Trade in the balance

Updated: 2013-02-01 08:54

By Yan Yiqi (China Daily)

|

||||||||

Tough times ahead for China's exports as global uncertainties continue

The coming of the Chinese Lunar New Year is often associated with change. But the next few days, when the nation gets ready to welcome the Year of the Snake, or even months, are unlikely to lead to higher shipments or better trade numbers for export-oriented Chinese companies as global uncertainties continue to drag down demand.

Though the final days of the Year of Dragon were remarkable for many Chinese traders, as exports rebounded to a seven-month high in December, experts admit that a similar turnaround looks highly unlikely this time around, despite bright prospects in developing markets.

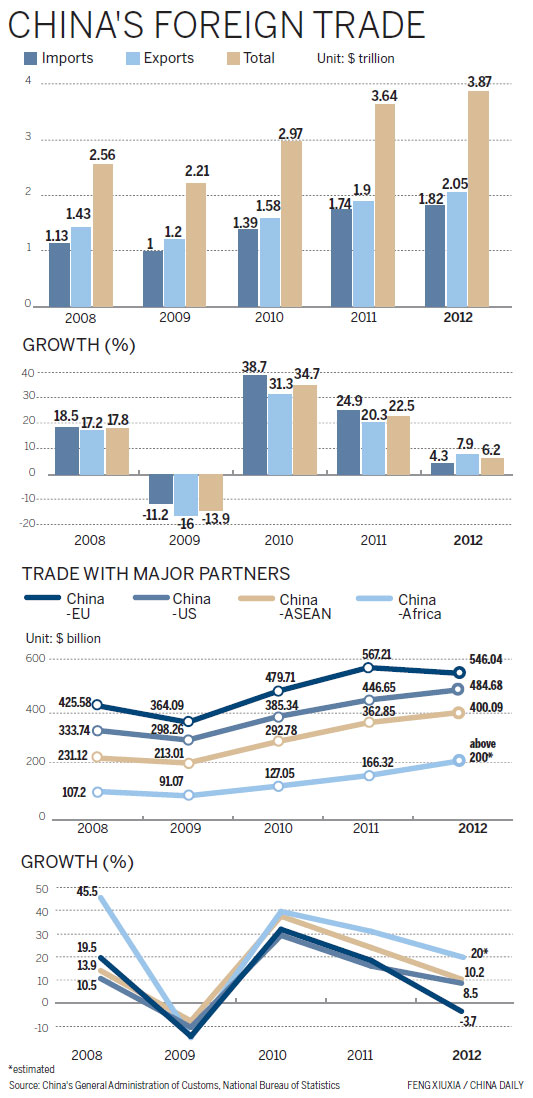

China's foreign trade posted a year-on-year growth of 6.2 percent in 2012 to $3.87 trillion (2.88 trillion euros), but was still far from the anticipated full-year growth target of 10 percent. Exports grew by 7.9 percent to $2.05 trillion, while imports grew by 4.3 percent to $1.82 trillion.

Part of the reason why the experts are still glum in their trade forecast stems from the fact that the global economic climate continues to be fragile with hardly any indications of a sizable pick-up in future demand. The continuing growth-oriented reforms in China also do not augur well for exporters as most of these measures are intended to boost domestic consumption.

Though some experts maintain that they are "cautiously optimistic" on growth prospects, others feel that overall growth prospects are still gloomy.

Wei Jianguo, secretary-general of the China Center for International Economic Exchanges, says that the global trade environment will become even more complicated this year.

"Of course, the biggest challenge is whether the eurozone can overcome its debt crisis this year. The vitality of the European Union is essential for us as it is still one of China's largest trading partners. The second concern is the continuous appreciation of the renminbi, which will put further pressure on Chinese exporters. Though we anticipate a pick-up in trade with developing nations, it is not clear whether it would be enough to offset the losses in developed markets," he says.

Wei says the overall prospects for 2013 are at best "cautiously optimistic". "The full year numbers will be slightly better than that of 2012, but the growth rate will still be in single digits," he says.

Wei's opinion is shared by many other experts and also by a recent business confidence survey of Chinese exporters.

