Equities fall as economic woes trigger sell-offs

Updated: 2015-08-22 09:36

By Li Xiang(China Daily)

|

||||||||

Disappointing economic data aggravated investor concerns about downside risks to the economy and triggered a sharp decline in the capital market barometer on Friday.

The benchmark Shanghai Composite Index tumbled by 156.55 points, or 4.27 percent, to close at 3,507.74, almost exactly the same level when the market touched the bottom on July 8 at 3,507.19 which prompted massive government intervention to rescue the market.

The selling pressure was even heavier on the smaller Shenzhen bourse and the startup board, both of which suffered more than 5 percent loss on Friday. Textiles, automobiles and agriculture stocks led the decline.

The sell-off came after the release of the preliminary reading of the Caixin Purchasing Managers Index, a main gauge of manufacturing activities, which fell to 47.1 in August, the lowest level since March 2009. A figure above 50 indicates growth while a reading below that signals contraction.

"The weak PMI confirms that the economy is still not on a solid footing and looks set for a flat growth in the second half of the year," Chang Jian, a China economist at Barclays Bank said in a research note.

The panic selling in the Chinese market over the past two trading days also spread to international markets. The United States stock market saw its worst performance in 18 months on Thursday with the Dow plunging 358.04 points, or 2.1 percent, and the Nasdaq composite down by 141.56 points, or 2.8 percent.

"The reaction of markets around the world is understandable and contains a very audible sign of concern about the slowdown of the Chinese economy," said Kamel Mellahi, professor of emerging markets at the United Kingdom-based Warwick Business School. "There is still plenty of time for the economy to pick up in the second half of the year, but better figures can't come soon enough," he said.

On Friday, the China Securities Regulatory Commission said that it will continue to clamp down on illegal reduction of stock holdings by large shareholders of listed companies.

The regulator has till now investigated 52 cases and the largest amount of illegal stock holdings reduction involved 737.56 million yuan ($119.37 million), according to Zhang Xiaojun, a CSRC spokesman. A positive development that the CSRC announced on Friday is the further opening of the mainland securities market to financial institutions from Hong Kong and Macao.

- Tsipras formally resigns, requesting snap general elections

- China-Russia drill not targeting 3rd party

- UK, France boost security

- China demands Japan face history after Abe's wife visits Yasukuni Shrine

- DPRK deploys more fire units to frontlines with ROK

- DPRK, ROK trade artillery, rocket fire at border

Across America over the week (Aug 14 - Aug 20)

Across America over the week (Aug 14 - Aug 20)

Stars in their eyes: leaders in love

Stars in their eyes: leaders in love

A survival guide for singles on Chinese Valentine’s Day

A survival guide for singles on Chinese Valentine’s Day

Beijing police publishes cartoon images of residents who tip off police

Beijing police publishes cartoon images of residents who tip off police

Rare brown panda grows up in NW China

Rare brown panda grows up in NW China

Putin rides to bottom of Black Sea

Putin rides to bottom of Black Sea

The changing looks of Beijing before V Day parade

The changing looks of Beijing before V Day parade

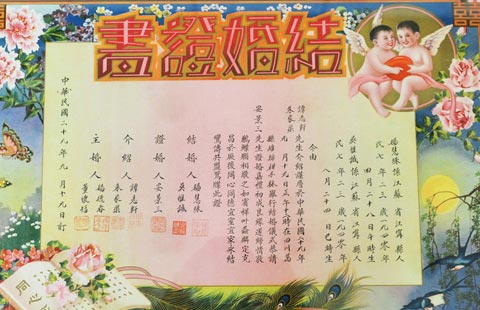

Nanjing displays ancient marriage, divorce certificates

Nanjing displays ancient marriage, divorce certificates

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Emissions data won't change China policy

Preparations shutter Forbidden City, other major tourist spots

President Xi Jinping calls for crews not to ease up

Chemical plants to be relocated in blast zone

Asian sprinters on track to make some big strides

Jon Bon Jovi sings in Mandarin for Chinese Valentine's Day

Tsipras formally resigns, requesting snap general elections

DPRK deploys more fire units to frontlines with ROK

US Weekly

|

|