Markets put in the dock

Updated: 2013-02-01 07:55

By Chen Yingqun (China Daily)

|

||||||||

|

Harvard professor Michael Sandel says it is important to see the distinction between a "market economy" and a "market society". Provided to China Daily |

Chinese are becoming aware of the moral limits of market forces, says Harvard academic

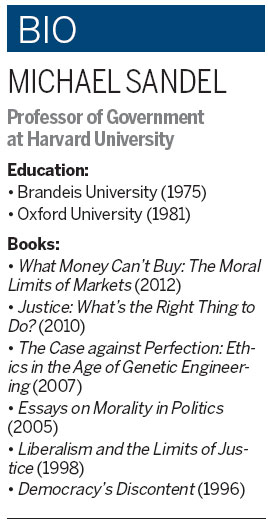

Market principles should not be allowed to invade our civic, social and family lives, says Michael Sandel, a political philosopher and a professor at Harvard University's Department of Government.

Sandel, author of the bestseller What Money Can't Buy: The Moral Limits of Markets, says there is often a misconception that markets represent the public good.

"When people believe that markets and market logic can by themselves define the public good, there is a temptation to avoid moral and ethical reflection and discourse in public life," he says.

This, Sandel says, is because most people consider such a process messy, uncertain and controversial. "So over the past two to three decades people have not really reflected on it."

There is also nothing wrong in challenging common philosophical assumptions, as it is important to gauge if the received wisdom is adequate, he says.

Sandel runs the popular Justice series of courses at Harvard, and taught more than 15,000 students over 20 years. It was also the first Harvard course to be made available on public television and online free.

Much of the course's popularity can be attributed to the discussion-oriented format and the engaging style of incorporating context into discussion, that Sandel uses.

Using cases such as whether people can hire others to line up for them to buy a train ticket to get back home during the Spring Festival, when millions of Chinese traditionally return home for family get-togethers, or whether universities can enroll students whose families donate money, he has held discussions with college students in Beijing, Shanghai and Xiamen, often encouraging them to reflect on and debate the moral limits of the markets.

Sandel's latest book, the Chinese version of which he promoted when he was in the country recently, has been perceived by many to be a strong challenge to mainstream ideas like utilitarianism, market triumphalism and libertarianism. "All these ideas support, in one way or another, the unrestrained extension of markets and market thinking in daily life."

The biggest drawback of such an existence has been the steep erosion of values in daily lives. This tendency has been growing steadily in the past 30 years, especially in the West and in China, he says.

"After the end of the Cold War, many people misinterpreted the meaning of the end of the Cold War, thinking there's only one system left standing: that is, capitalism.

"The assumption was capitalism is one thing only, and that extends to the idea that markets are triumphant, and markets are the primary instrument for treating the public good.

"My book arose as a way of challenging and trying to inspire discussion about mainstream market assumptions, especially the market-driven assumptions. I think it is important to have a thorough discussion and debate on whether the money and markets actually serve the public good and where they don't belong."

Sandel, through keen observation, has collected many examples in his books that he uses to illustrate how market logic has seeped into every corner of life, and started to dominate, and even corrupt, important areas. Selling a kidney to buy a smart phone, paying money to make children read more books and selling hugs are just some instances of these, he says.

The good news, Sandel says, is that while talking to people, he discovered that most of them are dissatisfied with the current way of life and expressed resentment against the market-driven approach, terming it as utilitarian motives or a fixation with the size of the economy.

"I think we are uneasy about the social life that has resulted from these assumptions. I think there's a great desire or even hunger to reflect and question and challenge where the purely market-driven, GDP-approach has led us, in my own society, and also in China."

Sandel does not deny the effect of a market economy, but he reckons that while developing economic growth, countries should also see the distinction between "a market economy" and "a market society". Despite different levels of development, both China and the US have drifted from "having a market economy to becoming market societies", he says.

"A market economy is a tool; it's a valuable and effective tool for organizing productive activity, and it has brought prosperity and economic growth, and rising living standards to the countries around the world. But a market society is a place where everything is up for sale. It's a way of life in which the market values dominate every corner of social life."

After more than 30 years of reform and opening-up, China's economy has grown rapidly. As a developing country it is still working hard to maintain high growth. According to Sandel, most of the assumptions that he has challenged are now being questioned in China, too. "It is important for China, at this stage of its economic development, to think hard about the distinction between having a market economy and becoming a market society, and what to do about it."

Sandel says it is a good thing that many Chinese are now aware of the moral limits of market forces.

"Judging from the response that I hear from among Chinese students and readers and audiences, there seems to be a high level of awareness on the importance of thinking about the associated risk of allowing market values and money to dominate every spirit of life.

"There seems to be a high level of awareness that a purely market-driven approach can lead to growing inequality, or a growing gap between rich and poor, a lack of fairness, and can also erode family relationships and obligations, especially the more extended kind. Such an approach will be corrosive to the community and lead to erosion of values."

Sandel says one assumption that many mainstream economics textbooks make is that the activity of buying and selling or putting a price on an activity does not change the activity itself, and does not change the meaning or the value of the activity itself. He believes this is wrong.

It may be true enough if it were material goods, such as flat-screen televisions or cars, that were being traded, he says. But the same is not true when market reasoning reaches into and allocates and puts a price tag on non-material goods.

Sandel says he is not looking for specific solutions to the problems he talks of. What he does expect is a growing awareness by people of market economies turning into market societies.

"Once people stand back and notice that and begin to discuss how far they want this market logic to go, then people will come up with various ways of dealing with these problems."

What is required is a change in the public culture and attitudes and assumptions toward markets and market logic, and this means trying to appeal to non-market values in various domains, he says.

chenyingqun@chinadaily.com.cn

(China Daily 02/01/2013 page24)

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|