China property loans increase

Updated: 2015-10-24 14:52

(Xinhua)

|

||||||||

BEIJING - Lending to property sector, especially affordable housing projects, has increased, the People's Bank of China said Friday.

Outstanding yuan-denominated loans to the property sector at the end of September stood at 20.24 trillion yuan ($3.16 trillion), up 20.9 percent from the previous year, the central bank said.

In the first three quarters, such lending expanded by 2.81 trillion yuan, 701.6 billion yuan more than the same period last year.

Loans for the construction of affordable housing hit 1.69 trillion yuan at the end of September, up 61.7 percent year on year.

In the January-September period, loans to affordable housing projects grew by 544.6 billion yuan, 229.7 billion yuan more year on year.

The property sector, a major pillar for economic growth, continued to pick up thanks to the government's easing policies.

Of 70 large and medium-sized cities surveyed in September, new home prices climbed month on month in 39 cities, up from 35 in August, the National Bureau of Statistics (NBS) said Friday.

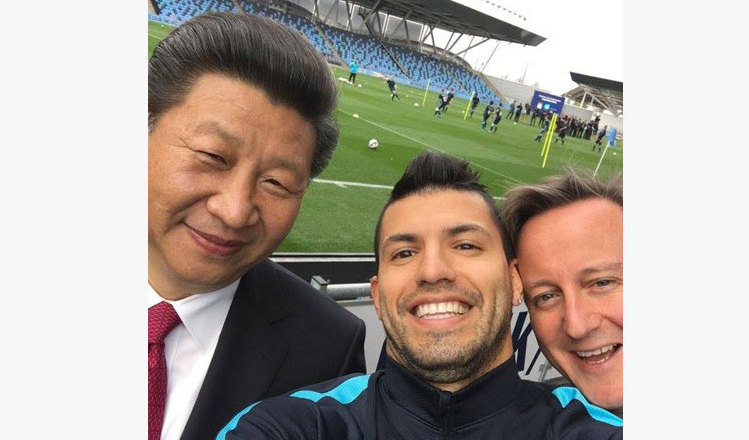

President Xi visits Man City football club

President Xi visits Man City football club

British PM Cameron treats President Xi to beer, fish and chips in English pub

British PM Cameron treats President Xi to beer, fish and chips in English pub

Xi hails role of Confucius institutes

Xi hails role of Confucius institutes

First Lady visits London's prestigious Royal College of Music

First Lady visits London's prestigious Royal College of Music

From Bond to Beckham: Highlights of Xi's speech at the Guildhall banquet

From Bond to Beckham: Highlights of Xi's speech at the Guildhall banquet

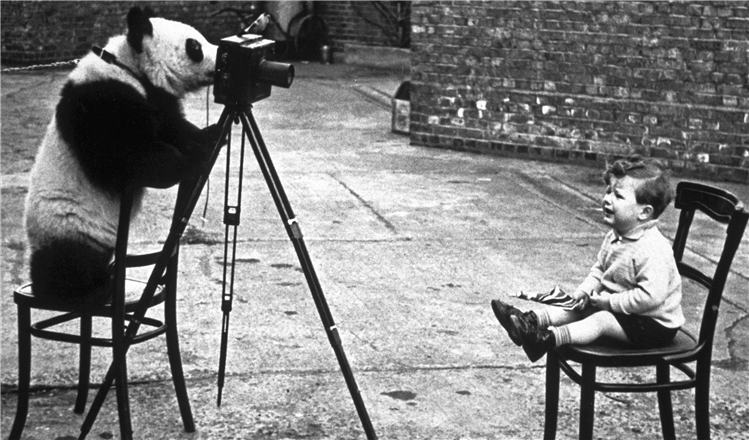

Beloved panda was wartime ambassador warming hearts of people

Beloved panda was wartime ambassador warming hearts of people

China and UK in the eyes of each other's painters

China and UK in the eyes of each other's painters

President Xi, first lady Peng attend Guildhall banquet in London

President Xi, first lady Peng attend Guildhall banquet in London

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

Xi pledges $2 billion to help developing countries

Young people from US look forward to Xi's state visit: Survey

US to accept more refugees than planned

Li calls on State-owned firms to tap more global markets

Apple's iOS App Store suffers first major attack

Japan enacts new security laws to overturn postwar pacifism

US Weekly

|

|