China inks corn pact with Brazil

Updated: 2014-04-14 05:36

By JACK FREIFELDER in New York (China Daily Latin America)

|

||||||||

China's move this month to allow Brazilian corn imports not only gives the world's second largest economy an alternative source to US-produced grain, it also affords international growers the opportunity to increase dialogue with Chinese agriculture authorities, according to an official with the National Corn Growers Association (NCGA).

Nathan Fields, director of biotechnology and economic analysis for the NCGA, said persistence and diligence are two key aspects in addressing any agricultural trade matter with China.

|

|

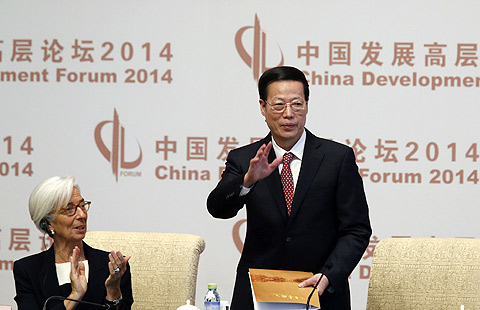

Tall feed corn is harvested on a warm summer day in Santo Antonio do Jardim on Feb 6. [Photo/Agencies] |

"We developed a coalition with growers groups in Brazil and Argentina — it's called MAIZALL — to stay consistent on our messaging and how to work with China," Fields said.

The International Maize Alliance — MAIZALL — is a non-governmental organization (NGO) organized in May that encourages North and South American corn producers to collaborate on issues including food security and biotechnology developments.

"We've sent delegations over to China to try to make sure that communication is as wide open as possible because we understand that the issues in China with biotech trade are not unique to just US corn," Fields said. "While there is competition from the supply side between the US and South American countries, it's in our best interest to work as one unit."

China's General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ) approved corn from Brazil for import on March 31, and the public announcement was made online on April 8.

The news regarding the admission of Brazilian corn gives Latin American producers another foothold in the Chinese market. Argentina, the world's third-largest corn exporter behind the US and Brazil, sent its first corn shipment to China in July, according to an April 8 report from The Wall Street Journal.

"Opening the door to Brazilian corn gives some competition to US exports," said Li Qiang, chairman of Shanghai JC Intelligence Co in Shanghai.

Xu Xiaomiao, an analyst with SCI International, a commodity market information service organization in China, said Brazilian corn could have a price advantage over US corn.

The price of Brazilian corn imported to China is about 1,745 yuan ($287) per ton after taxes. That is even cheaper than US corn, which stands at 1,800 yuan per ton after taxes, she said in a February interview with China Daily.

Xu said if the Brazilian corn passes the quarantine tests, there is a great chance it would challenge the dominant role of US corn in the Chinese market.

As recently as 2011, the US, Laos and Myanmar were the only three trading partners providing China with annual corn shipments of more than 10,000 tons. Ukraine and Argentina are now part of that group, but the US still supplies over 90 percent of China's corn and corn by products.

Chinese imports of corn products from the US last year totaled 2.5 million tons, per data from the World Trade Atlas. As of April 2, China's imports of corn from the US — the world's largest producer and exporter of corn — have climbed 38 percent year-on-year to 1.5 million tons.

Christie's to auction dazzling diamonds

Christie's to auction dazzling diamonds

Women's missile unit joins China's army

Women's missile unit joins China's army

Coldest marathon: a song of ice and fire

Coldest marathon: a song of ice and fire

Prince William, Kate unveil portrait of Queen Elizabeth

Prince William, Kate unveil portrait of Queen Elizabeth

Hagel gets recipe of goodwill

Hagel gets recipe of goodwill

US, China firms team up on green truck play

US, China firms team up on green truck play

21 injured in Pennsylvania school

21 injured in Pennsylvania school

Bakers perform with dough in pizza championships

Bakers perform with dough in pizza championships

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Experts discuss about custody of black box

China protests Japanese minister's visit to war shrine

China's financial reforms 'not tough one'

Boao Forum focuses on 'growth drivers' for Asia

Texas firm offers costly air purifier

NBA to play games in China

'Shared responsibility' emphasized

China's envoy: 'Yes, we can!'

US Weekly

|

|