According to a survey conducted by B2B media company Global Sources, many Chinese exporters anticipate a tumultuous business climate in 2013, although some are still confident of boosting overseas orders.

The survey, conducted in November, had polled nearly 1,546 Chinese exporters from various industries, such as electronics, telecoms and computer products, fashion accessories, home products, and garments and accessories, on the export prospects for 2013.

Fifty-one percent of the respondents said they expect revenue from overseas shipments to be higher in 2013, with some estimating 10 to 20 percent growth, and others by as much as 30 percent. In its confidence survey during the first half of 2012, 93 percent of the surveyed companies had anticipated a sales revenue growth in 2013.

Although confidence is low, Wei says people still have to look on the bright side.

"This year will be a year of opportunity for China to optimize its foreign trade structure. The traditional pattern of relying on exporting low added-value manufacturing products in large quantities cannot last long," he says.

Zheng Yuesheng, spokesman for the General Administration of Customs, on Jan 10 said that although China's foreign trade growth had slowed, there have also been considerable achievements in optimizing the trade structure.

"China has become less reliant on one or some trade partners. Emerging and developing markets are now beginning to account for larger amounts of the overall trade. The central and western provinces are also playing a key role in bolstering China's exports. A geographical export balance is certainly on the cards," Zheng said.

The economic climate in most of the developed Western markets, especially the eurozone, is still unclear and thereby pushing China to forge closer linkages in other markets, experts say.

Fading aura

Li Jian, a researcher with the Chinese Academy of International Trade and Economic Cooperation, says it is an opportune time for the developing markets to enhance their share in China's foreign trade.

"The big question, obviously, is whether the EU can stop the debt crisis from deepening this year. Obviously, market demand from the EU will remain sluggish. Japan is also losing its position as China's third largest trading partner because of the economic recession and unstable Sino-Japanese ties," he says.

In 2012, bilateral trade between China and the EU dropped 3.7 percent year-on-year to $546.04 billion. Exports dropped 6.2 percent to $333.99 billion, while imports grew slightly by 0.4 percent to $212.05 billion.

Li says the trade declines may continue this year.

"Trade with the EU will account for a smaller chunk of China's overall trade volume as the eurozone seems to be heading into a second round of post-crisis recession," he says.

In its October 2012 report, the International Monetary Fund had estimated that economic growth in the EU will be 0.2 percent in 2013, 0.5 percentage points lower than its July prediction, showing the multilateral agency's limited confidence in economic prospects for the region.

The report also indicated that the eurozone crisis has deepened, citing pick-ups in the Spanish and Italian sovereign spreads.

Institutions inside the EU are also not that positive on the quick recovery of the economy in 2013.

In his speech on Jan 13 in Frankfurt, Mario Draghi, president of the European Central Bank, said, economic weakness in the eurozone is likely to continue in 2013.

"The risks surrounding the economic outlook for the eurozone remain on the downside. They are mainly related to slow implementation of structural reforms in the eurozone, geopolitical issues and imbalances in major industrialized countries. There are indications that the fragmentation is being gradually repaired, but it is yet to percolate down into the real economy," he said.

Most of the Chinese exporters are fully aware of this situation, and have instead chosen to focus on new destinations.

Zuo Boliang, general manager of Shunde Hong Qiao Furniture Co, says his company's exports to the European markets have nosedived in recent years.

"Our products are faring reasonably well in the Middle East, Southeast Asia, Russia and even South Korea. So there is no point in focusing on the European market when we have far better opportunities elsewhere," Zuo says.

Exports account for nearly 50 percent of the company's total sales revenue, Zuo says, without revealing numbers. Incidentally Zuo's hometown of Shunde is the largest furniture-making center in China and was predominantly dependent on exports to the European markets.

Qian Jiang, executive president of Shunde Furniture Design Institute, says that the Middle East, South Africa and India were the new growth markets for the city's furniture trade last year.

"The loss of market share in Europe had a major impact on industry fortunes. Luckily, there are substitutes," he says.

According to the institute, the value of furniture exports from Shunde in 2012 was $1.5 million, a year-on-year growth of 2 percent. The average export growth rate during the past five years has been 6 percent.

