Tracking Africa's stolen billions

Updated: 2014-10-16 13:23

(UNECA)

|

||||||||

Illicit financial flows are a major drain on Africa's resources for development. International coordination is needed to slow the flow of stolen assets.

Last week, teodorin nguema obiang, THE SEC- OND vice president of oil-rich Equatorial Guinea, was ordered by a US court to sell $30 million worth of property, including luxury cars, real estate and his collection of Michael Jackson memorabilia. The US believes that Obiang, the son of Equatorial Guinea's president, obtained the money through the proceeds of corruption.

The case is the first of its kind in the US and could, some observers say, mark a milestone in the fight against African capital flight and illicit financial flows, which cost the continent between $50 and $148 billion per year, according to the United Nations Economic Commission for Africa. The wide spread of the estimated cost of illicit financial flows is an illustration of just how difficult it is to track and identify where money escapes, but even at its lower bound, the number is the same order of mag- nitude as the foreign aid that flows into the continent.

The capital lost to illicit financial flows could be vitally important to development in countries that are trying to improve their mobilisation of domestic resources for investment in infrastructure and services. Slowing, stopping and reversing these illegal flows requires con- vincing and coordinating a complex mix of international, local and private sector actors whose interests are not always aligned.

The majority of illicit flows occur at the point of trade. Exporters under-report the value of their goods and overestimate the value of imports to avoiding paying du- ties; others disguise profits by using complicated webs of trust companies and service companies based in tax havens and offshore financial centres.

"Trade transactions are the area where you normally have very serious capacity problems and widespread corruption," says Charles Abugre Akelyira, a Ghanaian economist and the African regional director of the United Nations' Millennium Campaign. “As long as your customs services and the management of your customs regime is not strong or easily manipulated, it's very easy for large corporations to take advantage of.”

The use of anonymous trust companies shields in- dividuals responsible for illicit capital flows from attention or prosecution. Added to this, weak corporate governance codes have created space for transnational corporations to operate with a degree of impunity, Ake- lyira says.

"This laxity of corporate governance was largely created in the 1980s, 1990s structural adjustment programmes. They date back to this period where, under the weight of indebtedness, the international financial institutions basically pushed these governments to dismantle strong corporate governance regimes in the name of encouraging private sector investments and expanding the market," he says. "In that sense, governments or the elites that run the state also found a way to arrange these corporate governance structures around their petty personal advantages.

"If you want to see that's what is actually facilitating this and making it difficult to keep a handle on these il- licit flows, you have to take a look at the corporate governance regimes, the company codes in these countries, and their reluctance to tighten these codes in order to make clear who are behind these companies."

The structure of many African economies, where natural resources are extracted and shipped out with minimal processing, lends itself well to systemic abuse. Resource exports happen in bulk, while the imports of equipment and services tend to be capital intensive. Added to this, Akelyira says, is the tangled relationship between power, politics and resources.

"The politics of natural resource extraction means that it is difficult for governments to take a strong hand in managing the governance of natural resource import and export transactions," he says.

Capital that leaves the continent illegally tends to end up in the international financial system, usually in banking centres known for their secrecy. There has been, however, a recent shift towards pressuring these havens to open up to scrutiny. The G8, G20 and Organisation of Economic Cooperation and Development have all made commitments to try to reduce the impact of illicit financial flows and tax evasion.

Akelyira is cynical as to their motives. "The Europeans and Americans, under the weight of the financial crisis, started to discover how this systematic network is creating fiscal crises in their countries, and they have started to claw back on some of these,"he says. "But they are not clawing it back globally and systematically. In order to bring discipline to corporate transactions globally, because some of them also do benefit from these flows of funds.

"It's a very selective attempt to address the systematic nature of these largely illegal and mostly immoral ways which money is moving around the world."

Despite high profile successes, such as the Obiang case, and the return last year of $700 million in assets si- phoned out of Nigeria to Switzerland by the Sani Abacha administration, the proceeds of illicit financial flows are hard to recover.

A report by the World Bank's Stolen Asset Recovery (StAR) programme found that, while nearly $1.4 billion in suspected corrupt assets were frozen in OECD coun-tries between 2010 and 2012, less than $150 million was returned.

Jean Pesme, StAR's coordinator, says that while there has been a step up in attention in financial centres, meaningful action is still slow.

"You are seeing an evolution, where [enforcement] is much less patchy than it was 10 years ago," he says. "We see a change in the approach, but again we are a long way to go before it translates to actual recovery. Although we've seen some change in trends and patterns, it's still uneven, it's still only a handful of countries.

"Some countries are very committed. Some countries are doing a lot of work, but not necessarily in a proactive way, more in a reactive way, when they are asked. They are providing assistance but they do not proactively go after corrupt assets. Some countries are less present in the discussion."

Pesme says that there is a need for improved day-to- day coordination between financial centres and countries affected by illicit financial flows, but that sometimes unilateral action, such as that taken by the US against Obiang, is necessary.

"In criminal justice, usually you wait for the affected countries to ask you something,” he says. “But financial centres can be proactive, they don't need to wait for the affected countries to ask them for assistance. They can open money laundering cases, they can use non-convic- tion based forfeiture. The concrete evidence of political will is proactive action from financial centres."

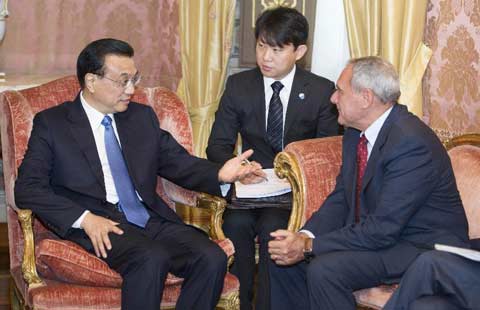

Li pledges stronger parliamentary exchanges with Italy

Li pledges stronger parliamentary exchanges with Italy

Forbidden City art goes on display

Forbidden City art goes on display

Photo Beijing 2014 kicked off

Photo Beijing 2014 kicked off

Bilateral difficulties on manageable track

Bilateral difficulties on manageable track

All eyes on White Cane Safety Day

All eyes on White Cane Safety Day

Taiwan photographer depicts NYC on grand scale

Taiwan photographer depicts NYC on grand scale

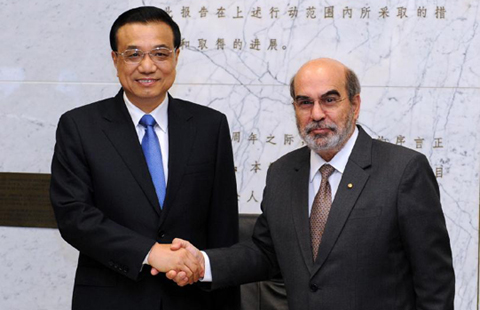

Premier Li meets director-general of UN FAO in Rome

Premier Li meets director-general of UN FAO in Rome

White House also produces harvest joy

White House also produces harvest joy

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Premier Li sows the seeds for farming

US CEOs wish trade treaty a priority

China singled out for 'important' role in Africa's development

Obama holds Ebola meeting

Exporters lower sights for sales at Canton Fair as woes persist

'Main course' still ahead, Li says

HK leader says protests hatched for more than year

Li pledges parliamentary exchanges with Italy

US Weekly

|

|