Belgian insurer Fidea returns after Anbang's acquisition

Belgian insurer Fidea NV has relaunched its life insurance business with a focus on long-term returns two years after it was acquired by Chinese insurer Anbang Insurance Group.

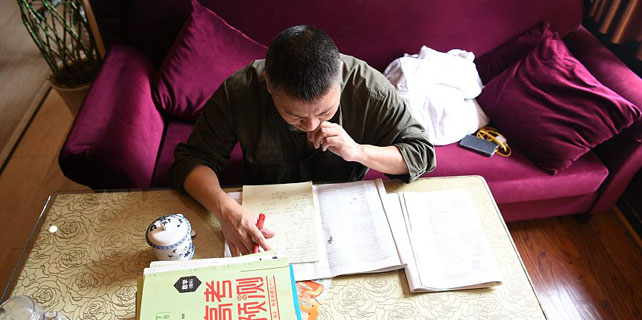

Edwin Schellens, the chief executive of the Belgian insurer, led a team of 20 Belgian insurance brokers on a visit to Anbang's headquarters in Beijing on Tuesday (May 9th), to introduce Anbang's international strategy to its partners in Belgium.

Schellens said Fidea's decision to relaunch its activities in life insurance in 2017 attested to Anbang's support for Fidea to develop a long-term business strategy.

The Chinese insurer acquired Fidea from former shareholder JC Flowers, a US private equity firm, in 2015.

"With JC Flowers it was strictly focused on short-term returns," Schellens said on the return-driven strategy of the former shareholder, which he understood for the nature of private equity business yet angered many brokers Fidea collaborated with.

When Anbang took over, the message he received was different. "Let's work for a long time together, guys." Schellens recalled the conversation with Anbang executives in Belgium. "You can see what synergies you can find in collaboration with Anbang and its other European entities."

In recent years, due to low interest rates in the European market, many Belgian insurers have decreased or completely dropped life insurance products. Schellens said Fidea's ambitious move in relaunching the product line was not "beating against the current" but rather "actively filling the void" at the request of its distributors.

According to Schellens, Fidea renewed its business partnership with one of Belgium's leading banks, Crelan, for another 10 years starting in 2017, which is a strong distribution channel for Fidea's life insurance products.

Fidea has also calibrated its products and focused specifically on pension offers. It aims to reach 200 million euros ($215 million) in premium income in life business in 2017, which compared with the 60 million euros in 2016, would indicate a strong and robust increase in a mature market like Belgium, and put Fidea's life business on equilibrium with its non-life operations.

"Being part of an international insurance group, we have gained more oxygen", Schellens said.

To help innovate, Anbang has redirected its resources in technology and assisted Fidea in building a digital platform and applications for direct customer engagement, which saved operational costs and boosted its market competitiveness, according to Schellens.

Bank Nagelmackers, another Anbang subsidiary in Belgium specializing in private banking and wealth management, has also collaborated with Fidea under Anbang's corporate leadership.