Chinese stocks fall first time in four days

Updated: 2015-03-03 16:12

By Dai Tian(chinadaily.com.cn)

|

||||||||

China's stocks fell for the first time in four days, led by financial and energy companies, amid market concern for growth prospect.

The benchmark Shanghai Composite index closed at 3,263.05 on Tuesday, down 2.2 percent or 73.23 points, while Shenzhen Component index slid 3 percent to 11,526.22.

Financial sector led the loss on Tuesday. Industrial and Commercial Bank, Ningbo Bank and Beijing Bank lost nearly 4 percent, and CITIC Bank 4.7 percent, as Shang Fulin, chairman of the China Banking Regulatory Commission, writing to an industry magazine urged banks to speed up adjusting development strategy and shift from traditional profit model.

The central bank announced a rate cut by 25 basis points on Saturday evening, lowering the one-year benchmark lending and savings rate to 5.35 and 2.5 percent respectively.

Brokerages including Guoyuan Securities, Huatai Securities and Western Securities tumbled more than 5 percent on Tuesday, despite the cut.

Index tracking coal and electricity sector edged down 2.1 and 1.3 percent respectively. The State Information Center said in a report on Monday that China's economy is expected to slow down and grow 7 percent the in the first quarter of this year.

The CSI 300 Index slid 2.6 percent and closed at 3,507.9.

All dressed up

All dressed up

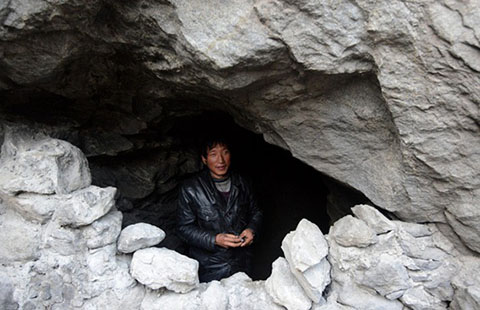

Caveman saves money for family

Caveman saves money for family

China's interest rate adjustments beteen 2008 and 2015

China's interest rate adjustments beteen 2008 and 2015

Buddhist monks break bricks in kung fu

Buddhist monks break bricks in kung fu

Beijing steps up security for two sessions

Beijing steps up security for two sessions

Han-style Chinese beauties at Cambridge

Han-style Chinese beauties at Cambridge

Prince William visits Forbidden City

Prince William visits Forbidden City

Aerial views of plum blossoms as beautiful as oil paintings

Aerial views of plum blossoms as beautiful as oil paintings

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US firms to lower China stakes in '15

China passes US at movie box office

Air pollution tops public concerns for two sessions

Wanda's Wang tops China's rich list

Hilary Clinton may have broken federal laws - reports

US policy focused on Asia: official

China more proactive at UN

Cooperation potential called 'limitless'

US Weekly

|

|