Fast forward

Updated: 2013-05-03 08:56

By Andrew Moody and Lv Chang (China Daily)

|

||||||||

"Growth won't be easy in the coming two decades and I expect it to slow to 3.7 percent in the 2020s as the labor force shrinks. China has experienced the classic catch-up when it was easy to grow by just catching the low gathering fruit. It now needs to up its game."

In China 2030, Hu takes the view China's state-owned enterprises, which dominate the major sectors of the economy, are a strength and not a weakness.

He points out that 64 of the Fortune 500 companies are now Chinese state-owned enterprises and remain a driving force of the economy.

But Xu Bin, professor of economics and finance and associate dean at CEIBS in Shanghai, insists China's SOEs are actually a barrier to growth and that many ought to be privatized.

"There is little doubt that the success of the Chinese economy will be closely associated with the reform of the state-owned sector. Without a vigorous private sector, there is no future for the Chinese economy.

"It needs to be driven by innovation and there is no way that this can be accomplished by state-owned enterprises."

Xu, who nonetheless believes China's GDP will overtake that of the US by 2018, believes growth could fall below 4 percent in the 2020s as the economy suffers from the "convergence effect" - the nearer it gets to the world's technology frontier the slower its growth rate becomes.

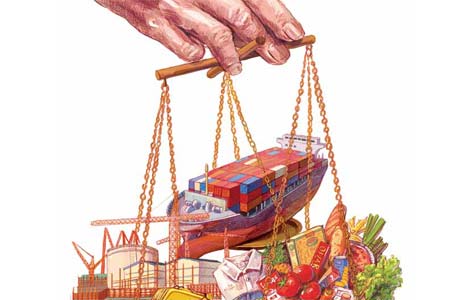

"The export-led model has come to an end for China. China is already an upper middle-income country, and the room for catch-up is significantly smaller than 30 years ago."

Martyn Davies, chief executive of Frontier Advisory, the research and strategic advisory firm based in Johannesburg, also believes China's state-owned enterprises are a barrier to future growth.

"They have done their job driving growth for the past three decades but now it is time to move on. Every Chinese SOE friend I speak to knows this. They also tell me it is going to change quicker than people think."

Qinwei Wang, China economist at London-based economics research organization Capital Economics, says China overtaking the United States should not be seen as some form of economic superpower battle since the United States would be a beneficiary of China's advance.

"The next phase of China's economic growth will see the Chinese buy more high-end consumer goods. They will buy a lot of these from the United States and other Western markets," he says.

"This is in contrast to the first stage of China's growth, which was all about buying commodities such as iron ore and copper from Africa, Latin America and Australia."

Ballim at Standard Bank also thinks China's growth over the next two decades will have a dramatic effect on salaries in the scientific and professional sectors.

"Because of its comparative advantage, China has caused the global price of blue collar and manufacturing labor to fall over the last two decades. With China churning out engineers and accountants by the millions, it will prevent runaway wage inflation in the professional sector, too."

Whatever the timeline, it is almost inevitable the Chinese economy will become double the size of the US economy at some stage - even if the date is way beyond 2030 - because it has more then four times the population.

There is no such inevitability about it overtaking the US's per capita income, however. The US had the sixth highest per capita income (on a purchasing power parity basis) in 2012, according to the IMF, at $49,922 a year, whereas China was ranked 93rd - sandwiched between the Maldives and Jamaica - on $9,162 a year.

Carr at NSBO says the US suddenly collapsing is not on the cards.

"It would require something catastrophic for US income levels to suddenly start dropping. These things do happen, however. If you suggested to someone in 1850 in China what the state of the country would be in 1950, people would have thought you were insane."

Davies at Frontier Advisory wonders whether it is even possible for China to overtake the US on this measure.

"It is possibly unachievable because it is a numbers game and it would be difficult to get 1.3 billion people in China on the same income level as Americans."

Contact the writers at andrewmoody@chinadaily.com.cn and lvchang@chinadaily.com.cn

(China Daily 05/03/2013 page1)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|