Economic data move toward new normal

Updated: 2015-01-21 13:56

By Louis Kuijs(Chinadaily.com.cn)

|

||||||||

Other growth drivers remain broadly intact, though. Infrastructure investment should continue to be supported by policymakers’ reliance on such investments to support growth, although the implementation of the new local government debt framework does pose downside risks. Consumption should continue to benefit from a solid labor market and low inflation, while the outlook for exports is reasonable.

Key risks to the outlook include a more pronounced global monetary and exchange rate upheaval, weaker global trade growth and, in China itself, a more pronounced downturn in real estate, lower infrastructure investment following the implementation of the local government debt framework, and jitters in financial markets on the back of credit events.

Policy support will be needed to achieve GDP growth of close to 7 percent in 2015 — the likely growth target for this year — but policymakers will remain reluctant to move toward major, high-profile stimulus measures in line with their emphasis on “the new normal”, instead of stimulus. On the fiscal front, while infrastructure investment will remain a focus this year, there is no major stimulus in the pipeline.

On the monetary front, calls for policy to support growth and contain borrowing costs will be balanced with the need to rein in the rise in leverage and financial risks. The People’s Bank of China has largely continued to implement “targeted” monetary policy measures instead of high-profile measures such as required reserve ratio (RRR) or further interest rate cuts. Earlier this week, the PBoC increased relending to financial institutions that serve agriculture and small companies. Another factor holding back an RRR cut has been large inflows into the equity market in recent months, in part fuelled by margin trading financed by the shadow banking system, although measures announced last Friday by the China Banking Regulatory Commission and China Securities Regulatory Commission to rein that in seem to have had a major dampening impact on the stock market and may make an eventual RRR cut more likely.

The author is chief China economist at the Royal Bank of Scotland.

- Inspection teams to cover all of military in anti-corruption drive

- Tornado, heavy rain batters Central China's Hunan

- Beijing's five-year plan: Cut population, boost infrastructure

- Palace Museum discovers relics buried for over 600 years

- Disney promises ‘safe, pleasing service of high quality’

- Couple detained for selling their two sons

- Rousseff: Accusations against her 'untruthful'

- Almost one-sixth of Brazil's confirmed microcephaly cases linked to Zika

- Impeachment trial against Rousseff recommended to senate

- With nomination secured, Trump to aim all guns at Hillary Clinton

- Obama sips Flint water, urges children be tested for lead

- Massive protests against Abe mark Japan's Constitution Memorial Day

Raging wildfire spreads to more areas in west Canada

Raging wildfire spreads to more areas in west Canada

World's first rose museum to open in Beijing

World's first rose museum to open in Beijing

Teapot craftsman makes innovation, passes down techniques

Teapot craftsman makes innovation, passes down techniques

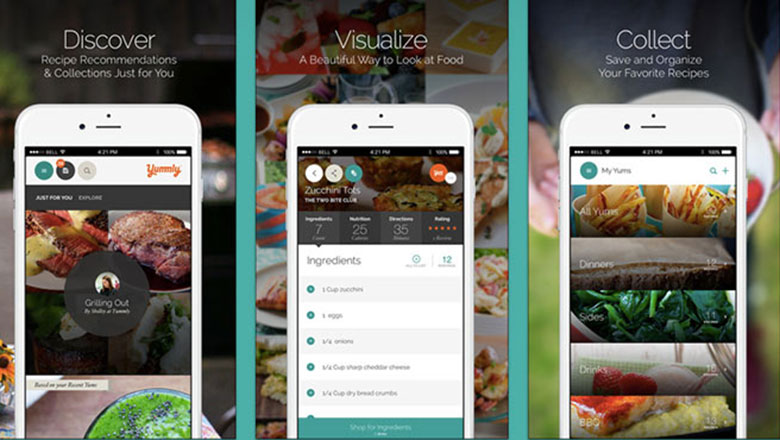

Top 8 iOS apps recommend for mothers

Top 8 iOS apps recommend for mothers

Five things you may not know about the Start of Summer

Five things you may not know about the Start of Summer

Art imagines celebrities as seniors

Art imagines celebrities as seniors

Japanese animator Miyazaki's shop a big hit in Shanghai

Japanese animator Miyazaki's shop a big hit in Shanghai

Star Wars Day celebrated around world

Star Wars Day celebrated around world

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|