On the right road to acquisition in Europe

Updated: 2013-10-14 06:32

By Wu Jiangang (China Daily)

|

|||||||||

For the past several months, Asia's richest man Li Ka-shing has been selling most of his real estate and businesses in China and buying British companies related to public facilities.

If not so long ago Chinese investments in Africa and South America were regarded as more compelling, for the past two years it seems China's participation in acquisitions in Europe has been attracting greater attention.

Statistics confirm there has been a sudden increase in Chinese acquisitions in Europe.

In 2011, China's acquisition investment in Europe totaled $10.4 billion (7.7 billion euros), accounting for 34 percent of its total overseas acquisitions that year, compared with 10 percent in 2010. While the percentage of acquisition investment in North and South America decreased from 34 percent to 27 percent. Europe became China's largest acquisition investment destination.

In 2012, Chinese acquisitions in Europe grew by 20 percent and the amount spent was for the first time bigger than that of European acquisitions in China. Again, Europe was the region with the largest acquisition activity for China.

Chinese enterprises are attracted to the European acquisition market mainly for two reasons.

The first is that European enterprises are walking out of the shadow of the sovereign debt crisis, but the prices of their equities are still low, which makes the stock market attractive for foreign investments.

Although the American stock market has rebounded significantly after the financial crisis of 2008, the European stock market has been under-performing. It is still facing substantial risks, but recovery is becoming increasingly evident.

Studies have also shown that the earnings of European corporates are mostly 0.5 to 1.5 percentage points better than the global average. Some investors think European assets are 30 percent cheaper than similar American ones.

In fact, not only has China increased investment in Europe, so have the US and other developed countries. In the first half of this year, US pension funds and large consortiums invested nearly $65 billion in the European stock markets. The European stock markets reached a three-month high mainly because of the increasing number of acquisitions.

The second reason is that European acquisitions are particularly important for Chinese enterprises to enable them to transform and upgrade.

Chinese companies have enjoyed rapid economic growth over the past few decades. While the entire growth model is facing a change, they find themselves with plenty of cash but less investment opportunities in China - and with their competitive advantages nullified by rising costs and outdated technology.

Many private Chinese companies are encountering bottlenecks in innovation and with government regulation. Many State-owned enterprises are suffering excess capacity. Both need to find better technology and new markets.

They may find markets in developing countries, but they can only find technology in developed countries. Because the Japanese technology market is relatively closed and the US over-protects its advanced technology, Chinese enterprises find the European market may be their only choice.

For mature and open markets such as West and North Europe, acquisition is the best way to access advanced technology and expertise - and the cheapest way to acquire well-known brands and sales channels.

There are also great benefits for Europe. The accumulated acquisition amount by Chinese companies of about $100 billion may only account for 1 percent of foreign acquisitions in Europe, but these investments have saved many enterprises on the verge of bankruptcy, retained millions of jobs and created nearly 100,000 more.

Europe still has a debt crisis and needs more foreign investment. Cross-border acquisitions within the region have not recovered yet.

Dow Jones data show that for the first half of this year, the European acquisition amount dropped nearly 30 percent. Since the share of Chinese overseas investment is still very low and China, as the second-largest economy, is still developing very fast, there will be more Chinese acquisitions in Europe. There could be more than $1 trillion of Chinese acquisitions in Europe in the next 10 years.

With mutual benefits for Europe and China, there should be more trust between them and a focus on longer-term development. Investment barriers should be reduced.

The author is a lecturer at the Management School of Shanghai University and a research fellow at the China Europe International Business School, Lujiazui International Finance Research Center..

(China Daily 10/14/2013 page20)

Senate leads hunt for shutdown and debt deal

Senate leads hunt for shutdown and debt deal

Chinese education for Thai students

Chinese education for Thai students

Rioting erupts in Moscow

Rioting erupts in Moscow

Djokovic retains Shanghai Masters title

Djokovic retains Shanghai Masters title

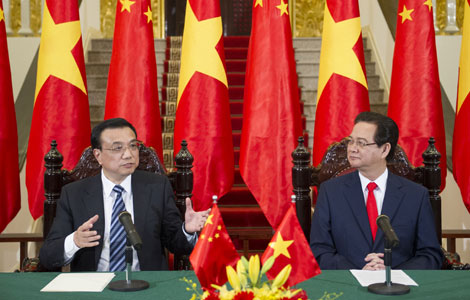

Working group to discuss sea issues

Working group to discuss sea issues

Draft regulation raises fines for polluters

Draft regulation raises fines for polluters

Other measures for the capital to become green

Other measures for the capital to become green

Colombian takes wingsuit crown

Colombian takes wingsuit crown

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Going green can make good money sense

90 killed in stampede in central India

Senate leader 'confident' fiscal crisis can be averted

China's Sept CPI rose 3.1%

No new findings over Arafat's death: official

Detained US citizen dies in Egypt

Investment week kicks off in Dallas

Chinese firm joins UK airport enterprise

US Weekly

|

|