Bank head assesses risk, opportunity ahead

Updated: 2013-10-11 10:19

By Liu Lian in New York (CHina Daily)

|

||||||||

"Most of us will never forget the week of Sept 15, 2008," recalled Richard Neiman, who was superintendent of banks at the New York State Banking Department at the time.

On the morning of Tuesday, the 16th, in his boardroom, he signed the branch license for the Industrial and Commercial Bank of China (ICBC) to open its New York branch.

A day earlier, Lehman Brothers had filed for bankruptcy. On the day of signing, the Federal Reserve authorized the New York Fed to make an emergency loan to AIG. The following weekend Goldman Sachs and Morgan Stanley received expedited approval to become bank holding companies.

"The granting of the (ICBC) license was one of the few bright spots for many of us during those very dark and scary times," said Neiman.

ICBC's New York branch hosted its 5th anniversary celebration Wednesday evening at the Metropolitan Club in New York. More than 100 guests attended the event. Jiang Jianqing, chairman of ICBC, delivered a keynote speech that highlighted ICBC's achievements in recent years and the challenges and opportunities facing the bank and the Chinese economy.

In 2010, ICBC made a splash by paying a $1 to acquire the US brokerage unit of Fortis Securities from France's BNP Paribas SA. In 2012, the bank acquired an 80 percent stake in the US subsidiary of Bank of East Asia (BEA). It was the first time a Chinese bank acquired a US commercial bank.

The acquisition also allowed ICBC to expand its footprint, with BEA (USA)'s 13 branches, on both the east and west coasts, including New York, Los Angeles and San Francisco.

The US operation of ICBC has nearly 400 employees and $50 billion in assets.

"In crisis, we not only have the risks, but also the opportunities," Jiang said of his visit to New York after five years. "This time everybody here feels more optimistic than five years ago.

"Of course there are still some uncertainties in economic growth," Jiang continued. "The US economy has shown positive signs of recovery, and yet people are concerned about the prospects after the tapering of the Fed's QE policies. In Europe, the economy has shown slow signs of recovery. However, we can say without extremely strong support from the fiscal and money policies in those countries, the real recovery will come much later."

"Therefore, people focus more on China and Chinese growth," said Jiang, "China needs to adjust the economy growth pattern to be more about domestic consumption and growth. In our economic growth, we must focus more attention on environmental protection, focus on resource utilization and preservation."

"Many people are concerned about whether the Chinese economy will have a hard landing or soft one. My answer to these questions is no landing. It's still flying," he said.

Regarding Shanghai's newly opened free-trade zone, Jiang offered his own insights: "One, the free zone in Shanghai will be a new test field for China's finance and economic reforms. Secondly, the free convertibility of RMB, interest rate liberalization, and the internalization of RMB, will be the key issues at the top of the agenda of China's financial system reform in the future."

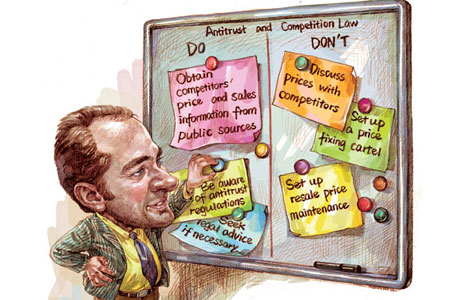

Jiang acknowledged the challenges facing global financial sectors. "More stringent rules and regulations are being propagated regarding banks regulation," he said.

"ICBC as a Chinese bank is also faced with challenges present in the Chinese financial system. Regarding interest rate globalization, now it lacks only one last step- the liberalization of the deposit interest rate," he added.

"We can predict that capital markets will experience faster growth. Most enterprises with stronger capacity will go to the capital markets to raise money through bonds and equity in the future. On the other hand, as the RMB's free convertibility is pushed forward, more and more Chinese enterprises will go overseas. If ICBC does not follow our customers to go to overseas markets, we will be left behind and degenerate into a local bank," he said.

Pondering the future of ICBC's US expansion, Jiang said that ICBC will look into both organic growth and acquisition growth strategies in the next five to 10 years.

"The interactions between the US and China in terms of economic activities are more and more frequent. Aside from trade, mutual investments between the two countries are increasing day by day. This will create new demand for Chinese and American financial institutions to promote the investment and the economic activities in our two countries."

"ICBC will certainly capture the opportunities and enlarge our business here," he concluded.

Contact the writer at lianliu@chinadailyusa.com

Storm swamps car insurance firms

Storm swamps car insurance firms

3 US economists share 2013 Nobel Prize in Economics

3 US economists share 2013 Nobel Prize in Economics

Canton Fair to promote yuan use

Canton Fair to promote yuan use

Smartphone firm rockets into the US

Smartphone firm rockets into the US

Vintage cars gather in downtown Beijing

Vintage cars gather in downtown Beijing

Riding the wave of big bargain buy-ups

Riding the wave of big bargain buy-ups

Senate leads hunt for shutdown and debt deal

Senate leads hunt for shutdown and debt deal

Chinese education for Thai students

Chinese education for Thai students

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Obama hopeful as meeting nears with lawmakers

Canton Fair to promote yuan use

Over 380 detained in Moscow riot

86 trapped at Mount Qomolangma camp amid snow

Going green can make good money sense

Senate leader 'confident' fiscal crisis can be averted

Sept CPI rise hits 7-month high

Smartphone firm rockets into US

US Weekly

|

|