Be more open for business

Updated: 2013-01-11 07:22

By Cecily Liu (China Daily)

|

||||||||

|

Sir Andrew Cahn, chairman of Huawei's advisory board, says Chinese companies need to adopt global standards of practice to integrate into the mainstream market. Cecily Liu / China Daily |

Fight protectionism by revealing more, huawei's man in london advises chinese firms

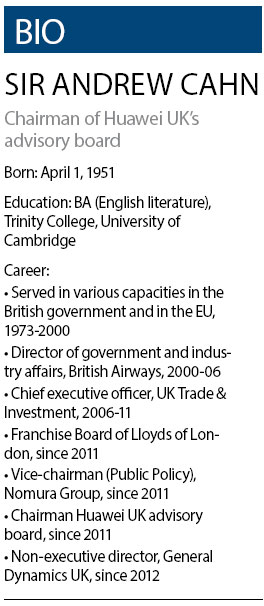

Chinese companies must increase transparency to become true industry leaders globally, says Sir Andrew Cahn, chairman of telecom giant Huawei's UK advisory board.

Transparency is particularly important, he says, for telecommunications companies like Huawei and ZTE, whose customers have a "legitimate concern" over the cyber security of the products they buy.

"In the UK, Huawei has already established a cyber security evaluation center, which provides reassurance to customers and to the British government, and I think that's a sensible way forward," he says.

But he points out that another aspect to achieving transparency is for companies to reveal their ownership structures and show they are independent of the Chinese government.

Espionage fears have prompted some Western governments to take away business opportunities from Huawei and ZTE in recent years, with tension escalating in October when the US House Intelligence Committee warned that the two companies "cannot be trusted to be free of foreign state influence".

In a report issued after an 11-month investigation, the committee recommended that both firms be barred from any US mergers and acquisitions.

Some industry analysts have unreservedly criticized the US government for protectionism, but Cahn believes the Chinese companies can positively contribute toward discussions through being more open.

"My observations on Huawei is that it is indeed independent from the Chinese government, but Huawei and other Chinese companies need to demonstrate this independence through the way they behave."

He believes such openness includes providing to Western governments and customers information on its ownership structure, the background of its chief executive and board of directors, its financial accounts, employees and employment principles.

"The sort of transparency that comes from listing on the stock market is a good discipline. But even for private businesses in the West, there is a significant amount of information available about them."

According to Huawei, most of its shares are owned by employees, allocated on the basis of performance. Shares cannot be bought. However, little information on employee ownership is in the public domain.

Soon after the US committee's report on Huawei and ZTE in October, the UK parliament's intelligence and security committee also launched an investigation over the commercial relationship between British Telecom and Huawei.

But Cahn draws a distinction between the British and US investigations. "I think domestic corporate lobbying will not play a significant role in the UK, whereas it appears to me from the outside that it has played a role in the US," he says.

According to an article in the Washington Post in October, Cisco, the largest US telecommunications company, had lobbied US representatives to create barriers for Huawei.

The article described a Cisco marketing document that compiled published views and concerns from around the world regarding Huawei. It reported unnamed politicians as saying that "American tech firms have lobbied them to increase scrutiny of Huawei".

Cahn says that he is "not impressed with the quality of the US report", which found no hard evidence of espionage by Huawei and ZTE.

Cahn says leading Chinese companies are caught in the middle of tension at a state level between China and the US.

"We are seeing the tectonic plates of global trade changing. China is more powerful than it used to be, and that's something difficult for the incumbents to accept. Secondly, in America there is a feeling that US companies don't have adequate access to Chinese markets, so they think: Why should we allow Chinese companies to access our markets?"

In China there are restrictions on foreign investments in certain industries, including construction, banking and insurance. Cahn acknowledges that such restrictions have been gradually lifted over the years, but says more needs to be done on the Chinese side to achieve a global trade balance.

Cahn also sees security concerns at both company and state level as justified, but says the US security panel's report is an example of protectionism rather than an honest security concern.

"My primary interpretation of what's happening in the US is that the Americans are trying to give themselves another five years, or another 10 years of a protected market," he says.

Cahn was appointed by Huawei to chair its UK advisory board in May 2011, four months after ending his five-year term as the chief executive of UK Trade and Investment, a British government agency.

In this role, he attends weekly meetings with Huawei's UK management team to help the Chinese company better understand Britain's business environment.

Cahn also holds a number of other posts, including as vice-chairman of public policy (in Europe, the Middle East and Africa) at Nomura, the Japanese bank that acquired the Asia-Pacific arm of Lehman Brothers in 2008.

Sitting in Nomura's office in London, Cahn praised the bank's multicultural employment base and says Chinese companies should do the same to become truly global businesses. "We're sitting here in the office of a Japanese bank, and if you look around, you'll see hundreds of nationalities and not many Japanese," he says.

"At Chinese companies there are very few non-Chinese in positions of influencing power. But to become international businesses, Chinese companies need to have non-Chinese on the board of directors at their headquarters, where decisions about global operations are made."

Cahn speaks at a time when Chinese companies are expanding overseas at an unprecedented pace. With advanced technology, innovative products and a determination to succeed globally, their expansion is in stark contrast to the country's low-cost manufacturing firms that have fuelled the export boom of recent decades.

Some of this new generation of Chinese companies are already global industry leaders by sales revenue. Huawei's revenue of 203.9 billion yuan ($33 billion; 25 billion euros) in 2011 made it the second-largest telecommunications equipment maker globally, after its Swedish rival Ericsson.

ZTE posted revenue of 86.25 billion yuan in 2011, which made it the world's fourth-largest mobile phone manufacturer and fifth-largest maker of telecoms equipment.

But Cahn says the next step for these high-tech Chinese companies to integrate in the global mainstream markets and gain trust from Western governments and customers is to adopt global standards of practice.

"If you're producing Apple iPads in a factory, it's Apple that satisfies its customers about the product's quality. But the great moment will be when an iPad is not only manufactured in China, but designed and developed in China.

"And to reach that, Chinese companies need to achieve global standards of transparency, accounting, financial management and human resource management."

cecily.liu@chinadaily.com.cn

(China Daily 01/11/2013 page24)

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|