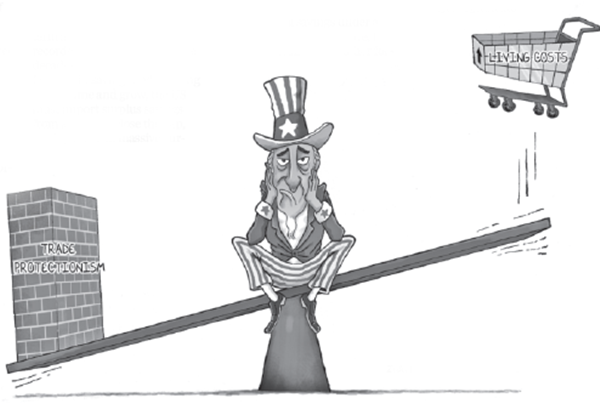

China-phobic US in codependency trap

|

|

ZHAI HAIJUN/CHINA DAILY |

This development could have far-reaching consequences. While there may be merit to the allegations, as documented in the latest "USTR Report to Congress on China's WTO Compliance", punitive action would have serious consequences for US businesses and consumers. Like it or not, that is an inevitable result of the deeply entrenched codependent relationship between the world's two largest economies.

But in a trade conflict, it is important to think about reciprocity-specifically, China's response to a US action. In fact, that was precisely the point made by China's Ministry of Commerce in its official response to Trump's gambit. China, the ministry vowed, would "take all appropriate measures to resolutely safeguard its legitimate rights".

Caught up in the bluster of the US accusations against China, little attention is being paid to the potential consequences of Chinese retaliation.

First, imposing tariffs on imports of Chinese goods and services would be the functional equivalent of a tax hike on US consumers. Chinese producers' unit labor costs are less than one-fifth of the US' other major foreign suppliers. By diverting US demand away from Chinese trade, the costs of imported goods would undoubtedly rise sharply. The possibility of higher import prices and potential spillover effects on underlying inflation would hit middle-class US workers, who have faced more than three decades of real wage stagnation, especially hard.

Second, trade actions against China could lead to higher US interest rates. Foreigners currently own about 30 percent of all US Treasury securities, with the latest official data putting Chinese ownership at $1.15 trillion in June 2017-fully 19 percent of total foreign holdings and slightly higher than Japan's $1.09 trillion.

In the event of new US tariffs, it seems reasonable to expect China to respond by reducing such purchases, reinforcing a strategy of asset diversification away from US dollar-based assets that has been under way for the past three years. In an era of still-large US budget deficits-likely to go even higher in the aftermath of the Trump administration's tax cuts and spending initiatives-the lack of demand for Treasuries by the largest foreign owner could well put upward pressure on borrowing costs.

And third, with growth in US domestic demand still depressed, US companies need to rely more on external demand. Yet the Trump administration seems all but oblivious to this component of the growth calculus. It is threatening trade sanctions not only against China-the US' third-largest and fastest-growing major export market-but also against North American Free Trade Agreement partners Canada and Mexico (the US' largest and second-largest export markets). As the reactive pathology of codependency would suggest, none of these countries can be expected to acquiesce to such measures without curtailing US access to their markets-a counter-response that could severely undermine the manufacturing revival that seems so central to the Trump presidency's promise to "Make America Great Again".

In the end, China's economic leverage over the US is largely the result of low US domestic savings. In the first quarter of this year, the so-called net national savings rate-the combined depreciation-adjusted savings of businesses, households and the government sector-stood at just 1.9 percent of national income, well below the longer-term average of 6.3 percent recorded during the final three decades of the 20th century. Lacking in savings and wanting to consume and grow, the US must import surplus savings from abroad to close the gap, forcing it to run massive current account and trade deficits with countries such as China to attract foreign capital.

It is sheer political chicanery on the part of the US to single out China, its NAFTA partners, or even Germany as the culprit for its savings-short economy. Fostering policies that encourage an economy to squander its savings and live beyond its means makes trade deficits a given-as are the seemingly unfair trading practices that may come with this Faustian bargain for foreign capital.

The US had trade deficits with 101 countries last year-a multilateral external imbalance rooted in the US' chronic domestic savings problem. The fix for this problem cannot be made in China. Ironically, with the Trump administration's policies likely to lead to larger budget deficits that put national savings under additional downward pressure, the need for Chinese and other foreign capital will actually intensify and the codependency trap will only close more tightly.

The US does not hold the trump card in its economic relationship with China. The Trump administration can certainly put pressure on China, and, on one level, there may well be good reason to do so. But deep questions concerning the consequences of such pressure have been all but ignored. Getting tough on China while ignoring those consequences could be a blunder of epic proportions.

The author, a faculty member at Yale University and former Chairman of Morgan Stanley Asia, is the author of Unbalanced: The Codependency of America and China.

Project Syndicate