reason why we need economic union: markets would be less likely to react negatively to temporarily higher deficits if they were more confident in future growth prospects. By committing governments to structural reforms, economic union provides the credibility that countries can indeed grow out of debt.

Ultimately, economic convergence among countries cannot be only an entry criterion for monetary union, or a condition that is met some of the time. It has to be a condition that is fulfilled all of the time. And for this reason, to complete monetary union we will ultimately have to deepen our political union further: to lay down its rights and obligations in a renewed institutional order.

The author is president of the European Central Bank.

- Inspection teams to cover all of military in anti-corruption drive

- Tornado, heavy rain batters Central China's Hunan

- Beijing's five-year plan: Cut population, boost infrastructure

- Palace Museum discovers relics buried for over 600 years

- Disney promises ‘safe, pleasing service of high quality’

- Couple detained for selling their two sons

- Rousseff: Accusations against her 'untruthful'

- Almost one-sixth of Brazil's confirmed microcephaly cases linked to Zika

- Impeachment trial against Rousseff recommended to senate

- With nomination secured, Trump to aim all guns at Hillary Clinton

- Obama sips Flint water, urges children be tested for lead

- Massive protests against Abe mark Japan's Constitution Memorial Day

Raging wildfire spreads to more areas in west Canada

Raging wildfire spreads to more areas in west Canada

World's first rose museum to open in Beijing

World's first rose museum to open in Beijing

Teapot craftsman makes innovation, passes down techniques

Teapot craftsman makes innovation, passes down techniques

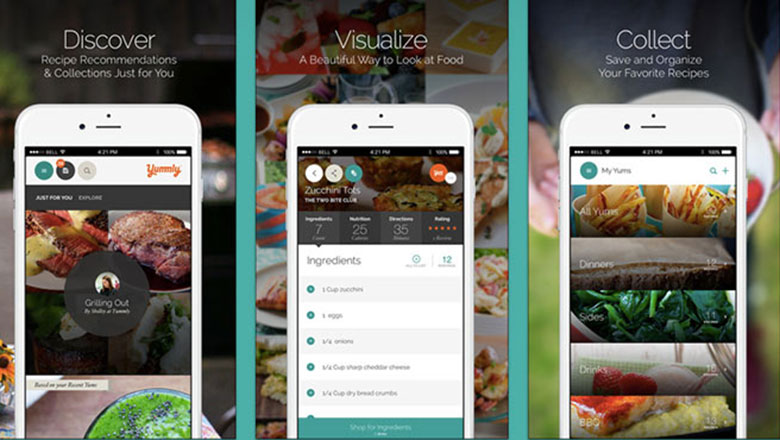

Top 8 iOS apps recommend for mothers

Top 8 iOS apps recommend for mothers

Five things you may not know about the Start of Summer

Five things you may not know about the Start of Summer

Art imagines celebrities as seniors

Art imagines celebrities as seniors

Japanese animator Miyazaki's shop a big hit in Shanghai

Japanese animator Miyazaki's shop a big hit in Shanghai

Star Wars Day celebrated around world

Star Wars Day celebrated around world

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|