Transparency key to bilateral investment: panel

Updated: 2016-01-20 22:57

By JACK FREIFELDER in New York(China Daily USA)

|

|||||||||

|

|

Xu Chen, chairman of China General Chamber of Commerce — USA, launches 2015 White Paper on Chinese investment in the US on Tuesday in New York. |

The direct investment relationship between China and the United States is expected to forge ahead in 2016 despite economic headwinds, but business experts would like to see more transparency.

Those were some of the observations by panelists in a discussion— Chinese Investors in the US: Partners or Competitors? — organized by the China General Chamber of Commerce - USA (CGCC) at the Waldorf Astoria New York hotel.

The CGCC also released a white paper on Chinese investment in the US on Tuesday.

Ni Pin, president of Wanxiang America, the US subsidiary of Wanxiang Group, the largest auto parts manufacturer in China, said that Chinese companies and their US counterparts can be partners and competitors in the US, during his keynote speech.

Globalization and competition are trends that expand across industries and country boundaries, said Xiao Yuqiang, chairman of the US Management Committee of the Industrial and Commercial Bank of China, who is part of the panel.

"China and the US need to work toward a more transparent regulatory environment to decrease arbitrage," said Xiao.

Liu Mingwei, an associate professor at the School of Management and Labor Relations at Rutgers University, said there are many partnership opportunities for American and Chinese companies.

"The localization of management for Chinese companies in the US is quite high," Liu said. "Most Chinese companies are aware of the domestic differences, so [they] have high awareness of adhering to local rules and management styles.

"In the long term, with the growth and development of Chinese companies, there might be more challenges or competition in the eye of American companies, like the solar panel industry," Liu said.

"Competition or cooperation is really a function of a few variables, like the type or structure of a transaction and whether it's a competitive play or not," said Mitchell Silk, a partner with global law firm Allen & Overy LLP. "One of the things to also look at is the strategy of an investor."

Xiao, Silk and Liu were joined by Li Ji, an associate professor at Rutgers Law School; Zhang Jun, vice-chairman of the CGCC and general manager of the New York branch of China Construction Bank; and Alexandra Bryant, a managing director at global commercial real estate firm Jones Lang LaSalle.

The report concludes that the United States is still a major overseas investment center for Chinese companies. But US government regulation continues to concern Chinese investors, as do reviews by the Committee on Foreign Investment in the United States (CFIUS) and the depreciation of the yuan.

On Tuesday, the International Monetary Fund cut its global growth forecasts for the third time in less than a year, citing a sharp slowdown in China.

The IMF maintained its previous China growth forecasts of 6.3 percent in 2016 and 6 percent in 2017, but cut global growth forecasts to 3.4 percent in 2016 and 3.6 percent in 2017, both down by 0.2 percent from the October 2015 estimate.

China's National Bureau of Statistics reported on Tuesday that economic growth fell to a 25-year low of 6.9 percent last year, down from 7.3 percent in 2014.

Zhang said there is "opportunity in the downturn," adding that it provides "a good opportunity for currency management for Chinese investments".

The white paper recommends a more transparent CFIUS review process, clarification of intellectual property rights regulation, and a more open audit selection process from the Internal Revenue Service.

Li said a number of Chinese investors did not engage in FDI projects in the US in 2015 due to a "CFIUS concern".

"On the Chinese side, we know there's a growing capital onslaught from China, and that may cause some concern to several governments to tighten their review of outbound FDI [from China]," Li said. "For Chinese investors especially, they need to know what they're getting into.

"Overall, there's still a concern that the process is not transparent, unfortunately," he said. "The US government should really take this opportunity to improve the CFIUS review process and put in more due process."

The paper also said that Chinese investors should familiarize themselves with real estate investment rules.

Chinese investors accounted for $11.7 billion in real estate deals between 2013 and 2015, the report shows. In 2015, they brokered deals worth $6.1 billion, with offices and hotels a large part of the real estate investment pool.

Bryant said Chinese FDI in real estate would benefit from added transparency.

"One thing in particular in the real estate space is cooperation and understanding what both sides can bring to the table," Bryant said.

"Real estate is a very important sector in China, but it's global and there's an education process," Bryant said.

"Real estate is what a lot of developers and insurance companies come to the US for, and it's about being a part of the process," she added. "[Chinese investors] don't just want to be passive money."

Two deals from Chinese companies were announced within the first two weeks of 2016 — Haier's $5.4 billion acquisition of GE's appliances unit and Dalian Wanda's $3.5 billion investment in Hollywood movie producer Legendary Entertainment.

- Railway police nab 40,315 fugitives in 2015

- China issues blue alert for snow storms

- Blast in firework factory leaves four missing, four injured

- Struggles of a Shanxi coal mine owner in bleak industry winter

- China launches system to check authenticity of living buddhas

- China sees rising online fraud in 2015: report

- Former US VP candidate Palin endorses Trump with a 'hallelujah'

- Gunmen kill at least 19 after storming Pakistan university

- Hollande makes last-chance push to curb French unemployment

- Taxi drivers block central Budapest all day in protest against Uber

- Police respond to reports of shooting at Sydney police station

- Okinawa squares up to Tokyo over US base row

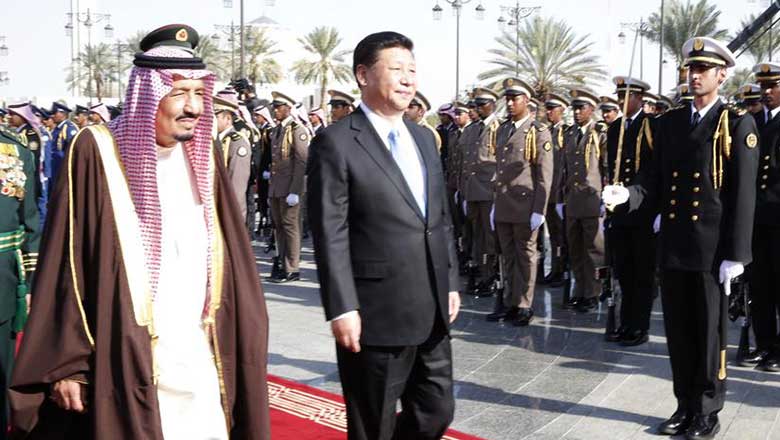

Xi boosts ties with Saudis

Xi boosts ties with Saudis

Cold wave sweeps across China

Cold wave sweeps across China

Internet tycoons' wacky costumes are annual galas' highlight

Internet tycoons' wacky costumes are annual galas' highlight

Culture Insider: 6 things you may not know about Major Cold

Culture Insider: 6 things you may not know about Major Cold

Chinese shoppers' 10 favorite destinations in 2015

Chinese shoppers' 10 favorite destinations in 2015

Glass bridge across Zhangjiajie Grand Canyon under construction

Glass bridge across Zhangjiajie Grand Canyon under construction

The life of a wood carving artist

The life of a wood carving artist

Glenn Frey, founding member of the Eagles, dead at 67

Glenn Frey, founding member of the Eagles, dead at 67

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

National Art Museum showing 400 puppets in new exhibition

Finest Chinese porcelains expected to fetch over $28 million

Monkey portraits by Chinese ink painting masters

Beijing's movie fans in for new experience

Obama to deliver final State of the Union speech

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

US Weekly

|

|