Trade between China and Japan is even worse. Bilateral trade fell 3.9 percent to $329.45 billion, while imports dipped 8.6 percent to $177.81 billion.

Li from the Chinese Academy of International Trade and Economic Cooperation says Sino-Japanese trade partly depends on the overall relationship between the two countries. "With disputes over the Diaoyu Islands continuing, imports from Japan may see further declines this year," he says.

Although the US might seem to be the only developed market that can expect a steady growth rate this year, experts still warn that the outlook might not be as bright as it looks.

In 2012, the US replaced the EU to become China's largest export destination, with $351.8 billion worth of exports, an increase of 8.4 percent year-on-year. China's trade surplus with the US was $218.91 billion, growing by 8.2 percent from a year earlier.

Wei from the China Center for International Economic Exchanges says the ever-growing trade surplus against the US is pushing it to impose stricter rules on imports from China.

"It has become a common practice for the US to issue anti-dumping and anti-subsidy investigations on Chinese products, as the trade surplus is too large," he says.

In 2012, 41 percent of US' anti-dumping and anti-subsidy cases were against Chinese products. At the beginning of this year, the US Department of Commerce imposed anti-dumping duties of up to 154 percent on food additives from China. This resulted in Chinese exporters of xanthan gum to consider quitting the US market.

China's production of xanthan, an additive widely used in food processing, reached 74,000 tons in 2010, about 67 percent of the world's total production.

"This is only a beginning of this year's trade frictions between China and the US. A lot more will follow, which will largely affect the export businesses," Wei says.

Nurturing emerging markets seems to be the most urgent mission for Chinese exporters, since the losses in the developed markets are inevitable, experts say.

John Ross, a former adviser of ex-London mayor Ken Livingstone and now a visiting professor at Shanghai Jiao Tong University, says that the situation in developed markets as a whole is weak.

"Adjusted for inflation, the latest data shows that imports by developed economies are still 5 percent below their level before the international financial crisis, whereas imports by developing economies are now 20 percent above pre-financial crisis levels. The majority of China's exports now go to developing economies and this trend will be further reinforced in 2013," he says.

Looking ahead

The one piece of good news that should drive Chinese exporters is the sheer number of developing markets.

In 2012, China's bilateral trade with the ASEAN countries rose by 10.2 percent year-on-year to $400.09 billion. The growth rate of China's trade with Russia was 11.2 percent.

Wei says the ASEAN and African markets are two important battlefields for Chinese exporters to maintain their growth rates this year.

"These two regions are the most friendly markets for Chinese exporters. Although up to now, the scale of Chinese exports to these two regions cannot be compared with the EU and US markets, the growth rate has been encouraging," he says.

Pascal Lamy, director-general of the World Trade Organization, said in November that trade between developing economies has been growing rapidly and will account for larger proportions in the global trade.

Lamy says Africa will overtake the EU and the US to become China's largest trading partner in the next three to five years.

On Dec 3, Standard Bank, South Africa's biggest bank, said trade between Africa and China in 2012 is likely to surpass $200 billion, compared with $166 billion in 2011.

The bank said in a report that China's trade with Africa has grown nearly twice as fast as its trade with Latin America, which is the second strongest performer.

According to the report, China accounts for 20 percent of Africa's trade and Africa has become China's fastest-growing export destination and trade partner. It estimated that 18 percent of Africa's imports were sourced from China in 2012, up from 16.8 percent in 2011.

Compared with China's total trade's year-on-year growth rate of 6.2 percent and 3.7 percent drop between China and the EU, the trade performance with Africa is more than encouraging.

According to statistics from China's General Administration of Customs, bilateral trade between China and South Africa reached $59.95 billion in 2012, rising 31.8 percent year-on-year. Exports from China to South Africa hit $15.33 billion, growing by 14.7 percent from a year earlier, while imports grew by 39 percent to $44.62 billion.

Yang Baorong, a researcher with the Chinese Academy of Social Sciences, says that the African markets can be good alternatives for Chinese exporters in many industries.

"We are expecting a higher economic growth in Africa this year, with an average of 4.8 percent. Growth is likely to be 6.3 percent for countries south of the Sahara Desert. Unlike developed economies, most markets in African countries are filled with potential in almost every industry. It is still in the first come first serve stage," he says.

