Expert says it is possible to minimize financial risks related to Initiative

To control financial risks, Chinese companies need to make prudent investments on expansion into economies participating in the Belt and Road Initiative, said Justin Yifu Lin, former chief economist and senior vice-president of the World Bank.

They must select only those destinations for investments where supportive facilities and policy are available, said Lin.

Project-related risk can be spread or minimized through insurance, to counter policy risk or exchange rate risk, he told a news conference recently.

In addition, private capital can play a vital role in deepening cooperation for creating new infrastructure, he said, suggesting the government departments concerned should set up a fund as a guide, and choose to "pay private investors first".

Lin's remarks came as China positioned the Belt and Road Initiative as one that can inject vitality into the world's economy through several big-ticket infrastructure projects around the globe.

There have been concerns that the envisaged infrastructure could increase the debt burden of some developing countries participating in the initiative.

But Lin played down such concerns. The debt level, he argued, is not the only criteria to evaluate the projects. It is more important to analyze which fields the new loans are funding.

Capital should be directed to local sustainable industries that could "create jobs, increase exports and accumulate foreign-exchange reserves," he said.

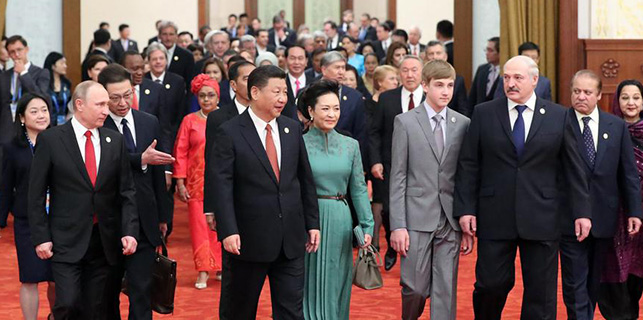

Highlighting multilateral cooperation for creating new infrastructure, Chinese President Xi Jinping said on Sunday that the Asian Infrastructure Investment Bank has provided $1.7 billion in loans for nine projects in countries and regions participating in the Belt and Road Initiative.

In future, China will continue to offer financing support for the Belt and Road Initiative by contributing an additional 100 billion yuan ($14.76 billion) to the Silk Road Fund, Xi said in his keynote speech at the opening ceremony of the Belt and Road Forum for International Cooperation in Beijing.

To further facilitate international cooperation for new infrastructure, creation of additional industrial capacity and strengthening of financial services, the China Development Bank and the Export-Import Bank of China are going to set up special lending schemes worth 250 billion yuan and 130 billion yuan respectively, he said.

The Belt and Road Initiative, proposed by Xi in 2013, consists of the Silk Road Economic Belt and the 21st Century Maritime Silk Road.

Between 2014 and 2016, trade between China and economies covered by the initiative exceeded $3 trillion, with China's investment in these economies surpassing $50 billion.