Reform can prevent Japan-like debt crisis

Updated: 2016-06-30 08:25

By STEPHEN ROACH(China Daily)

|

||||||||

|

| Wang Xiaoying / China Daily |

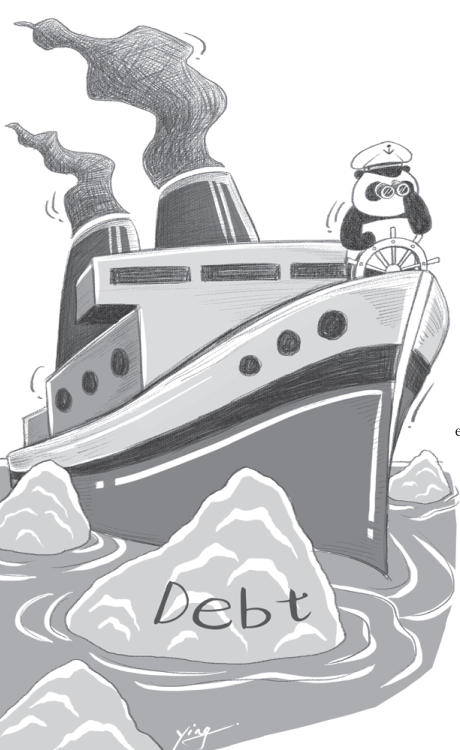

Despite deepening concerns about China's economy, the country is not heading toward "lost decades" of Japan-style stagnation. And yet a worrisome ambiguity clouds this verdict.

China's non-financial debt has increased from 150 percent of GDP in 2008 to 255 percent today, with two-thirds of the increase concentrated in the corporate sector, largely State-owned enterprises. Since China has the highest savings rate in the world-its gross domestic saving averaging 49 percent of GDP since 2007-its surging debt hardly comes as a surprise. Economies with high savings are prone to high investment, and the lack of capital market reform in China-exacerbated by the bursting of the equity bubble in 2015-reinforces the disproportionate role that bank credit has played in funding the country's investment boom.

The Japan comparison is especially instructive in assessing the risks of debt-intensive growth. At nearly 390 percent of GDP in late 2015, Japan's overall debt ratio is about 140 percentage points higher than China's. But because Japan has such a high savings rate-averaging 24 percent of GDP since 2007-it basically owes its debt to itself. That means it is not vulnerable to the capital flight of foreign investors that often triggers crises.

With China's savings rate double that of Japan's since 2007, that conclusion is all the more pertinent for its debt-intensive economy. The China scare of early 2016-stoked by hand-wringing over capital flight and currency risk-missed this point altogether. Fears of a hard landing stemming from a Chinese debt crisis are vastly overblown.

Zombie companies-the economic walking dead-are also a topic of intense discussion in China. Key actors in Japan's first lost decade in the 1990s, zombie corporations were kept alive by the "ever-greening" of subsidized bank lending-masking an outsize build-up of non-performing loans (NPLs) that ultimately brought down the Japanese banking system. Significantly, the insidious interplay between zombie corporations and zombie banks clogged the arteries of the real economy-leading to a sharp slowdown in productivity growth that Japan has yet to reverse.

In recent public statements, the Chinese leadership has made explicit reference to zombie SOEs. And, unlike Japan, which remained in denial over this problem for close to a decade, the Chinese authorities have moved relatively quickly to rein in excesses in two key industries-steel and coal-while hinting of more to come in cement, glass and shipbuilding.

China's deteriorating loan quality is also reminiscent of Japan's experience. The official NPL ratio of 1.7 percent for listed banks is only the tip of the iceberg. Beneath the surface are "special mention loans"-where borrowers are in the early stages of repayment difficulties-along with bad credits in the shadow banking sector, both of which could raise China's fully-loaded NPL ratio to about 8 percent. In that case, the authorities will eventually need to inject capital into the Chinese banking system.

None of this is a dark secret in Beijing. On the contrary, an interview in early May with an "authoritative insider", published in China's flagship official newspaper, People's Daily, underscored an increasingly open and intense debate over how to avoid ending up like Japan. The insider highlighted the insidious connection between China's debt and zombie problems that might well culminate in a Japan-like "L-shaped" endgame.

This gets to the heart of the China-Japan comparison. Two and a half lost decades (and counting) is simply an unacceptable outcome for China. But knowing what it doesn't want is not enough to guarantee that China won't fall into a Japan-style trap of its own.

Reforms are the decisive differentiating factor. Japan's failure to embrace structural reforms was a hallmark of the 1990s, and it is an equally serious impediment to the current "Abenomics" recovery program. By contrast, China's strategy emphasizes the heavy lifting of structural change and rebalancing. In the end, success or failure will hinge on the willingness of the Chinese leadership to confront the powerful vested interests resisting reform.

The author, a faculty member at Yale University and former chairman of Morgan Stanley Asia, is the author of Unbalanced: The Codependency of America and China.

Project Syndicate

- Hillary Clinton boasts double-digit lead over Trump: poll

- First New York Pride March since Orlando shooting targets gun control

- Intl experts question proceedings of South China Sea arbitration

- South China Sea tribunal has no legal validity

- Cambodia positions itself along new Silk Road: media

- UK opposition leader Corbyn says will not resign after Brexit vote

Paintings on paddy fields in Shenyang, NE China

Paintings on paddy fields in Shenyang, NE China

Rio 2016 Olympic medals under preparation

Rio 2016 Olympic medals under preparation

London protesters reject Brexit, stand with EU

London protesters reject Brexit, stand with EU

David Beckham promotes football in South China school

David Beckham promotes football in South China school

Made-in-China regional jet starts commercial operation

Made-in-China regional jet starts commercial operation

Iceland shock England 2-1 to reach quarterfinals

Iceland shock England 2-1 to reach quarterfinals

Former NBA player Kobe instructs young players

Former NBA player Kobe instructs young players

The world in photos: June 20-26

The world in photos: June 20-26

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

US Weekly

|

|