In fact, some insightful exporters from Yiwu, East China's Zhejiang province, have already started to make their presence felt in the African markets.

Wu Bocheng, chairman of Yiwu China Commodities City, says the company, together with some large companies in Yiwu, has been establishing international logistics centers in Africa to better serve their expansion in the African market.

Long Quan, sales manager of Zhejiang Shilei Socks Co in Yiwu, says the company has started to make inroads in the South African market since July 2012.

"During the first half of last year, we realized that our export focus on the Japanese market would be a total failure. Since the European market was also in a bad shape, we decided to concentrate on the African market, and it has paid off," Long says.

In 2011, 80 percent of Shilei Socks' sales revenue came from exports to Japan. Because of shrinking demand from the Japanese market, Long says the company's revenue dropped nearly 30 percent to 70 million yuan ($11 million).

In November, Long and some sales representatives, visited Cape Town in South Africa to attend an international textile fair.

"At first, we did not go there with the hope of getting orders directly from the fair. However, the result was encouraging. Many local clients showed their interest in our products and some of them even signed deals with us," Long says.

He says the company is planning to set up a representative office in Johannesburg by the end of June to expand the African market.

Global role

Although Chinese trade prospects faced a tough time in 2012, its trade performance is still far better than most other major economies.

From January to November of 2012, Japan's foreign trade grew by only 1.1 percent year-on-year. For the EU, foreign trade dropped 2.1 percent from January to October. US' foreign trade growth was 4.2 percent for the same period.

"China is the best trade performer among the world's major economies, though it failed to achieve the 10 percent growth target," said Zheng from the General Administration of Customs.

According to a report in the Associated Press, China had become the largest trading partner of 124 economies by 2011, rising from 70 in 2006. The figure made China the largest trading partner to most nations in the world.

The US used to be the biggest trading partner for most nations. It was the largest trading partner with 127 regions five years ago. However, the number dropped to 76 by 2011.

He Weiwen, co-director of the China-US-EU Study Center of the China Association of International Trade, says that despite a sharp slowdown in global activity, China's foreign trade has continued to prosper.

"China's positive economic influence has been surging in surrounding countries over the past five years," he says.

Therefore, China's trade performance this year will be important not only to Chinese businessmen, but also to its 124 trading partners.

Apart from the shrinking demand from developed markets, the biggest challenge for Chinese exporters are the trade barriers being set up by other countries.

According to statistics from the Ministry of Commerce, 72 investigation cases were filed against Chinese products in 2012, a 38 percent year-on-year growth.

Li Jian of the Chinese Academy of International Trade and Economic Cooperation says the situation will be even worse this year, with an increasing number of emerging markets joining the campaign.

"The emerging markets want to get the same 'benefits' that the developed markets got by establishing trade barriers for Chinese products. The problem is especially difficult in traditional manufacturing industries because these are the industries they intend to develop domestically," he says.

Meanwhile, developed markets have also shifted their emphasis from China's traditional manufacturing industries to advanced ones, where they can set up more technical barriers.

Zhou Zhenyang, general manager of Vollodis Furniture (China) Co in Shunde, says that trade barriers are the biggest obstacle for the company to expand in overseas markets.

"Developed markets like the EU and the US have very strict environmental protection rules and standards, which forces us to adjust our sales structures. It will take a long time for companies like ours to adjust the products to meet these standards," he says.

According to Li, emerging industries like photovoltaic and telecommunications will bear the brunt of the trade barriers erected by Western countries.

"The EU and US markets have taken trade protectionism to the political level, making it hard for us to counter it," he says.

But, Ross says that no matter how fierce the trade protectionism is, which Chinese exporters have their strategies to fight back.

"There is not a great deal that can be done solely by China's individual export industries which are hit by protectionism - although of course lobbying, legal challenges and other methods should be used. China's strongest bargaining position is that it is the world's second largest importer, with an extremely rapid growth of imports. Therefore other countries are extremely anxious to keep access to China's markets open for themselves," he says.

Yang Yang and Bao Chang contributed to this story.

yanyiqi@chinadaily.com.cn

(China Daily 02/01/2013 page1)

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|