Latin America benefits from US economy, analysts say

Updated: 2015-01-19 04:55

By PAUL WELITZKIN in New York(China Daily Latin America)

|

||||||||

A continued steady recovery of the US economy in 2015 will be most helpful from Mexico to Panama in Latin America, while the rest of the region will also benefit from the anticipated upbeat US economic performance, according to analysts at Standard & Poor's (S&P).

Speaking at the S&P 2015 Outlooks: Economics, Oil & Consumers event on Jan 15 in New York, S&P US Chief Economist Beth Ann Bovino said the US economy is likely to continue its steady recovery from the 2008 financial crisis. She and her team are expecting the nation's gross domestic product to rise 3.1 percent this year as low oil prices will bolster already improving fundamentals.

Standard & Poor's is a unit of financial information provider McGraw Hill Cos Inc.

Joydeep Mukherji, managing director in the Latin America sovereign ratings group at S&P, said China's rapidly increasing trade with countries in South America has changed the relationship between the US economy and the region.

"From Panama north to Mexico, the economy of those countries is much more tied to the US in terms of trade, tourism and payments," Mukherji said. "The countries in South America have more economic ties to China now. Despite that, it's still important for them that the US economy does well."

Even though low oil prices may hurt producers like Venezuela, Bovino believes the overall impact will be positive. Mexico is one of the 10 largest oil producers in the world according to the US Energy Information Administration; Mukherji believes the country will be able to handle the low price situation this year.

"Oil accounts for about a third of the government revenue in Mexico. Mexico has already hedged oil prices for this year so the government will not suffer that much. Now if the low prices extend into 2016 that could be a different story."

However, Mukherji said low prices may hold back investment in Mexico's oil sector. "Mexico has just opened its energy sector to outside and foreign investment and the country was counting on that to finance an expansion of its oil facilities. The low prices may mean that investors will not be interested in investing until the price recovers," he said.

In Brazil, Mukherji said the economy is big enough to withstand low crude prices. "The Brazilian economy has been stumbling for the past two years and many were counting on a thriving energy sector to help offset the lack of growth and that probably won't be happening this year," he added.

The big question, according to Mukherji, is how will the Brazilian government respond? "Some are hopeful that the government will loosen some of the rules in Brazil's energy sector. This could eventually lead to more foreign investment."

Europe is a large trading partner for the US, China and Latin America. There are concerns that the region's very slow recovery from the financial crisis combined with a deflation threat could hammer the European economy in 2015. However, European troubles or any other overseas concerns may benefit the US economy, said S&P's US economist Satym Panday.

"The US is always a safe (investment) haven," noted Panday. "When turbulence emerges, investors always seem to turn to the US whether it's for treasury bills or real estate."

paulwelitzkin@chinadailyusa.com

Bank, Rockets help out school

Bank, Rockets help out school

Top 10 trading partners of the Chinese mainland in 2014

Top 10 trading partners of the Chinese mainland in 2014

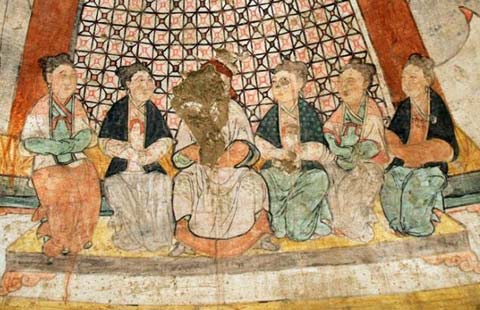

Yuan Dynasty fresco tomb excavated in Shaanxi

Yuan Dynasty fresco tomb excavated in Shaanxi

Most artistic metro stations in China

Most artistic metro stations in China

3D printed houses seen in China's Suzhou

3D printed houses seen in China's Suzhou

Automatic bartender machine invented

Automatic bartender machine invented

Trending: Tuckered out panda goes viral

Trending: Tuckered out panda goes viral

Govt takes measures after 93 wild birds die

Govt takes measures after 93 wild birds die

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US to help China find fugitives

Chinese stocks dive most in 7 years

Protest breaks out at HP subsidiary

Marco Polo proves a hit in US

Rep Meng warns of immigrant frauds

Secret Service: Shots fired outside Bidens' home

China's civil servants to see 60% increase in salary

Hundreds of Chinese trapped by fighting in eastern Myanmar

US Weekly

|

|