China, G20 must reverse the eclipse of globalization

Updated: 2016-09-08 14:52

By Dan Steinbock(chinadaily.com.cn)

|

||||||||

|

|

|

Photo taken on Aug 25, 2016 shows the Hangzhou Olympic Sports Center in the Binjiang district of Hangzhou, capital of East China's Zhejiang province. Hangzhou is the host city for the G20 Summit.[Photo/Xinhua] |

As China assumes the G20 leadership, the prospect of global “protectionism” is on the rise and the stakes could not be higher for cooperation and major structural reform. Without continued investment and trade, secular stagnation in advanced economies and growth deceleration in emerging economies will continue to broaden.

Since 1980, global economic integration accelerated dramatically until the onset of the financial crisis in the fall of 2008. After years of secular stagnation in major advanced economies and deceleration of growth in large emerging economies, modest signs of recovery have prompted international observers’ hope for the revival of globalization.

In the absence of broad policy acceleration following the G20 Summit in Hangzhou, China, such hopes may amount to hollow pipe dreams.

Massive monetary stimulus, but no pickup in trade and investment

At the peak of globalization, the Baltic Dry Index (BDI) was often used as a broad barometer of international commodity trade and as a leading indicator since it seemed to reflect future economic growth. The index soared to a record high in May 2008 reaching 11,793 points. However, as the financial crisis spread in the advanced West, international trade collapsed in the emerging East. Barely half a year later, the BDI had plunged by 94 percent, to 663 points; lowest since 1986.

As China and other large emerging economies chose to support the ailing advanced economies through the G20 cooperation, major economies in North America and Europe pledged accelerated reforms in global governance, while launching massive fiscal stimulus and monetary easing. These factors caused the BDI to rise to 4,661 in 2009. But as promises of reforms were ignored and stimulus policies expired, the BDI bottomed out at 1043 in early 2011, coinciding with the European sovereign debt crisis.

In the past half decade, advanced economies have sustained a semblance of stability, but only by relying on historically ultra-low interest rates and massive injections of quantitative easing; today QE measures exceed $12 trillion, some $10 trillion in negative-yielding global bonds, and there have also been 660 interest rate cuts since the collapse of Lehman Brothers in 2008. Intriguingly, these huge shifts are not reflected by the BDI, which has continued to stagnate. It reached a historical low of 290 last February oscillating in upper-600 point range today – amid the global crisis levels.

Optimists argue that the index reflects poorly on globalization because it is a better indicator of international commodity trade than global economic integration. And yet, the indicators of global investment and trade herald even gloomier prospects.

- British parliament to debate second Brexit referendum petition

- Chinese women find their way through the glass ceiling

- Rousseff leaves presidential residence in salutation

- Thousands of Chinese rally in Paris to call for 'security for all'

- Xi tells Park China opposes deployment of THAAD in ROK

- Singapore confirms 27 new cases of Zika infection

Unforgettable moments of Premier Li at ASEAN meeting

Unforgettable moments of Premier Li at ASEAN meeting

Six policy signals China sent at G20 Summit

Six policy signals China sent at G20 Summit

'First Lady table ware' a hit in Hangzhou

'First Lady table ware' a hit in Hangzhou

Paralympics opens in Rio

Paralympics opens in Rio

Street-straddling bus continues tests

Street-straddling bus continues tests

British man falls for ancient Jiangxi village, buys property

British man falls for ancient Jiangxi village, buys property

Post-90s property beauty's daily life

Post-90s property beauty's daily life

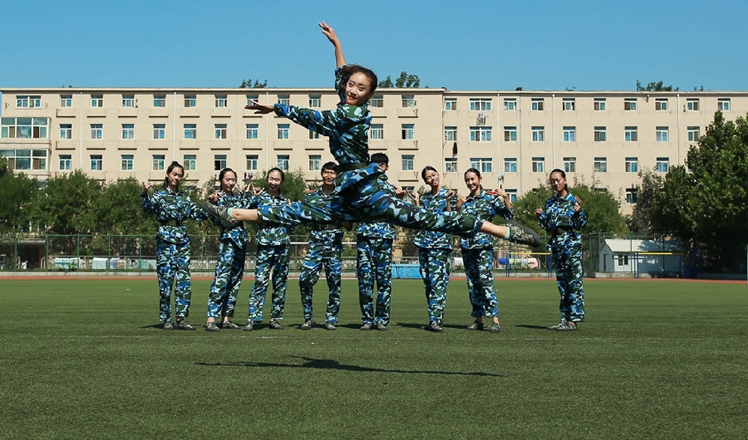

Freshmen show dance skills during military training

Freshmen show dance skills during military training

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|