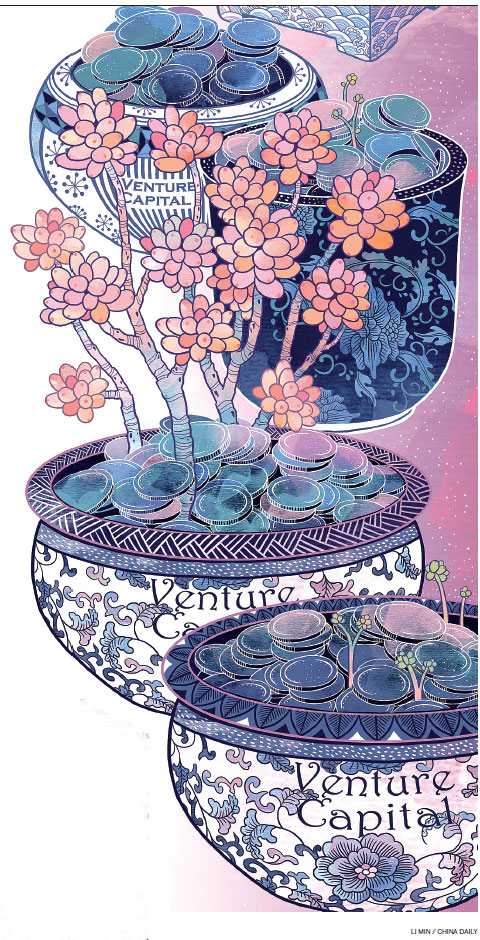

Growing future money trees

China's venture capital has increased tenfold - from $3 billion to $31 billion - since 2013, as the nation has placed more and more emphasis on innovation

Investors are proving they don't believe the claim that Chinese industry can't innovate. A recent KPMG international survey of business leaders found that 23 percent say China "shows the most promise for disruptive technology breakthroughs that will have a global impact", close behind the United States at 29 percent. All other countries are in single digits. A recent study by the McKinsey Global Institute estimates that "indigenous innovation" could contribute as much as half of Chinese GDP growth, $3 trillion to $5 trillion per year, by 2025.

Investors are putting their money behind these opinions. Venture capital investments in China soared from only $3 billion in 2013, to $12 billion in 2014, to $26 billion in 2015 and to $31 billion in 2016, according to Venture Pulse. More than half that total was invested in Beijing, mostly in the high-tech district of Zhongguancun in the northwest section of the city.

Encouraging innovative startup companies is a key part of China's strategy to move toward an economy based on more homegrown high-tech and high-value-added products by 2025. Premier Li Keqiang often stresses the need for "mass entrepreneurship and innovation". In his speech to the meeting of the National People's Congress in March, he mentioned "entrepreneurship" 22 times and emphasized that 12,000 new companies were founded in China each day in 2015.

Many countries are attempting to create innovation hubs, but only a handful succeed. So why might Chinese innovation now challenge the dominant position of Silicon Valley?

Wang Jun, founding and managing partner of Kinzon Capital in Beijing, argues that the ecosystem needed to support innovative companies is coming together.

The surge in startups is also supported by government policies and by China's vast innovation-loving consumer market. John Gu, head of private equity at KPMG China, says: "China is changing very, very rapidly in terms of having the environment to embrace new technology and new business models. I can clearly see a trend where a lot of the commercialization of new technology (whether Western developed or Chinese developed) takes place in China. This is because China has large consumer markets and government support for the startups. The Chinese government is more receptive to new technology, with the view to upgrading the structure of the Chinese economy. So, if you have an early startup technology and get the right government support, it is easier to roll out new products in China than in the US. It appears that no foreign government will provide that kind of support."

VC companies are the link between startup companies and investors. Small startups come with high risks, so they usually don't have access to bank loans or stock markets. The VC receives investment from various types of investors - insurance companies, wealthy individuals, large corporations, governments - and uses that money to buy partial ownership of promising young companies. If the VC chooses wisely, the investors might get a big payday after 5 to 10 years, but there is always the risk of losing. VCs invest early in the life of a business, so they are betting on new technology or a new business model. Private equity firms, which are structured similarly, invest at a later stage, when the company has a record of revenues and profits. Chinese venture capital and private equity firms have assets totaling more than 7 trillion yuan ($1.02 trillion) under management, according to the research firm Zero2IPO.