Latin American steel industry seeks 'win-win' cooperation with China

Updated: 2014-11-24 04:25

By JI YE in Rio de Janeiro(China Daily Latin America)

|

||||||||

|

|

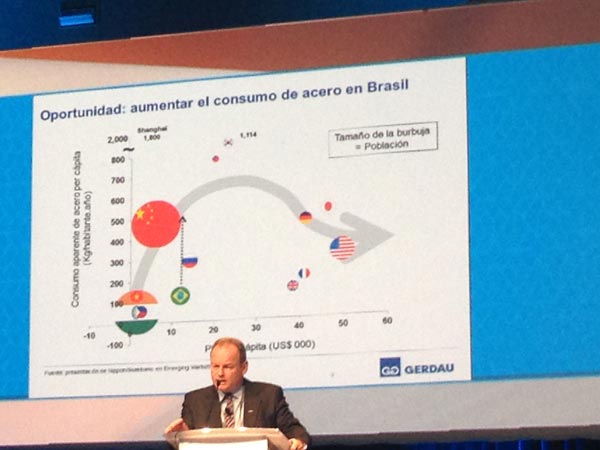

Andre Gerdau Johannpeter, president and CEO of Brazil's largest steel producer, Gerdau (Brasil), made a presentation during the annual conference of the Latin American steel industry in Mexico City held from Nov 9-11. XUN WEI / Xinhua |

At the annual conference of the Latin American steel industry, a number of local steel companies expressed willingness to seek win-win cooperation with China's steel industry even though a substantial rise in steel imports from the world's second-largest economy has accelerated rivalry with local steel producers.

Statistics released by the Latin American Steel Association (ALACERO) showed that during the initial seven months of the this year, China sent 4.7 million tons of finished steel to the region, an increase of 60 percent from the same period last year.

Analysts point out that like China, the Latin American steel industry also is dealing with over capacity, which is causing local steel producers to see imports from China as a threat to their profitability.

During the meeting held Nov 9-11 in Mexico City, some speakers said that Latin American steelmakers need to go beyond the issue of steel imports from China and focus more on improving their own industry and enhancing customer service.

One of those was Osvaldo Rorales, the International Trade and Integration Division director from the United Nations Economic Commission for Latin America and the Caribbean (ECLAC). He said that rather than complain about the growth of China's exports to the region, the Latin American steel industry should respond by upgrading its own industrial structure and improving value-added products through technology and innovation.

"Latin America needs to actively implement the cooperation framework of 'one plan, three engines, six fields', which is recognized by Latin America and China, and promote the economic development and boost the demand of steel to achieve win-win cooperation," he said.

As predicted by Zhang Changfu, vice-chairman of China Iron and Steel Association (CISA), massive imports of low value-added steel from China with cheaper prices will bring about trade friction. Chinese steel imports have been subjected to several anti-dumping investigations this year. Earlier in November, Brazilian authorities decided to levy anti-dumping duties of $908.59 per metric ton on seamless steel tube imports from China.

Andre Gerdau Johannpeter, president and CEO of Brazil's largest steel producer, Gerdau (Brasil), acknowledged that there is a rivalry between Chinese and Brazilians steel producers, but he said that Brazil should not simply limit China's steel exports. On the contrary, he said, Brazil's steel industry should increase investment and infrastructure construction. Meanwhile, the Brazilian steel industry is also in need of adjusting its structure, improving its labor and production efficiency.

According to ALACERO, from January to July of this year, Latin America maintained its position as the second main destination for Chinese finished steel, surpassed by South Korea, which received 7.3 million tons.

Yang Yong, chief representative of Citic Pacific Special Steel in Brazil, China's largest steel exporter to Brazil, said that Latin America is an important overseas market for China's steel. But at the same time, China should standardize its steel exports, maintain market order and avoid economic losses and wasting resources caused by internal malicious competition.

In analyzing the advantage that the Latin American steel industry has compared with its Chinese counterpart, Benjamin Baptista Filho, CEO of Flat Carbon South America ArcelorMittal (Brazil) said it has a better understanding of local markets and customers.

"The Latin American steel industry should respect the laws of the market and enhance customer service, providing customers with a full range of solutions when selling products. The Latin American companies clearly have a better understanding of their markets and customers. This is our advantage," he said.

Aryam Vasquez, senior Latin America economist of Oxford Economics, discussed the global economic situation and structural changes affecting the markets and the Latin American region during the conference.

He said that China's economic influence in Latin America and throughout the world is growing every year. He suggested that Latin American companies need to recognize that the future economic development of the region will be closely linked to China and make good use of it.

Mascots from Olympic, Paralympic games arrive in Rio

Mascots from Olympic, Paralympic games arrive in Rio

China's boxer Zou Shiming defeats unbeaten Thai

China's boxer Zou Shiming defeats unbeaten Thai

Mountains echo to the sound of music

Mountains echo to the sound of music

Chinese modern dance makes debut in Malta

Chinese modern dance makes debut in Malta

Chocolate warriors with Christmassy characteristics

Chocolate warriors with Christmassy characteristics

Trending: Panda beating video triggers outrage

Trending: Panda beating video triggers outrage

Baidu introduces smart bike

Baidu introduces smart bike

Culture Insider: 7 things you may not know about Minor Snow

Culture Insider: 7 things you may not know about Minor Snow

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China, Pacific island nations boost ties

Media reveals aircraft carrier base spying case

Chinese newspaper, magazines punished

China's interest rates cut to bolster growth

Kekexili applies for world heritage

Banner year for US, NYC real estate investment

Obama takes executive action on immigration

Strong earthquake hits SW China

US Weekly

|

|