Sunset clauses

Updated: 2013-05-24 08:51

By Fu Jing (China Daily)

|

||||||||

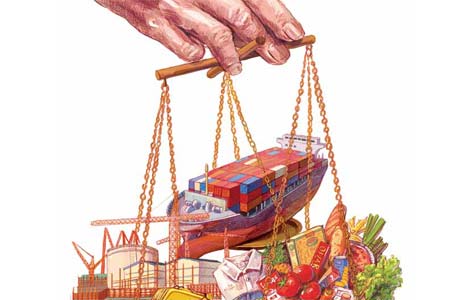

China's solar companies change horizons as protectionist pall falls over european market

Chinese manufacturers of solar panels and components are taking measures to counter the immediate threat of punitive anti-dumping tariffs by the European Commission.

Regardless of the eventual outcome of Brussels' investigation into the alleged trade practices, they are moving to reduce their dependence on the European market.

"We have greatly reduced our presence in Europe due to the uncertainties brought by the European Commission's anti-dumping and anti-subsidy investigation," says Qian Jing, global brand director of JinkoSolar Holding Co Ltd.

As one of China's solar panel producers listed on the New York Stock Exchange, JinkoSolar found itself heavily reliant on markets in Germany, Italy, Spain and France after it had benefited from these countries' "feed-in tariffs" and other policies to encourage renewable energy.

This is what created the boom for China's solar panel manufacturers, she claims.

But Qian says the company, which produces high-quality crystalline ingots, wafers, cells and crystalline PV panels, is now aiming to reduce its European market share to 20 percent of its total overseas business this year. In 2011 and 2012, the European market accounted for 70 to 80 percent.

Since the EC launched its investigation last September, Qian says JinkoSolar has actively cooperated.

"And at the same time, we are clearly pointing out the harm that Brussels' anti-dumping and anti-subsidy investigation is doing to our European partners," says Qian. "I hope they have been putting sufficient pressure on Brussels."

According to The Wall Street Journal, which reviewed the EC document on provisional tariffs due to be applied next month, JinkoSolar would be charged a 58.7 percent tariff on its exports.

Most of the 100-plus Chinese companies will face an average 47.6 percent tariff. Those who have not cooperated with the EC probe will pay 67.9 percent.

Qian says her European partners are also active in other countries and it is exploring new business opportunities in South Africa, Thailand and the United States.

The US has started to levy anti-dumping and anti-subsidy duties on solar imports, but this is only targeted at solar cells imported from the Chinese mainland. So JinkoSolar has expanded cooperation with solar cell producers in Taiwan to continue business with its US partners.

"Our business in the US actually increased last year, instead of falling," says Qian, whose company was set up in 2006.

Also, in another move, JinkoSolar's Swiss subsidiary has entered into an agreement with the Guangdong branch of China Development Bank to the tune of $1 billion (776 million euros) over a five-year period.

JinkoSolar (Switzerland) AG will act as a platform to expand the company's presence overseas and to develop through mergers and acquisitions.

"But we are very cautious about offering credit and expanding businesses in Europe due to the uncertainties ahead," says Qian.

Trina Solar, another leading NYSE-listed Chinese producer, stands to be charged 51.5 percent tariff on its solar sales to Europe if the EC decides next month to impose provisional duties. Based in Zurich, Trina Solar started operating in Europe in 2005. It now has 86 employees and recorded revenue in Europe last year of $623 million - 48 percent of its global revenue. Germany contributed the lion's share of $429 million.

Jodie Roussell, director of public affairs for Trina Solar, says the European market has become more competitive since it was driven by government subsidies and tax incentives. And she points out that the PV supply chain is global, with no country dominating.

She says PV prices dropped due to changing government policies, cheaper raw materials, and economies of scale in manufacturing.

"EU member states' assessment of the industry in December (when the EC completes its 15-month investigation) will decide the future of solar PV in Europe," says Roussell.

For a long time, the EU has benefited from open markets and free trade," Roussell says. "Protectionist measures create a lose-lose situation on many fronts."

Compared with JinkoSolar and Trina Solar, Winsun New Energy is a newcomer on the scene.

Based in China's Jiangsu province, the company only set up its European branch in Belgium in 2010. By that time, Europe's sovereignty debt crisis had deepened and countries were beginning to phase out feed-in tariffs for solar power plants.

The competition had also intensified considerably as hundreds of Chinese investors put their money into the solar industry.

Fortunately, Winsun New Energy won a major project for solar plants in Italy, which last year went into production. And recently, it secured a tender to construct more than 20 solar power plants in Greece.

"But the anti-dumping probe has made us hesitant about moving forward, and the bank is also unwilling to offer financial loans," says Qu Fajun, Winsun's representative in Europe.

Qu says the installation of solar plants offers more jobs for downstream companies, as well as for construction workers, which is critical for countries such as Greece.

"But because of the uncertainties, which may raise the price of solar panels and components, investors and bankers will have second thoughts," Qu adds.

Shen Xiaoxia, who works in a law firm in Belgium, suggests Chinese companies can counter problems by entering into partnership with a European company.

This way, a Chinese solar panel producer can finish the final stage of assembling in Europe, with 90 percent of its work being carried out in China.

"Changing the Made-in-China label to Made in Europe is one solution for these companies," says Shen.

"I think they should also try to cooperate with their European competitors through mergers and acquisitions."

fujing@chinadaily.com.cn

(China Daily 05/24/2013 page12)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|