Modern Greek theater and Europe's future

Updated: 2015-01-23 08:05

By Daniel Stelter(China Daily)

|

||||||||

|

|

Greece's Prime Minister Antonis Samaras smiles during the second of three rounds of a presidential vote at the Greek parliament in Athens December 23, 2014. [Agencies] |

Politicians in Berlin and Brussels are not too inclined to give in to being blackmailed by Alexis Tsipras and a potential next Greek government led by him. And for good reason.

The politicians in Berlin and Brussels point to the fact that "Grexit" (withdrawal of Greece from the eurozone) would no longer affect financial stability or the overall existence of the eurozone. This is due to the fact that most of Greece's debt today is held by governments and the European Central Bank.

It is, in fact, quite attractive for eurozone politicians to play with the idea of Grexit. If things were to turn in that direction, the resulting chaos in Greece - including bank runs, capital controls and an even deeper slump of the economy - could serve as a powerful example for other countries with similar ideas for opting out.

In particular, the electorates of Spain and Italy would see the price to be paid if they followed the political prescriptions by the likes of left-wing Spanish party Podemos and euro-skeptic Italian party Cinque Stelle.

Interestingly, on the opposite end of the political spectrum, there is similar excitement about a potential Grexit. The turbulences that would follow - if and when Tsipras-led left-wing Syriza indeed overplays its hand - would suit the needs of those who like to see more intervention by the ECB, notably via quantitative easing.

A eurozone without Greece, while more aligned on the economic strategy of austerity, would be commensurately more challenged by financial markets. It would undoubtedly need the strong support of its central bank - this time not only with words, but also with action.

Over the short and medium terms, this might well work. But a look at the fundamentals of the eurozone is sobering. Even six years after the onset of the financial and eurozone crisis, a true recovery is not in sight.

- Inspection teams to cover all of military in anti-corruption drive

- Tornado, heavy rain batters Central China's Hunan

- Beijing's five-year plan: Cut population, boost infrastructure

- Palace Museum discovers relics buried for over 600 years

- Disney promises ‘safe, pleasing service of high quality’

- Couple detained for selling their two sons

- Rousseff: Accusations against her 'untruthful'

- Almost one-sixth of Brazil's confirmed microcephaly cases linked to Zika

- Impeachment trial against Rousseff recommended to senate

- With nomination secured, Trump to aim all guns at Hillary Clinton

- Obama sips Flint water, urges children be tested for lead

- Massive protests against Abe mark Japan's Constitution Memorial Day

Raging wildfire spreads to more areas in west Canada

Raging wildfire spreads to more areas in west Canada

World's first rose museum to open in Beijing

World's first rose museum to open in Beijing

Teapot craftsman makes innovation, passes down techniques

Teapot craftsman makes innovation, passes down techniques

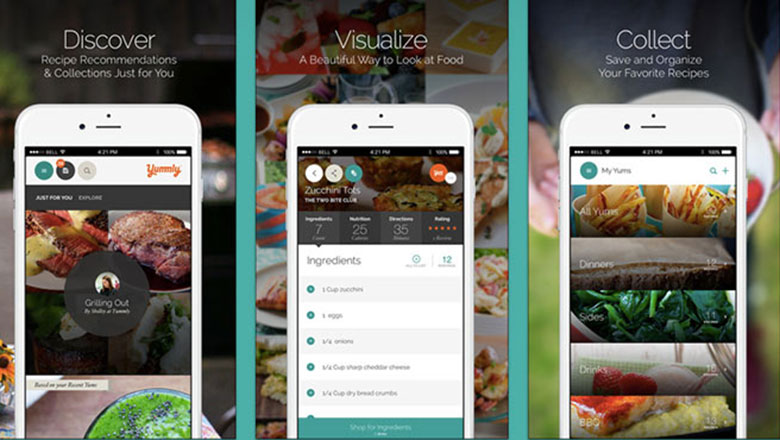

Top 8 iOS apps recommend for mothers

Top 8 iOS apps recommend for mothers

Five things you may not know about the Start of Summer

Five things you may not know about the Start of Summer

Art imagines celebrities as seniors

Art imagines celebrities as seniors

Japanese animator Miyazaki's shop a big hit in Shanghai

Japanese animator Miyazaki's shop a big hit in Shanghai

Star Wars Day celebrated around world

Star Wars Day celebrated around world

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|