Home ground

Updated: 2011-11-18 08:49

By Alexis Hooi (China Daily)

|

|||||||||

|

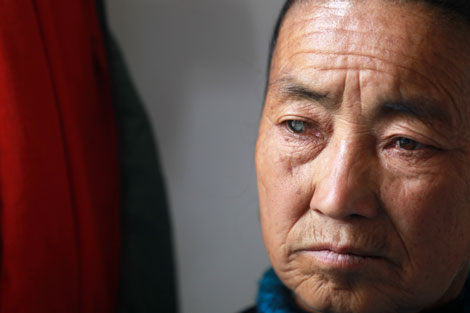

Zhao Wenquan, chairman and CEO of BlueFocus Communication Group, says local market knowledge is an advantage for Chinese PR companies. Zhang Wei / China Daily |

Chinese Public Relations agency banks on local market knowledge

Foreign public relations (PR) agencies may have been practicing their trade in the Chinese market longer, but Zhao Wenquan believes his home team has what it takes to thrive in the field.

"Foreign PR agencies have their advantages and strengths. They have broad strategies to deal with issues. After all, they have been around decades longer. Their methodology is very valuable. And in terms of language, there are huge differences. When we aim to serve the same international clients, they might have advantages in language," Zhao says.

"But for Chinese companies, we have the local knowledge. PR can be a unique area where its connections and links to the area's culture and history are very important. When you deal with the local media or with government, many things rely on communication. If you do not understand the cultural or historical context, communication might not achieve the desired results. That's where the local PR agencies can have an edge over foreign competitors.

"Our grasp of the Chinese market can be much better than foreign companies.

"While foreign companies can have an edge over local ones in terms of articulating strategy for clients, when it comes to execution, the local companies might also be able to perform better. Foreign firms might not be able to deliver as well as they can offer. Conversely, for local companies, their results can be better."

Zhao, 41, is the chairman and chief executive officer of BlueFocus Communication Group. Started in 1996 and based in Beijing, it is the first Chinese PR company to be listed and has more than 20 regional offices. Since its listing, the group has branched out from its core PR business to other areas such as advertising, events and sales promotion with more than 1,000 employees. Most of its employees are Chinese.

But BlueFocus is also up against foreign PR giants like Burson-Marsteller and Hill & Knowlton that have been in the Chinese market since the mid-1980s, when the local competition was practically "non-existent".

"When we started 15 years ago, there were some foreign PR companies but virtually no local competitors, maybe just two or three. But we have come a long way and public relations in China can now be considered an industry that has come into its own," Zhao says.

Figures from the China International Public Relations Association show that the Chinese PR industry last year hit 21 billion yuan ($3.31 billion, 2.43 billion euros), at an annual growth rate of 25 percent, with sectors such as automobiles, healthcare, IT and finance expected to continue leading its rise.

BlueFocus itself raked in about 500 million yuan last year and is experiencing about a 30 percent growth in its business, Zhao says. His biggest client is IT giant Lenovo.

But while the Chinese PR sector offers immense opportunities, its relative youth means there are several challenges to overcome.

The impact of social media is now the top concern that many PR practitioners are scrambling to face, and BlueFocus is no exception.

"The domestic media landscape has experienced vast changes. Media in the country was previously limited in number, with print media made up of publications like newspapers and magazines totaling about more than 10,000 types," Zhao says.

"But now with the Internet and digital age, anyone can be a 'media outlet'. Anyone can make his or her voice heard and act as a form of media. How do we manage our clients' brand and image in this new environment? Very few of us have experience in this and are struggling to keep up with the latest developments. The strength and influence of social and new media is now very formidable. Its impact on the Chinese market and how we deal with it is a major development of the industry here," he says.

For his company, social media's impact on Chinese PR can be most clearly felt in the area of crisis management.

"Crisis management is a large part of what we do. Every day, we deal with many cases out of the hundreds of clients that we have," Zhao says.

"What is being said in micro blogs, online forums and other online platforms are all issues for businesses and stakeholders to follow up on.

"That also means that communication is key to solving these cases. For example, if someone says something negative about our clients online, we first try to contact this person and find out what exactly it is all about. If there is some discrepancy, we go through our clients to see how the problem can be addressed and whether a satisfactory answer is reached," Zhao says.

"Where the media is concerned, we need to communicate with them and let them know what the issue is about from the customer's side. Then we help make sure that whatever reports they produce are as complete as possible.

"Our response has to be very fast. We typically have to address any issue in one to two hours now with the Internet playing such a big role. When it blows up it can be very difficult to control or manage."

That also means technology is beginning to feature very highly on his agency's agenda, Zhao says.

And finding the right people to manage all of that continues to be a huge obstacle for BlueFocus and the industry as a whole, he says.

"Human resources and talent continue to be a big challenge for us. The industry has been growing very fast in the past few years. People's skill sets just cannot keep up with the pace.

"We are not short of business or clients, we are short of people and talent. It's very difficult to find these people. As a professional services firm, we need time to nurture our talent, with new entrants typically needing about 2-3 years to take on work independently. The professional levels of the industry might be adversely affected."

Homegrown PR agencies like BlueFocus are very different from foreign players. But the similarities can only increase as the industry grows, he says. "International companies can increase their efforts to enter the Chinese market just as we push to increase our work overseas. This doesn't necessarily mean we need to have business operations overseas, but rather that we need international talent, and the standards and ways to solve problems.

"Chinese enterprises are of course beginning to fan out globally, but there are still very few competing globally. Even companies like Lenovo, for example, use foreign PR agencies for overseas work. Currently, many Chinese PR firms, ourselves included, might not have the capabilities to serve our clients in the global markets," Zhao says.

"Of course, we are doing some work overseas. But we will not directly operate overseas. We might consider expanding into overseas markets and serving our clients there through mergers and acquisitions.

"Our advantages are still in the local market. Once we get out of the door, we lose those advantages, whether it's people, resources or understanding of the specific market."