Home prices continue to rise

Updated: 2013-04-01 23:33

By Hu Yuanyuan (China Daily)

|

||||||||

Costs increase for 10th month in a row, but govt curbs expected to rein in rises

|

|

Residential buildings in Shanghai's Pudong New Area. House prices in major cities across the country continued to rise in March after the central government announced new tightening policies and measures. Jing Wei / for China Daily |

Property prices in China's major cities saw a 10th consecutive monthly increase in March, but new government policies aimed at cracking down on speculation are expected to rein in the price increases.

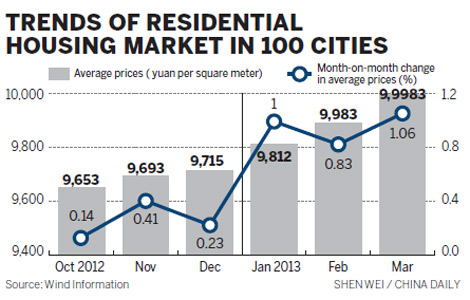

China Index Academy, a Beijing-based real estate research institute, said on Monday the average price of new homes in 100 monitored cities was 9,998 yuan ($1,600) per square meter during March, up 1.06 percent on the previous month.

The month-on-month growth rate, according to the academy's figure, is up 0.83 percentage points from the previous month.

A total of 84 cities saw price increases on a monthly basis, with 10 more reporting a price hike in March than the previous month, while the number of cities experiencing a price drop fell by 10 from February.

On a yearly basis, the growth was 3.9 percent last month, compared with a 2.48 percent year-on-year rise in February. It was the fourth time that 100 cities saw a price hike on a year-on-year basis, with the growth rate further accelerating.

The average house price in key cities, including Beijing and Shanghai, stood at 16,803 yuan per sq m, an increase of 1.25 percent from the previous month and up 6.05 percent over the same period last year, indicating an accelerating price growth rate.

However local governments' detailed regulations following the introduction of the State Council's measures to cool the sizzling real estate market are expected to stabilize property prices across the country, industry analysts said.

Over the weekend, a number of major cities, including Beijing, Shanghai, Guangzhou and Shenzhen, announced how they would be putting the central government's measures into practice.

Local governments in all of these four key cities said they would strictly implement the 20 percent tax on capital gains from property sales if a homeowner sells the property within five years of its purchase and the apartment is not the only one owned by the family.

The authorities in Beijing said that single adults with hukou - registered permanent residence - in the city are allowed to purchase only one apartment, as opposed to two previously. And the government will also not grant sales licenses to projects priced "much higher" than the average rate in the region.

Banks in Shanghai will be prohibited from granting loans to residents who own two apartments and are attempting to buy more. The down payment and mortgage rates for second-home purchases may be further increased, depending on market conditions.

Shenzhen plans to limit price increases of new properties below the city's per capita disposable income target, which was set at 9 percent by the local legislature earlier this year.

The regulations in Guangzhou did not mention detailed measures to limit property prices. But the government said land for the construction of small and medium-sized dwellings will account for at least 70 percent of the total for residential use.

Other cities only announced their house price target for 2013, without mentioning detailed measures to implement the 20 percent taxation policy.

Zhang Dawei, research director at real estate brokerage company Centaline Group, said transactions may tumble this year, and prices are set to stabilize.

"If those policies could be implemented for more than six months, prices may drop by more than 20 percent," said Zhang.

According to Zhang Lei, an analyst with real estate brokerage company Century 21st, the regulations will lead to a wait-and-see scenario in the market in the short term, and have a major impact on the pre-owned home sector.

huyuanyuan@chinadaily.com.cn

Qingming Cultural Festival opens in C China

Qingming Cultural Festival opens in C China

World Bank seeks end to extreme poverty by 2030

World Bank seeks end to extreme poverty by 2030

World Trade Center rises again

World Trade Center rises again

UN General Assembly approves Arms Trade Treaty

UN General Assembly approves Arms Trade Treaty

Xi gives green light for planting

Xi gives green light for planting

Sotheby's to hold Spring Sale in HK

Sotheby's to hold Spring Sale in HK

Cities urged to step up drainage improvements

Cities urged to step up drainage improvements

Opening up on autism

Opening up on autism

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China, US to deepen military ties

BYD to build electric bus assembly plant

Chinese becoming US citizens decline

Beijing calls for DPRK talks

Kerry reaffirms defense commitment to ROK, Japan

Caroline Kennedy may be US envoy to Japan

New Chinese Ambassador arrives in US

Apple revises warranty terms

US Weekly

|

|