Struggling EU casts shadow over Davos

Updated: 2015-01-20 08:12

By Fu Jing(China Daily)

|

||||||||

The third factor is linked to the second shock for the EU. Many anticipate the European Central Bank will make the long-debated decision on Jan 22 on whether to buy government bonds to increase money supply or to launch a quantitative easing (QE) policy. If this happens, the global market will respond wildly, with China already identifying it as one of the uncertainties that could have a great impact on its economy.

And the fourth factor is the Greek election, which, according to initial reports, could see the far-left party Syriza forming the new government. This could create a stir in the financial market, strengthen the Grexit (Greece's exit from the eurozone) debate and dampen public and business sentiments.

There is a fifth factor too: the ongoing Ukraine crisis and the sanctions and counter-sanctions between the EU and Russia, which have already caused damage to both economies. Although this is not a new happening, neither side has been able to find ways to overcome the crisis.

Each of the above factors could weaken the EU economies further. From the perspective of policy, the EU economies, their neighbors and the rest of the world need to work together to avoid further market shocks. This is short-term effort but in the long run, the EU, as an evolving monetary, fiscal and economic union, should forge a unitary policy. Of course, it should also deepen political reform and take measures to minimize the economic and market uncertainties that emerge from its member countries' competitions.

Some may say that the collapse of the euro is good news for Chinese tourists, because they can spend less to visit the EU countries and find it easier to invest money and buy property there. But can they really do so with fear, uncertainties and panic ruling the markets?

The author is China Daily chief correspondent in Brussels. fujing@chinadaily.com.cn

- Inspection teams to cover all of military in anti-corruption drive

- Tornado, heavy rain batters Central China's Hunan

- Beijing's five-year plan: Cut population, boost infrastructure

- Palace Museum discovers relics buried for over 600 years

- Disney promises ‘safe, pleasing service of high quality’

- Couple detained for selling their two sons

- Rousseff: Accusations against her 'untruthful'

- Almost one-sixth of Brazil's confirmed microcephaly cases linked to Zika

- Impeachment trial against Rousseff recommended to senate

- With nomination secured, Trump to aim all guns at Hillary Clinton

- Obama sips Flint water, urges children be tested for lead

- Massive protests against Abe mark Japan's Constitution Memorial Day

Raging wildfire spreads to more areas in west Canada

Raging wildfire spreads to more areas in west Canada

World's first rose museum to open in Beijing

World's first rose museum to open in Beijing

Teapot craftsman makes innovation, passes down techniques

Teapot craftsman makes innovation, passes down techniques

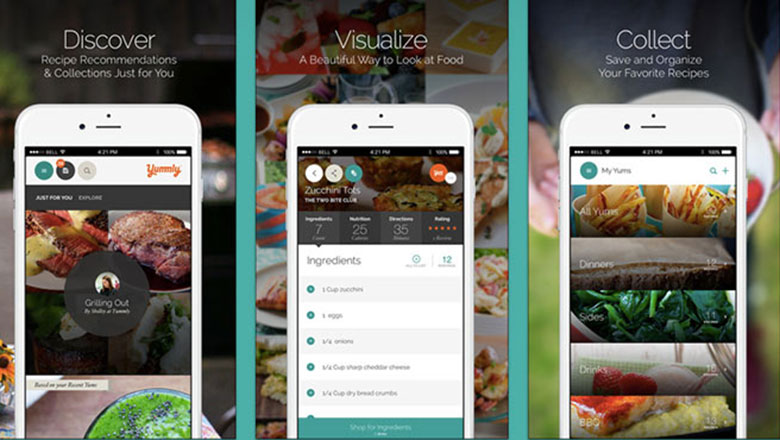

Top 8 iOS apps recommend for mothers

Top 8 iOS apps recommend for mothers

Five things you may not know about the Start of Summer

Five things you may not know about the Start of Summer

Art imagines celebrities as seniors

Art imagines celebrities as seniors

Japanese animator Miyazaki's shop a big hit in Shanghai

Japanese animator Miyazaki's shop a big hit in Shanghai

Star Wars Day celebrated around world

Star Wars Day celebrated around world

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|