How best to fight secular stagnation

Updated: 2016-09-19 07:47

By MICHAEL SPENCE(China Daily)

|

||||||||

|

|

A Chinese worker processes steel at a factory in Qingdao city, East China's Shandong province, July 1, 2016. [Photo/IC] |

Much of the world, especially the advanced economies, has been mired in a pattern of slow and declining GDP growth in recent years, causing many to wonder whether this is becoming a semi-permanent condition-so-called "secular stagnation". The answer is probably yes, but has limited utility. There are, after all, different types of forces that could be suppressing growth, not all of which are beyond our control.

Many of the growth-destroying headwinds that we currently face would be difficult, if not impossible, to counter in the near term without endangering future growth and stability. The result of these persistent conditions can be called "secular stagnation one" (SS1).

The first indication that we are experiencing SS1 relates to technology. If we are, as the economist Robert Gordon argues, experiencing a slowdown in productivity-enhancing technological innovation, long-term potential growth would be constrained.

A second condition supporting SS1 is rooted in the impact of heightened uncertainty-about growth, job security, policies and regulations, and the many developments that could affect any of those factors-on investment and consumption.

With future demand far from guaranteed, private investment has been declining in many countries, including, most recently, China. The same goes for household consumption, particularly in the advanced economies, where a larger share of consumption is optional (for example, replacing consumer durables, traveling and eating out at restaurants). And it seems that a reversal in these trends will not arrive anytime soon.

Debt is the third indicator of SS1. Households, corporations, financial institutions, and governments are all facing balance-sheet constraints, which it seems plausible to assume, are holding back expenditure and investment, elevating savings, and contributing to a broadly deflationary environment.

Actions aimed at supporting deleveraging and balance-sheet repair-such as recognizing losses, writing down assets and recapitalizing banks-carry longer-term benefits but short-term costs. Indeed, balance-sheet repair takes time, especially in the household sector, and produces an unavoidable drag on growth.

The picture is somewhat bleak. But there's a more precise question: Is there a set of policy responses that could, over time, increase the level and quality of growth? The answer again seems to be yes. This suggests we are also facing another type of secular stagnation: "secular stagnation two" (SS2) that is dictated by our unwillingness or inability to implement the right policy mix.

A key element of that policy mix would focus on tackling rising inequality. While the forces fueling this trend-especially globalization and progress in digital technology-will be difficult to counter fully, their adverse effects can be mitigated through redistribution via the tax and social-security systems.

Moreover, monetary policy, which has been shouldering much of the burden of recovery since the 2008 global economic crisis, must be rethought, because years of ultra-low interest rates and massive quantitative easing have not increased aggregate demand sufficiently or adequately reduced deflationary forces.

But raising interest rates unilaterally carries serious risks, because in a demand-constrained environment, higher interest rates attract capital inflows, thereby driving up the exchange rate and undermining growth in the tradable part of the economy. Given this, advanced-countries' policymakers should consider imposing some controls on their capital accounts (much as successful emerging economies do).

A third priority should be to strengthen fiscal responses, especially with respect to public-sector investment. Europe, in particular, is paying a heavy price for under-using its fiscal capacity-a decision that has been driven by the political unpopularity of debt and fiscal transfers.

There are more areas where countries should consider reforms, including tax policy, inefficient or improper use of public funds, impediments to structural change in product and factor markets, and mismatches between the reach of global financial institutions and the capacity of sovereign balance sheets to intervene in case of financial distress.

SS1 will make addressing SS2 much more difficult. But that is no reason to delay action in the areas where policy can make a difference. Just as our past policy choices helped generate the SS1 we face today, failure to implement policies aimed at tackling SS2 could create a much more intractable and potentially unstable situation tomorrow.

The author, winner of the Nobel Prize for economics, is a professor of Economics at New York University's Stern School of Business and a senior fellow at the Hoover Institution.

- Merkel faces setback in Berlin vote due to migrant fears

- Anti-TTIP protesters take to streets in Germany

- Death toll of Friday's suicide blast in NW Pakistan rises to 36

- In photos: Explosion rocks Chelsea in New York City

- UN General Assembly kicks off 71st session

- Britain records warmest September day since 1911

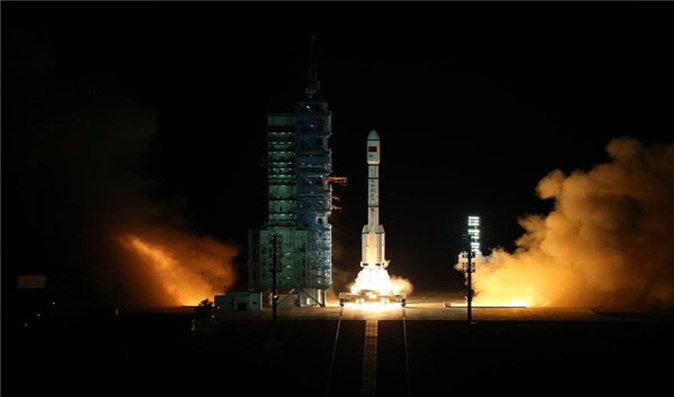

China launches second space lab into orbit

China launches second space lab into orbit

Riding on smart cycles in Nanjing city

Riding on smart cycles in Nanjing city

Britain records warmest September day since 1911

Britain records warmest September day since 1911

Island retreats you may not want to miss for holidays

Island retreats you may not want to miss for holidays

Industrial-style canteen surprises university students

Industrial-style canteen surprises university students

Cute animals share a bite of moon cake festival

Cute animals share a bite of moon cake festival

Orphaned Chinese marries American at SOS village

Orphaned Chinese marries American at SOS village

French royal porcelains shine in Xi'an

French royal porcelains shine in Xi'an

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|