Syngenta expects ChemChina deal to close

Updated: 2016-07-23 02:02

By AGENCIES

|

|||||||||

Syngenta AG, which has agreed to be taken over by China National Chemical Corp for $43 billion, said talks with US regulatory authorities to win approval for the deal have been constructive and the Swiss company is confident the transaction can be closed on time.

Talks with the Committee on Foreign Investment (CFIUS) in the US are ongoing and the goal remains to complete the deal by year end, CEO Erik Fyrwald said in a phone interview on Friday with Bloomberg News.

Political developments surrounding the forthcoming US election are a "completely separate issue" to the CFIUS review, Fyrwald said. Accepting the Republican Party's nomination on Thursday, Donald Trump accused China of manipulating its currency to distort trade, and vowed to renegotiate trade deals with the nation should he win.

Basel, Switzerland-based Syngenta on Friday reported a 12 percent decline in first-half earnings before interest, taxes, depreciation and amortization to $1.77 billion, lower than an average of $1.91 billion predicted by analysts surveyed by Bloomberg. Sales fell 7 percent to $7.1 billion.

ChemChina's bid values Syngenta at about 20 percent above the closing stock price on Thursday.

ChemChina is seeking regulatory approval for the purchase that will make it the world's largest supplier of pesticides and other crop-care chemicals, albeit temporarily. Dow Chemical Co's merger with DuPont Co and Bayer AG's possible purchase of Monsanto Co will reorder the rankings as the top six suppliers jostle for market share and financial power to drive research and new product releases.

ChemChina recently bought out its Israeli partner in generic agrochemical maker Adama, though the Syngenta CEO doesn't see that as a prelude to combining the companies as they are separate investments.

"I've gotten to know ChemChina through the years, and have great respect for them," Fyrwald said in the interview. "They are long term investors, and that will be the case here."

- The world in photos: July 18-25

- Cambodia hailed for upholding justice on maritime issue

- ASEAN countries urged to 'dispel disruptions'

- One dead, 12 injured in blast near Nuremberg, Germany

- Fashion of Queen Elizabeth on exhibition in London

- Hollande urges Britain to begin EU exit talks 'as soon as possible'

Sunny images of 60-year-old go viral in China

Sunny images of 60-year-old go viral in China

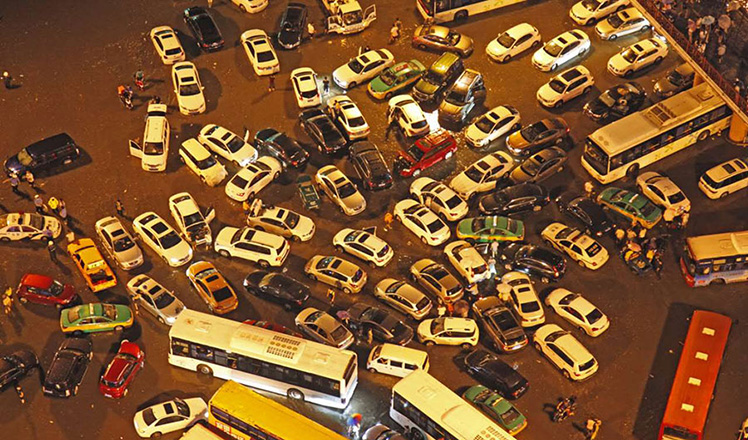

Xi'an battered by summer downpours

Xi'an battered by summer downpours

Photographer uses traditional technique to capture images

Photographer uses traditional technique to capture images

Now and then: Rebirth of Tangshan 40 years after quake

Now and then: Rebirth of Tangshan 40 years after quake

Things you may not know about Major Heat

Things you may not know about Major Heat

Unveiling the secrets of Elizabeth II’s wardrobe

Unveiling the secrets of Elizabeth II’s wardrobe

Go global: Wanda's top 10 foreign acquisitions

Go global: Wanda's top 10 foreign acquisitions

Hot pepper and ice tub challenge held in E China

Hot pepper and ice tub challenge held in E China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

Liang avoids jail in shooting death

US Weekly

|

|