In Europe for Europe

Updated: 2013-03-15 07:20

By Yan Yiqi, Cecily Liu and Zhang Chunyan (China Daily)

|

||||||||

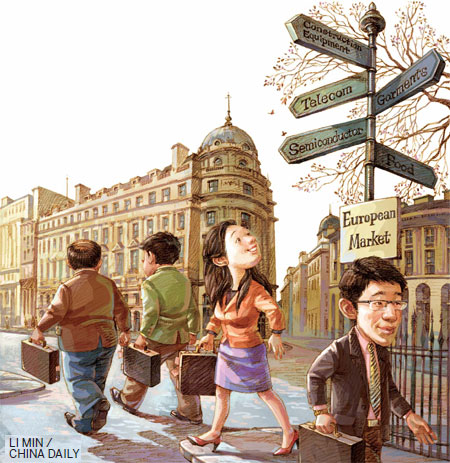

Chinese companies raise their game

When the global financial crisis broke out in 2008, little did economic experts think it would be the precursor for a healthy economic relationship between China and Europe. But in the subsequent years the alliance, aided by a series of mergers and acquisitions in Europe, has managed to give Chinese outbound investment a new direction.

More importantly, the Chinese investment footprint covers the entire continent, ranging from the cantons of Switzerland, to the industrial heartlands of Germany, the vineyards of France, a port in Greece, and textile companies in Italy. It also includes utility investments in the UK and services sector investments in many European nations.

|

||||

"Italy is the fur capital of the world. There is a lot of know-how we can gain from the Italian factory. It will also help in making our products appeal more to European customers," says Zhu Weixiang, general manager of the company. "The debt crisis in Italy has given us an ideal investment opportunity."

In July last year, China's leading down coat producer, Bosideng International Holdings Ltd, opened its first overseas store in London's West End. The $55 million store is the first main link in Bosideng's overseas expansion.

The company, named Chinese Investor of the Year in 2012 by the British Business Award council, expects overseas business to account for more than 5 percent of its total revenue in the next five years.

Chinese investment in Europe has not only grown rapidly, but also outpaced its investments to the US. And not surprisingly, most of these investments have managed to create jobs amid a dismal economic climate in Europe.

A recent study conducted by the European Chamber of Commerce in China, KPMG and Roland Berger Strategy Consultants indicates that Chinese companies operating in the EU will not only increase their investments in Europe, but also look to acquire more technology, brands and expertise through M&As to further improve their competitiveness.

|

Davide Cucino says revenue is not the only factor propelling Chinese companies to Europe. Provided to China Daily |

"We were surprised to find that most of the respondents wanted to continue to invest in Europe. This gives us the feeling that Chinese companies that have an ongoing investment in Europe are happy with these projects and want to continue to stay invested in Europe," says Davide Cucino, president of the European Chamber of Commerce in China.

Of the 74 surveyed Chinese enterprises that have invested in the EU, 97 percent indicated that they would make future and additional investments in the EU, with the vast majority of them planning higher outlays, the study says.

Lending further credence to the survey findings were figures published by the National Development and Reform Commission in December, indicating that 11 of the newly approved outbound investment projects were in Europe.

Zoje Europe GmbH, the fully owned unit of Zoje Sewing Machine Co, a sewing machine company in East China's Zhejiang province, has recently completed two major acquisitions in Germany and is considering another.

The company plans to buy the German industrial sewing machine maker Pfaff Industrial to hone its technological strengths, says Chen Yongwu, general manager of Zoje Europe GmbH. If the purchase is successful, Zoje will hold more than 15 percent of the global sewing machine market, and become the world's second largest sewing machine company.

"We expect the Chinese investment wave in Germany to continue for the next five to 10 years," Chen says.

According to Germany Trade and Invest, the official investment promotion agency of Germany, investments from China accounted for 18 percent of the total investments last year. It is estimated that Chinese companies invested $1.47 billion in Germany last year, almost equal to Germany's investments in China.

"Germany is located in the center of Europe. Chinese companies can enter the European market easily by using the 'Made in Germany' tag. We expect to attract more Chinese investment this year," says Benno Bunse, chairman of Germany Trade and Invest.

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|