Solar business brightening

Updated: 2014-04-14 05:36

By ZHANG YUWEI in New York (China Daily Latin America)

|

||||||||

As Chinese investment in the Latin American region grows, the energy sector is emerging as a field that Chinese investors — solar companies in particular — can tap into and produce win-win results, according to leading executives in the region.

"There are big opportunities to develop factories and export components to Brazil," said Mathias Becker, CEO of Renova Energia, a São Paulo-based wind energy company, after the Bloomberg New Energy Finance Summit last week in New York.

|

|

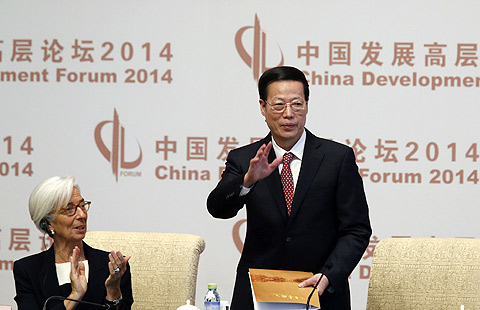

Mathias Becker (left), CEO of Renova Energia, and Tomas Garcia, head of market development and strategy for Latin America at SunEdison, participate in the Bloomberg New Energy Finance Summit on April 9 in New York. ZHANG YUWEI / CHINA DAILY |

Becker said the partnership his company formed with China's Yingli Solar last year has opened doors for the company's solar business in Brazil.

"We just received the first panels from Yingli," said Becker.

"What's really important for Chinese investors is to develop relationships with local players who understand the needs of the customers," he said.

Becker said that the two advantages Chinese investors should take note of when investing in the solar business in Brazil are financing from the Brazilian Development Bank (BNDES) and the good quality of silicon for the production of solar panels.

"The whole supply chain has to be developed in Brazil," said Becker. "It will be extremely beneficial for Chinese investors and Brazil."

Yingli Solar, the world's largest solar module maker and a sponsor of the 2014 FIFA World Cup, established an office in São Paulo in 2011.

Jeffrey Barnett, vice-president of international sales of Yingli Green Energy Americas, said the company's goal is to help the maturation of Latin America's solar market by serving as a valuable resource to project developers.

"Because Yingli is committed to the success of the emerging Latin American market, we have invested in establishing local offices and operations, including local inventory in Brazil and Mexico, that simplify and expedite our customers' procurement processes," he said. "These investments enable our partners to more efficiently and cost-effectively complete projects."

Barnett, who manages business development throughout Central America, South America and the Caribbean, said the energy crisis Brazil now faces has the potential to limit the nation's fast-paced economic growth.

"By partnering with Renova and other leading Brazilian energy companies, we can help expand Brazil's generating capacity, and fuel the economy's further growth," said Barnett.

Becker said China is "well-positioned" in Latin America's solar business. Using Brazil as a stepping stone, "it can replicate the opportunities for Chile, Mexico and other countries", said Becker.

China is the world's No 1 solar panel maker. The slowdown in the European market and high tariffs from the United States have made Chinese solar companies refocus their overseas strategies. Chinese companies are now moving into Latin America, Africa and the Middle East where there is a need to meet the rising demand for solar power.

In March, Yingli Solar announced that it will supply 1 megawatt (MW) of solar panels to Grupo Neoenergia, one of Brazil's largest energy companies. The panels will deliver clean electricity to Arena Pernambuco, the site of five 2014 FIFA World Cup games.

This landmark project is expected to generate more than 1,500 MWh of electricity annually, which is equivalent to approximately 6,000 Brazilians' annual electricity consumption. It will meet 30 percent of Arena Pernambuco's electricity demand. The clean solar energy will be delivered to the local community's electricity grid — through Brazil's net energy metering program — when the stadium is not in use.

Barnett said Yingli's expansion in Brazil and other countries in the region will also help those local players who are now entering the solar market draw on Yingli's "deep experience supplying a broad range of projects globally".

Tomas Garcia, head of market development and strategy for Latin America at SunEdison, an American solar panel maker, said new opportunities for Chinese solar companies in the region also lie further along in the supply chain.

"There are a lot of very strong, successful Chinese solar companies — some of them have been traditional manufactures — and now they are starting to develop and finance projects, moving on to the downstream part of the business," Garcia said.

Christie's to auction dazzling diamonds

Christie's to auction dazzling diamonds

Women's missile unit joins China's army

Women's missile unit joins China's army

Coldest marathon: a song of ice and fire

Coldest marathon: a song of ice and fire

Prince William, Kate unveil portrait of Queen Elizabeth

Prince William, Kate unveil portrait of Queen Elizabeth

Hagel gets recipe of goodwill

Hagel gets recipe of goodwill

US, China firms team up on green truck play

US, China firms team up on green truck play

21 injured in Pennsylvania school

21 injured in Pennsylvania school

Bakers perform with dough in pizza championships

Bakers perform with dough in pizza championships

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Experts discuss about custody of black box

China protests Japanese minister's visit to war shrine

China's financial reforms 'not tough one'

Boao Forum focuses on 'growth drivers' for Asia

Texas firm offers costly air purifier

NBA to play games in China

'Shared responsibility' emphasized

China's envoy: 'Yes, we can!'

US Weekly

|

|