Year-end bonuses at SOEs to rise: Poll

Updated: 2013-12-27 07:27

By He Wwi in Shanghai (China Daily)

|

||||||||

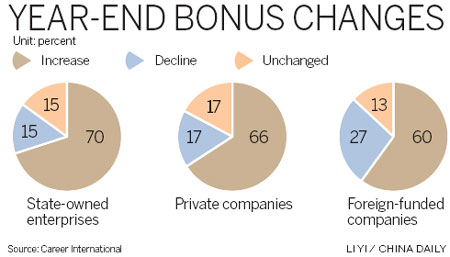

More State-owned enterprises in China will offer higher year-end bonuses to employees than foreign and private companies, a recent survey suggests.

About 70 percent of SOEs will see their bonus level rise compared with last year, as opposed to 66 percent of private companies and 60 percent of foreign businesses, according to a survey conducted by leading staffing firm Career International.

The survey polled human resources officers from 847 companies. It covered 14 industries, including real estate, IT, automobile and retail.

Half of the respondents worked for multinational corporations. Three-quarters of the rest were from State-backed companies.

In general, 64 percent of all surveyed firms expected to lift the bonus threshold, up 6 percentage points from 2012.

Growth was largely seen to be moderate, as 47 percent rated the rise to be less than 10 percent.

"Compared with foreign and private firms, bonuses claim a significantly higher share, or 35 percent, of an SOE's payment composition. Therefore, more companies encourage employees by raising bonuses," said Li Jie, leader of Career International's Asia Pacific operations.

SOEs have generated a combined profit of 2.15 trillion yuan ($354 billion) from January to November, up 8.2 percent year-on-year, data from the Ministry of Finance showed. Margins of centrally administered enterprises rose 11.2 percent compared with last year.

Only 23 percent reported lower incentives, a proportion that dropped by 9 percentage points from last year.

Nearly 27 percent of foreign-funded companies said they would cut bonuses, a percentage that was notably higher than the other two categories.

Foreign firms were more greatly exposed to the lingering effects of the global financial crisis, which squeezed their margin for bonuses, said Li.

Changes to bonus levels were projected to vary by industry. The most generous companies were seen in the real estate sector, with 70 percent expecting to pay higher bonuses, boosted by soaring property prices in 2013.

By contrast, the auto industry saw the biggest number of HR officers, or 35 percent, expecting to reduce bonuses. Li attributed the cutback to the constrained growth in the sector in 2013, when fierce competition watered down profit margins.

Zhang Yuting, a customer service manager at a State-owned enterprise's Shanghai branch, said bonuses were lower this year, with the amount falling to 7.5 times her basic monthly salary from eight times the amount a year ago.

"Our bonus is composed of two elements: the completion of the company's overall sales target and one's own personal performance," Zhang said.

But in the eyes of Shen Ziying, a clerk at a foreign commercial bank in Shanghai, Zhang's bonus was "enviable".

"Last year, we received, on average, 1.5 times our monthly income. The best possible scenario is to keep up with last year," Shen said.

She said her previous employer may have offered around 2.5 times her basic monthly salary when economic conditions were sound and healthy.

"Foreign banks are at a disadvantage compared with local banks, especially with our business being squeezed by large State-run banks. I cannot pin much hope on bonuses after browsing our recent balance sheets," Shen noted.

Despite that, SOEs are losing their allure among recent graduates in China, according to a new survey by the country's largest recruitment site, Zhaopin.

hewei@chinadaily.com.cn

(China Daily 12/27/2013 page13)

Ice fishing in NE China

Ice fishing in NE China

Fire on express train in India kills at least 26

Fire on express train in India kills at least 26

Times Square visitors purge bad memories

Times Square visitors purge bad memories

Ice storm leaves many without power in US, Canada

Ice storm leaves many without power in US, Canada

'Chunyun' train tickets up for sale

'Chunyun' train tickets up for sale

Abe's war shrine visit sparks protest

Abe's war shrine visit sparks protest

LeBron James is AP's Male Athlete of the Year

LeBron James is AP's Male Athlete of the Year

Year-end horse-ride parade California

Year-end horse-ride parade California

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

High stakes for US people losing jobless benefit

Li says economy stable in 2014

Abe's shrine visit a denial of justice

China's high-speed rail on fast track

US judge upholds NSA program

India train fire kills at least 26

China reports 12th vaccine-related death

China begins e-commerce legislation

US Weekly

|

|