China Oct data shows economy cooling further

Updated: 2014-11-13 15:15

(Agencies)

|

||||||||

BEIJING - China's economy lost further momentum in October, with factory growth dipping and investment growth hitting a near 13-year low, reinforcing views that Beijing will need to do more to fight slackening growth.

Months of tepid performance in factories and the growing drag from a weakening housing market are putting Beijing's 2014 growth target of around 7.5 percent at greater risk.

Fixed-asset investment, an important driver of growth, grew 15.9 percent in the first 10 months of the year from a year ago, the National Bureau of Statistics said on Thursday. That was the weakest pace since December 2001.

October factory output rose 7.7 percent from a year earlier, which was higher August's 6.9 percent rise but below expectations and the second weakest pace since the height of the global financial crisis. Retail sales growth eased slightly to 11.5 percent, the slowest pace since early 2006.

|

|

|

|

That followed data this week which showed inflation remained near a five-year low and producer prices fell for 32nd consecutive month, highlighting sluggish domestic demand.

"Chinese core October data came in uniformly softer and below consensus," said Dariusz Kowalczyk, senior economist at Credit Agricole CIB in Hong Kong.

"The data highlights downward pressure on the economy. It will encourage further monetary easing."

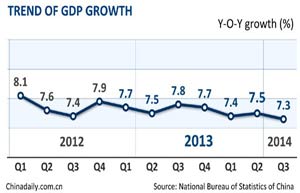

Despite a raft of stimulus measures, China's annual economic growth slowed to 7.3 percent in the third quarter, the weakest pace since the global financial crisis.

Many analysts believe additional support measures may be needed to offset the drag from the cooling housing market, but they are divided over whether authorities will take more forceful action such as cutting interest rates unless there is a risk of a sharper slowdown.

Growth in real estate investment, which affects about 40 other industries in China, cooled to 12.4 percent in the first 10 months of 2014 from a year earlier, with property sales and new construction continuing to fall.

In a bid to stem the slide in the property market, China cut mortgage rates and down payment levels for some home buyers in late September for the first time since the 2008/09 global financial crisis.

But economists are divided over whether the measures will have a long-term effect, pointing to massive inventories of unsold homes hanging over the market.

Policymakers have rolled out a series of measures since spring to bolster growth, including the latest move in late October and early November to approve over $100 billion worth of infrastructure projects.

The central bank, which pumped 769.5 billion yuan worth of three-month loans into banks in September and October, has pledged to keep its policy stance accommodative but stressed that it will not flood markets with cash.

Chinese top leaders, taking comfort from a relatively resilient job market, have flagged on many occasions that they would be more tolerant of slower economic growth while forging ahead with reforms to pursue a more sustainable growth model.

In the latest indication of Beijing's tolerance of slightly lower growth, Chinese President Xi Jinping said on Sunday that even if China's economy were to grow 7 percent, that would still rank it at the forefront of the world's economies.

|

|

|

|

China's GDP expands 7.3% in Q3 |

Lang Lang honored with German award

Lang Lang honored with German award

Premier Li attends the 9th East Asia Summit

Premier Li attends the 9th East Asia Summit

Airshow China soars to success in Zhuhai

Airshow China soars to success in Zhuhai

The most people dine on the beds

The most people dine on the beds

Dangling workers rescued from World Trade Center

Dangling workers rescued from World Trade Center

Long-term visas issued for China, US citizens

Long-term visas issued for China, US citizens

Long-term visas issued for China, US citizens

Long-term visas issued for China, US citizens

Culture Insider: Chic items in ancient China

Culture Insider: Chic items in ancient China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese company, US farm coop to build milk-powder plant in Kansas

China, ASEAN set goal for upgrading FTA

Country pushes for code at South China Sea

Beijing wants to keep 'APEC blue'

The Waldorf's hefty price tag

US, China reach landmark pacts

Youth urged to get politically involved

Rick Snyder seeks to woo China trade, giant pandas

US Weekly

|

|