|

|

Developer with a fine sense of strategy shuttles between China, US to realize his dreams

Just as real estate developers throughout China were pondering the prospect of another bleak 12 months as the new year approached, one of their peers, Feng Lun, was making a resolution: To build a "great city" in New York.

With more Chinese firms doing business and investing in the United States, Feng sees his own opportunities in those distant pastures.

China's outward direct investment grew by 17 percent to $68 billion in 2010, ranking as the world's fifth-largest outbound direct investor, according to an earlier report by the United Nations Conference on Trade and Development.

"I hope to build a 'great city' in New York for the new Asian migrations in the future," says Feng, chairman of Vantone Holdings Co Ltd, which owns Shanghai-listed Beijing Vantone Real Estate Co Ltd.

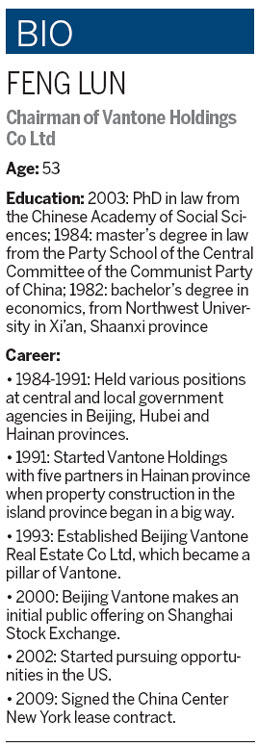

The company, which Feng set up with a few partners in 1991, has become one of the largest property developers in China and the first major Chinese real estate company operating in the US.

"Where our clients go is where our realty and services will be," Feng says. "We are in the US, but still serve our Chinese clients," says Feng, 53, who holds a PhD in law and worked as a government official before he started the business.

During the first three quarters of last year, Vantone reported profits of 409 million yuan ($65 million, 50 million euros) on revenue of 2.3 billion yuan.

The idea of a "great city" is based on urban sustainable development and accommodates a population of 100,000-150,000 people within one square kilometer.

It would include residential, working, education, medical and entertainment areas within the same compound, with its own energy recycling systems.

Feng believes about 350 million Chinese will move from rural areas to big cities by 2020, and the land scarcity will make the living environment in China even worse.

According to Vantone, the first "great city" project will be built in the Tianfu New Area of Chengdu, Sichuan province, and construction is expected to start this year.

Feng believes his vision can also be applied to New York.

"The barriers to successful real estate investments in New York are very high, even more so for ground-up development," says Joseph Hilton, executive managing director of Murray Hill Properties LLC, a commercial real estate agent in New York.

Hilton says that what is crucial to foreign real estate investment in New York is sufficient funding, many years of experience in the city and broad business networking skills that can tap into all local resources.

"I see a few Chinese real estate developers are coming to New York and investing in the commercial property market, but none of the Chinese developers we talked with are interested in grounding up a new building."

Will those issues also be a challenge for Vantone? After a few years of experience in the metropolis, Feng seems more confident.

"New York is one of the most open cities in the US. It has the most centralized capital flow, a large floating population and strong purchasing ability, as well as the busiest commercial events. All those features mean more opportunities for commercial real estate."

Feng saw the trend seven years ago and helped Vantone become the first corporate tenant, in 2009, in the new World Trade Center.

China Center New York is Vantone's symbolic project in the US, and it will occupy the 64th to 69th floors of One World Trade Center in 2014, and serve as a resource for Chinese companies entering the US, as well as US businesses seeking opportunities in China.

As early as 2002, when Feng first heard the World Trade Center would be rebuilt, he started collecting information on the new skyscrapers above ground zero.

Over the years Feng has faced many challenges in New York, but feels he has come to grips with doing business in the US.

At the start, Feng intended to buy 10 floors of property at One World Trade Center, but problems there forced him to shift his target to its neighbor, Seven World Trade Center, in 2005.

In an effort to win over US property owners, Feng traveled between China and the US more than 10 times in one year. For more than four months of that year Feng suffered from fever and jet lag due to the long journeys.

But the rental in Seven World Trade Center fizzled out a year later. Vantone missed out - by just a few days - submitting a Chinese government issued certificate to the US property owner on time.

Despite the setback, Feng insisted on returning to New York once again and presenting all his certificates to the World Trade Center owners. For him, the story continues.

There is a saying that "opportunities belong to the well-prepared people". When the opportunities come along, Feng seems to catch them eventually.

The lease in One World Trade Center, Feng's first option, became available a few months later. With his good relationship with big US real estate developers, the experience in New York over the past seven years and, armed with fully-prepared materials, Vantone became the first corporate tenant in the redeveloped One World Trade Center.

Feng is a strategist who long ago realized the big attraction of the best business location in Manhattan to Chinese outbound investment.

In June, the aviation company AVIC International USA Inc announced its intention to reopen its east coast office in One World Trade Center, becoming the first client of China Center.

From the first day starting the processing of the China Center program, Feng spent huge sums on hiring the best accountants and lawyers in New York.

"The only thing I need to do is to sign the papers," Feng says. Through those experts, he gained an important insight into the industry.

By the time he signed the final contract, Feng had made as many as 1,820 hours of conference calls, flew to New York more than 30 times, and the papers he signed could be stacked as high as a person.

Facing increasing competition from his home country, Feng is not fazed about the coming challenges in the US.

"We have built very good cooperative relationships with major American real estate developers, which most Chinese developers do not have," Feng says.

Durst Organization, one of New York's largest developers, signed a deal with Vantone in August, with an investment of $11 million. Through this partnership, Vantone will invest in 855 Sixth Avenue, a mixed-use hotel and residential rental building in Manhattan.