Ties to drive demand for RMB services

Updated: 2016-08-02 23:39

By PAUL WELITZKIN in New York(China Daily USA)

|

||||||||

While demand for yuan-denominated products still limited, lower costs could spur 2-way activity

As the US and China continue to deepen financial ties, the development of products and services for Chinese currency in the US will increase, participants at a New York forum were told Monday.

"The demand for RMB-denominated products and services in the US is modest, but it is growing," Mary Schapiro, former chair of the US Securities and Exchange Commission and vice-chair of The Working Group on US RMB Trading and Clearing told the HSBC China Forum.

The Working Group is backed by several titans of US finance who want to establish the trading and clearing of the renminbi (RMB), or yuan, in the US. Michael Bloomberg is the group's chairman. Former US Treasury secretaries Timothy Geithner and Henry Paulson serve as co-chairs.

By making it easier for US institutions to make or receive RMB payments, the group believes it will lead to lower transaction costs and increase economic activity between the two nations.

As part of their bilateral summit last year, President Barack Obama and President Xi Jinping agreed to strengthen financial cooperation, including discussing mechanisms "to facilitate renminbi trading and clearing in the United States".

Helen Wong, the chief executive for Greater China at HSBC, noted that as China expands its middle class and service sector, the US could be poised to profit.

"For the US, with its advanced service sector, China represents a huge opportunity," Wong said.

She also noted that the renminbi will enter the International Monetary Fund's Special Drawing Rights basket of currencies on Oct 1, joining the dollar, euro, pound and yen. That is also expected to increase demand for RMB transaction services.

Wong said that the RMB is already among the top six payment currencies in the world.

By increasing RMB transaction services in the US, Schapiro said both US and Chinese companies will benefit.

"The US and China are each other's largest trading partners," Schapiro said. "The Chinese will have greater flexibility when financing US investments. Small businesses in the US will not be at a disadvantage because they don't have access to an international trading desk." "China's second-quarter GDP of 6.7 percent was better than expected," Wong said. "The worries about China's economic slowdown have dissipated for the moment."

paulwelitzkin@chinadailyusa.com

- Not for the faint-hearted: Glass bridge opens in Hunan

- Geneticist defends his groundbreaking technique

- Activist jailed for subversion, harming national security

- New Hainan port opens as annual fishing ban ends

- From hunting wild fruits to satellite dishes: Life of Myanmar returnees

- World's first panda-themed subway line runs in Chengdu

From dusk to dawn: The other side of Beijing

From dusk to dawn: The other side of Beijing

Huangluo: China's 'long hair village'

Huangluo: China's 'long hair village'

Typhoon Nida lashes Shenzhen

Typhoon Nida lashes Shenzhen

Amazing robots work hard at Qingdao beer fest

Amazing robots work hard at Qingdao beer fest

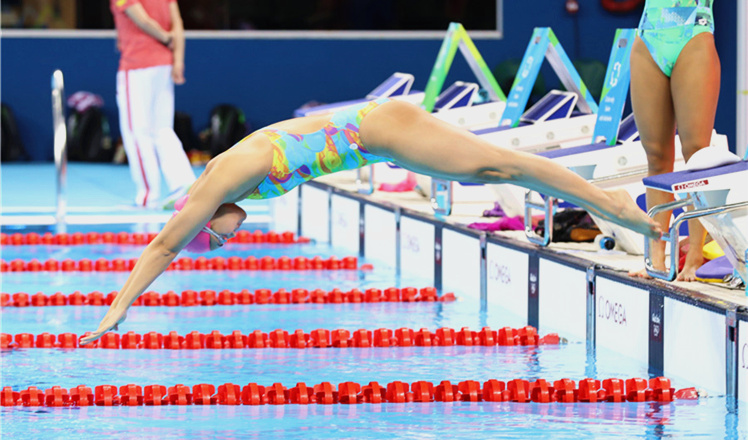

Chinese swimmers 'test the water' in Rio

Chinese swimmers 'test the water' in Rio

Amazing night view of Kaifeng in Henan province

Amazing night view of Kaifeng in Henan province

In pics: Women soldier carrying the flag

In pics: Women soldier carrying the flag

Rough and tough world of soldiers' training

Rough and tough world of soldiers' training

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

US Weekly

|

|