Something special in Shenzhen

Updated: 2013-04-12 08:39

By Hu Haiyan and Chen Hong (China Daily)

|

||||||||

|

Shenzhen, with favorable government policies, has spawned about 450,000 private companies. Lu Hanxin / Xinhua |

The southern metropolis leads the way in adapting to economic change and innovation

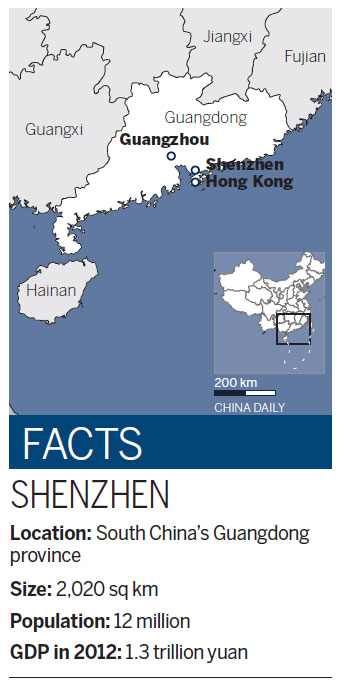

It used to be a poor fishing village, but in little more than 30 years it has developed into a bustling metropolis with a population of 12 million. The southern coastal city of Shenzhen, neighboring Hong Kong, is best known as the nation's first special economic zone, a testing ground for the country's reform and opening-up.

Over those years, hundreds of thousands of private companies have sprung up, backed by strong innovation and favorable government policies. Now the city is evolving into something else, an economy with a better-coordinated industry mix, and the city's companies are beginning to embrace those changes, ready to take on the biggest challenges that their global rivals can throw up.

In December, President Xi Jinping visited Shenzhen, following in the footsteps of Deng Xiaoping 20 years earlier, and underlining the central government's determination to push on with policies of reform and opening-up.

Guo Wanda, executive vice-president of the China Development Institute in Shenzhen, says rapid growth of the private sector mirrors the city's achievements.

"The two are intertwined," says Guo, who has studied the country's macroeconomic development for more than 20 years.

Revenue from private companies accounted for 65 percent of the city's GDP last year and the private sector accounted for about 80 percent of jobs, the institute says.

Shenzhen has been a hothouse of private economic growth, spawning about 450,000 private companies, including international behemoths such as Huawei Technologies Co Ltd, the world's second-largest telecommunications equipment maker by sales; Tencent Holdings Ltd, China's biggest Internet company; China Vanke Co Ltd, the country's largest property developer by market value; and BYD, the Warren Buffett-invested automobile company.

Government policies have given Shenzhen an economy that is highly export-oriented, and as the global downturn has bitten and labor costs have risen, the city has been moving to build a better-balanced industry mix so that the momentum of economic growth can be maintained.

Part of that new mix is the financial sector, and last year Qianhai, a 15-square-kilometer area on the western side of Shenzhen, was set up as the testing ground for financial innovation in China, and has been dubbed the Manhattan of southern China.

Its official name is Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone, and its stated aim is to strengthen collaboration between Hong Kong, Shenzhen and the Pearl River Delta as a whole.

In December, the central government announced measures that would enable companies in Qianhai to borrow renminbi from Hong Kong banks, with interest rates to be fixed independently, one aim being to accelerate the internationalization of the renminbi by establishing closer ties between Shenzhen and Hong Kong, and enhancing Hong Kong's role as an offshore business center for renminbi.

Another aim for the region is to soon become an international financial hub connecting Hong Kong and the mainland. By 2015 the expected output of the area is forecast to be 50 billion yuan ($8 billion; 6.3 billion euros), and that is expected to triple by 2020.

Gao Chengjing, president of Tibetan Crane Fund Management Co Ltd, speaking in the Kingkey 100 building, a landmark skyscraper in Shenzhen, says: "Based on the dynamic private economy and the favorable geographic location, the finance sector can be given full wing. But simply learning from your neighbor is not enough. Shenzhen needs to grow according to its own specific situation."

Apart from the potential that Shenzhen's proximity to Hong Kong offers the financial sector, there is also great scope for service industries, which will further boost the local private economy, analysts say.

One company that is eyeing opportunities there is the Internet firm Tencent, whose president and co-founder, Pony Ma, says it will move e-finance and e-commerce operations to Qianhai, which gives priority to modern services and finance.

A company that has already made the move to Shenzhen is the consumer electronics enterprise TCL Group, which has set up its international business headquarters there.

The company had turnover of 69.6 billion yuan ($11.2 billion; 8.7 billion euros) last year, 14.5 percent higher than the year before, and international sales accounted for 38 percent of the latest figure.

"It's natural for Chinese companies go global," says Li Dongsheng, chairman of TCL Group. "We attach great importance to the international market and regard it as another profit growth engine. Because of Shenzhen's favorable conditions, we will raise our international business ratio to about 50 percent by 2015."

TCL Group's international business headquarters were once in Hong Kong, Li says, and the decision was taken to move to Shenzhen because of its abundance of talented people with an international perspective and because of the labor cost compared with Hong Kong.

"In addition to being so close to Hong Kong, Shenzhen is also a great place for the electronics industry with its complete and well-coordinated auxiliary system for both IT and electronics," Li says.

As the rising cost of labor and materials puts pressure on manufacturers' profit margins, companies in Shenzhen should fully exploit its innovation strengths, he says.

"Shenzhen is a good place for developing capital-intensive and technology-intensive projects. Every company stands to gain from this in the long term," says Li, adding that TCL Group is doing research and developing high-end technologies such as liquid crystal display TVs and 3D TV sets in the city.

In 2010, the company built a factory costing 24.5 billion yuan to make liquid crystal panels in the city, the largest industrial project in Guangdong province, Li says.

The group attaches great importance to Africa as a market, regarding it as "one of the most important and significant new growth points for the group".

"That potential has been pushed along by growing cooperation between the Chinese government and African governments. There's no doubt Africa is one of the fastest growing economies, and we plan to set up manufacturing plants there to increase our sales."

Dai Shu, a spokesman for ZTE's overseas business, echoes Li, saying that with Shenzhen being so near Hong Kong, people in the city are highly innovative, have an international perspective and are market-oriented.

The fact that the huge IT industry has grown so quickly in Shenzhen can largely be attributed to the local government's innovation, says Dai, who went to Shenzhen in 1998.

"As a test bed for reform and opening-up, the local government has been bold enough to make any reform that is in line with the central government's guidelines and market needs. Here, companies can find fertile ground for developing international markets."

The Shenzhen government has dared to do things without fear of making mistakes, he says, such as encouraging joint ventures with foreign companies or acquiring advanced technologies from them, something that was regarded as highly progressive in the 1990s.

"Without these pioneering deeds huge companies like ZTE and Huawei would not be here," says Dai, speaking in ZTE's headquarters in Shenzhen Nanshan Technology Industrial Park, where many local IT companies, including Tencent, are located. "ZTE has hugely benefited from Shenzhen's openness and innovation. Our company's development is a microcosm of Shenzhen's evolution; both are innovative and pioneering."

The company, founded in 1985, was among the first Chinese companies in the 1990s to realize the potential in telecommunications in China based on what was happening elsewhere. It then shifted its focus from being a manufacturer to telecommunications, a decisive step.

ZTE has also exploited its strong research and development strengths to the hilt to ensure its long-term competitiveness.

"Shenzhen has plenty of IT talent," Dai says. "As a high-tech enterprise, research and development is of great significance to our success. We will continue to invest 10 percent of our revenue in research and development and draw on the city's strengths to ensure our sustainable development."

With Shenzhen as its backbone, ZTE aims to rank in the top three by sales globally by 2015, with the EU and the US being among the biggest contributors to its revenue, Dai says.

At the moment, about half the group's revenue comes from overseas, with the EU and the US contributing about 20 percent, he says.

"Global telecom carriers, including those in the EU and US, are likely to spend a lot on network construction and upgrades, bringing big opportunities for ZTE's business growth in these markets.

"It is hard to say what contribution these markets will make to our global revenue, but I'm sure the figure will increase as we enjoy a close relationship with various EU and US telecom carriers."

Dai says that Africa, as one of the first international markets for the group, is of great importance to ZTE. The company has business operations in 57 African countries, and revenue from that market accounted for about 9 percent of the group's revenue last year.

However, African expansion plans face particular challenges, given that it is often harder to get payment on time, and political turbulence makes it difficult to ensure employees' safety, he says.

Liu Sanxi, assistant chairman of Shenzhen Wuzhoulong Motors Co Ltd, says strong R&D in Shenzhen benefits companies like his.

Speaking in Baolong Industrial Park in Longgang district, Liu says Wuzhoulong is typical of innovative companies that have benefited from the city's reform and opening-up process.

The company was founded in 2000 and was one of the first Chinese companies dealing in new-energy vehicles, and it has played a role in shaping the central government's policies on new energy.

Shenzhen offers a great platform for tapping into international business, Liu says.

The group gained international recognition through the Shenzhen Universiade in 2011 by providing 200 hybrid vehicles as the shuttle buses for competitors, and it has worked with the city of Hamburg in Germany in developing electric vehicles.

The group had turnover of about 2.2 billion yuan last year, and profit of 200 million yuan. Overseas sales, mainly in Africa, were worth 90 million yuan, Liu says.

Wuzhoulong will carry out its overseas strategy in two phases, he says.

"First we will build up our brands in areas such as Africa, where brand operation costs are relatively lower compared with the US and the EU. Once we have good brand recognition, we will move into the developed nations such as the US and the EU."

Overseas sales are expected to account for 10 percent of its target revenue of 12 billion yuan by 2015, he says.

Shenzhen is at the forefront of reform and opening-up and has a wealth of experience in business management, which is key to the growth of the private economy, Liu says.

It would have been impossible for a private company like Wuzhoulong to develop its vehicles without the help of the Shenzhen government, he says, either in subsidies or in introducing new technology.

"There is no other city government in China that encourages innovation as much as Shenzhen does.

"With national policies to develop new-energy vehicles and to consolidate the industry, huge groups will evolve in this field over the coming three to five years. That will most probably be in Shenzhen, the capital of the private economy, a place that is full of people who have come here to build, to dream and to create something new for themselves, their families and their countries."

Contact the writers at huhaiyan@chinadaily.com.cn and chenhong@chinadaily.com.cn

(China Daily 04/12/2013 page12)

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|